Banking in the Era of the Connected Customer

-

📈 Explore the emerging trends in Banking and Fintech industries. How personalization and AI play a role in automating customer engagement

-

📡 Banking in the era of the connected customer: How to create the ‘Netflix of Banking’ experience by understanding shifts in life stage definitions

-

💡 Create a perfect customer-centric banking experience: Get a worksheet that helps you design intelligent lifecycle campaigns.

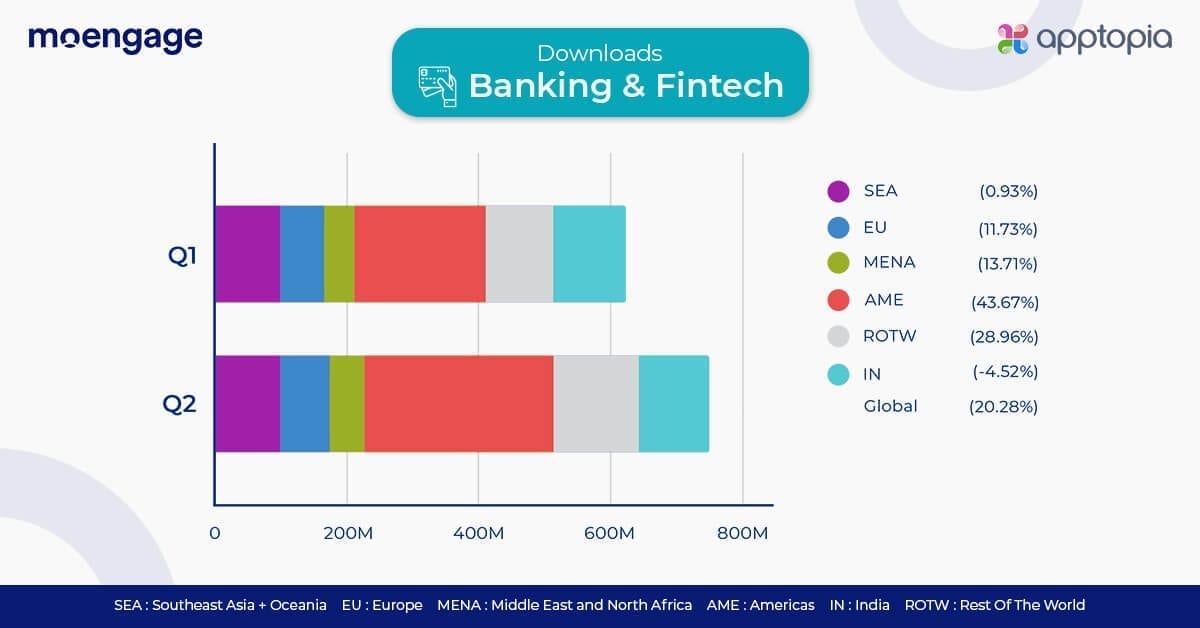

Trends for Banking & Fintech Apps in Q2, 2020

The banking, financial services and insurance industry saw 20.28% global growth in app downloads in Q2 as compared to Q1. The Americas led the growth in downloads for this industry, posting a solid 43.67% growth in Q2 for app downloads.

How to create a perfect customer-centric banking experience?

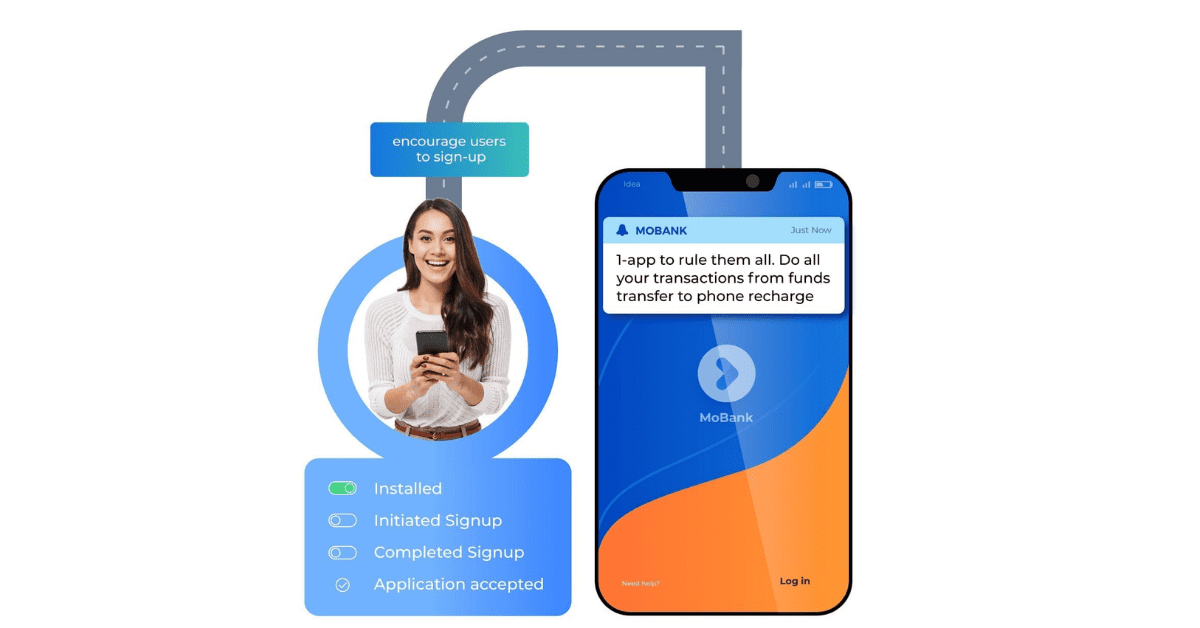

- App Onboarding

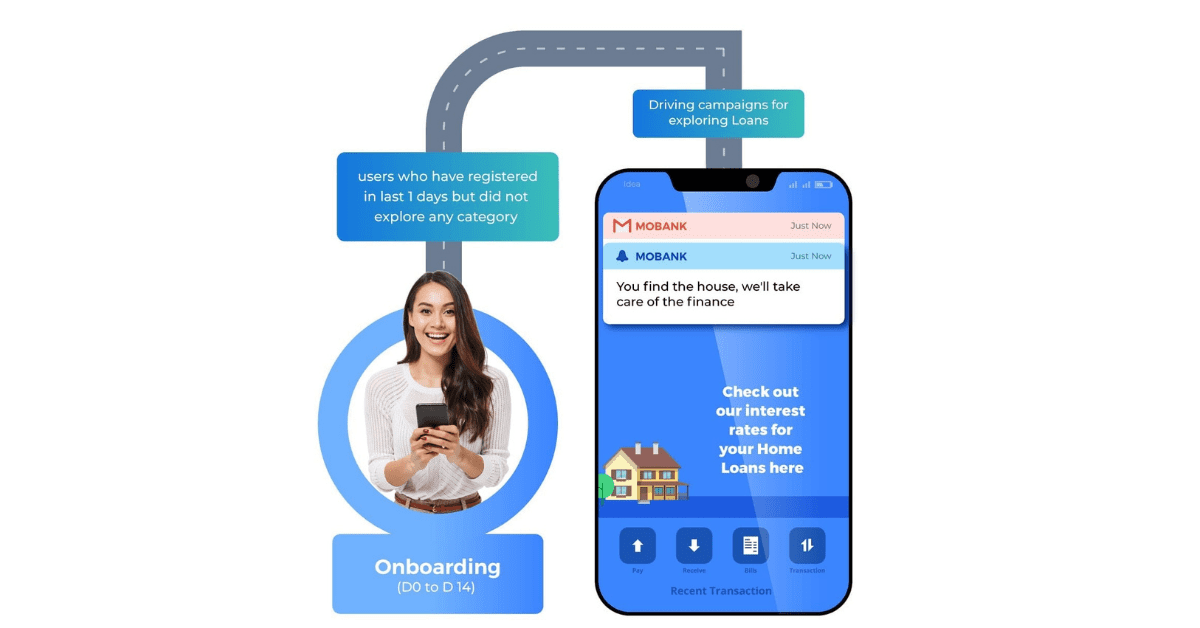

- Onboarding - Days 0 - 14

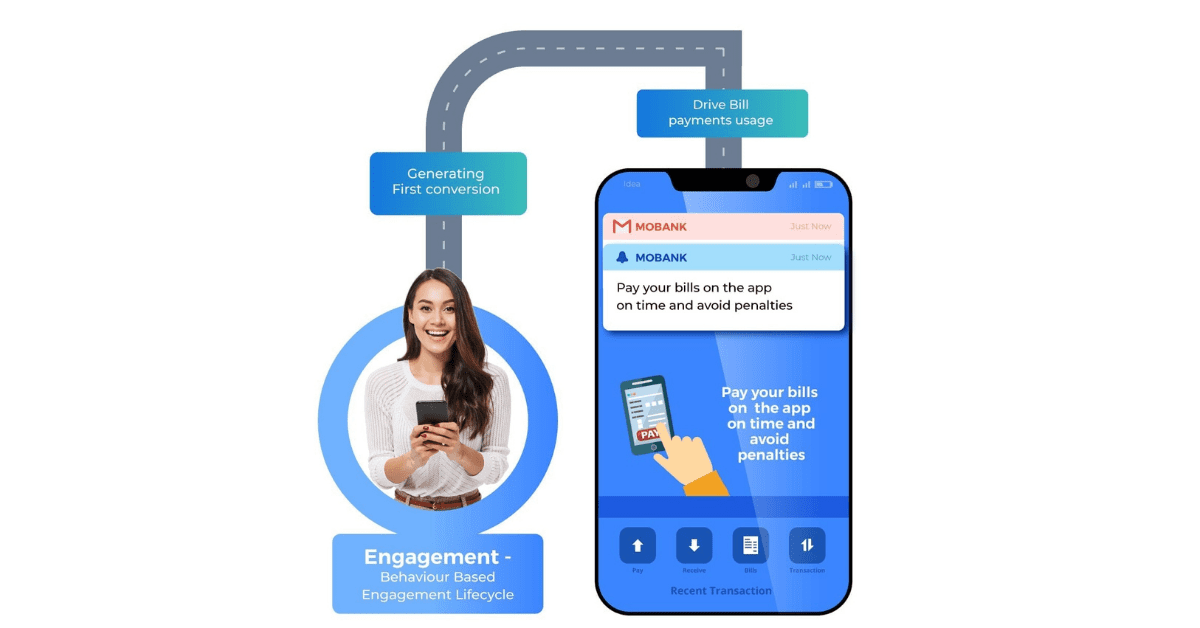

- Behavioral (Lifestyle)

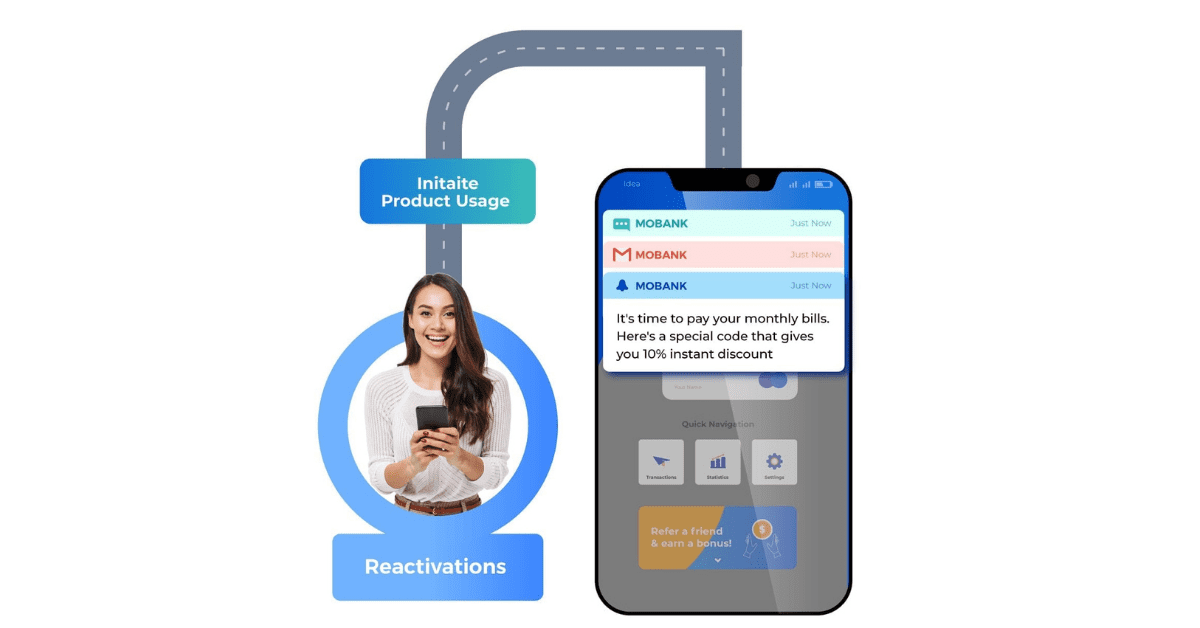

- Reactivations

It’s always easy and cost-effective to retain your existing customers than get new ones. Identify your dormant customers and initiate product usage for them with exclusive offers. Or win back your lost customers with attractive coupon codes.

Drive product discovery across all banking categories: Money Transfer, Bill Payments, Loan Services etc. in the first 14 days. Use the right content at the right time on the right channel to achieve high conversions for your engagement campaigns.

Generate up-sell and cross-sell opportunities from your customers by keeping a track of their behavioral attributes. Send them an alert based on their geolocation, device, and time. Or drive registrations for home/auto/business loans based on your customer’s needs.

It’s always easy and cost-effective to retain your existing customers than get new ones. Identify your dormant customers and initiate product usage for them with exclusive offers. Or win back your lost customers with attractive coupon codes.

How does MoEngage help Banking and Fintech brands?

• Intelligent Customer Engagement Platform for the mobile-first world

• Connect with users across multiple channels seamlessly

• 1 Integrated platform for both automation and analysis

• AI-enabled optimizations for every campaign

Trusted By

Frequently Asked Questions

What are the emerging Banking and Fintech trends in 2020?

As downloads and DAU metrics for Banking and Fintech Apps soar in 2020, the average session duration shows a slight fall. This indicates that the total number of sessions has outperformed the average time spent per session. More and more banking activities like P2P payments and digital wallets (E-wallets) are happening on mobile devices.

What is the ‘Netflix of Banking’ experience model?

The ‘Netflix of Banking’ experience model focuses on seamless connectivity. A banking activity (such as adding a beneficiary on the laptop/desktop screen) should show up seamlessly on all devices ( scheduling a transfer to the beneficiary via the mobile device). Similar to how Netflix preserves your last watched show and favorite preferences across devices and channels.

Which geographical region is showing the most promise in the Banking and Fintech landscape?

The Americas led the growth in downloads for the Banking and Fintech industry, posting a solid 43.67% growth in Q2 for app downloads. It also led DAU growth in this industry in Q2 with growth of 20% over Q1.

How has covid impacted the Banking and Fintech industries?

When the COVID-19 crisis took the form of a global crisis, it influenced the financial behavior of customers in a big manner.

1. Cash and plastic cards were replaced by contactless payment modes like digital wallets

2. Bank-owned online banking apps became popular for lifestyle and utility payments

3. Payment aggregators who unified all payment activities under one portal became popular

What role can Personalization play in the Banking and Fintech landscape?

The mention of the customer’s first name is only a feeble attempt at personalization in communication. True personalization comes in the form of these 3 main pillars:

1. right product suggestions,

2. marketing tone, and

3. communication medium that is bespoke to the user’s life stage, current needs, and future plans.

What role can Artificial Intelligence play in the Banking and Fintech landscape?

AI in banking can automate manual processes that otherwise require a significant amount of manual effort and time. In addition to automation, banks can leverage Artificial Intelligence in several other ways, such as:

● Enhanced customer experience

● Accelerated decision making

How to create a perfect customer-centric Banking experience?

Creating a perfect customer-centric experience starts with having a complete view of your user’s online behavior coupled with derived user attributes. You can then segment your users based on different use cases and target them with intelligent customer engagement campaigns. An example of a campaign that maps the entire life cycle of a customer should include:

● App Onboarding with minimal drop-offs

● Onboarding campaigns – Days 0 to 14

● Behavioral (Lifestyle) based campaigns