State of Mobile Finance in 2021

Download Trends and Benchmarks For

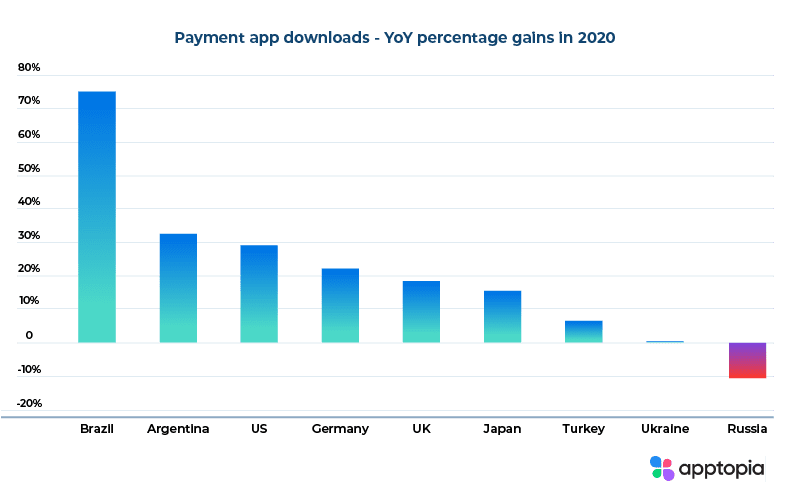

As you can see, emerging market countries of South America such as Brazil and Argentina lead the way in terms of year-on-year growth in downloads for payment apps. They are closely followed by the US, Germany, UK and Japan.

Emergent Trends in Mobile Finance Ecosystem in 2021

Successful Growth Strategies From Leading Mobile Finance Brands

- Pre-launch Referral Programs

- Fine-tuning Product Design

- Incentives Program & Optimization

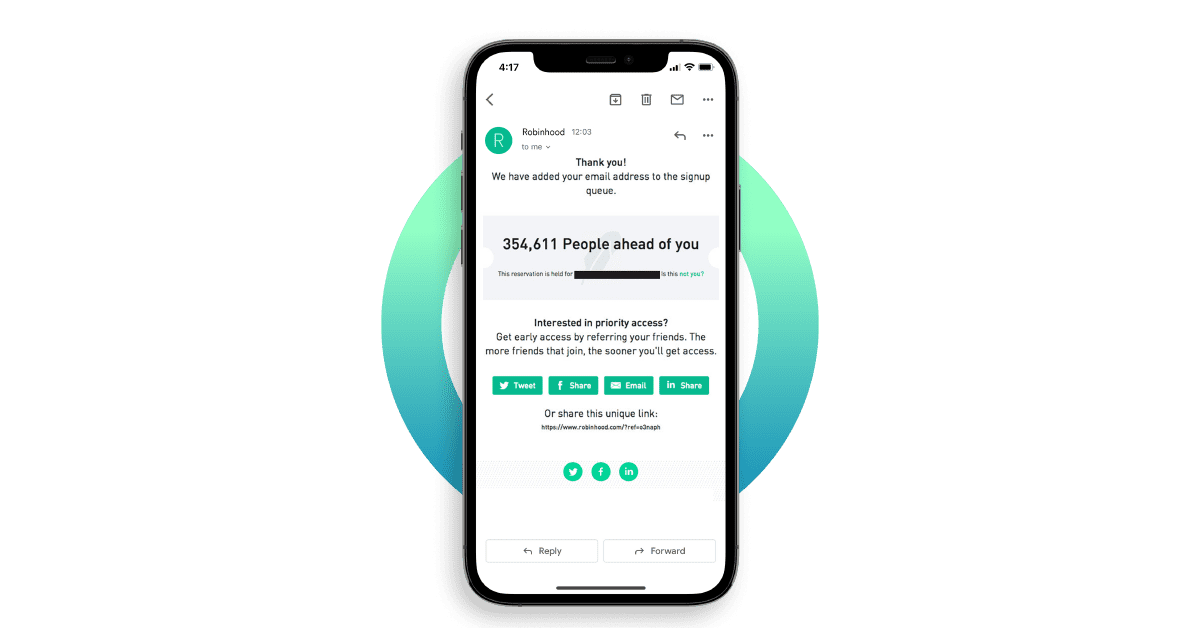

The no-commission-fees trading app played to the innate psychology of moving ahead in a queue by creating a priority referral program. Leveraging the human desire to jump up in a long waitlist enabled Robinhood to create product evangelists among their users. What followed next was unprecedented growth.

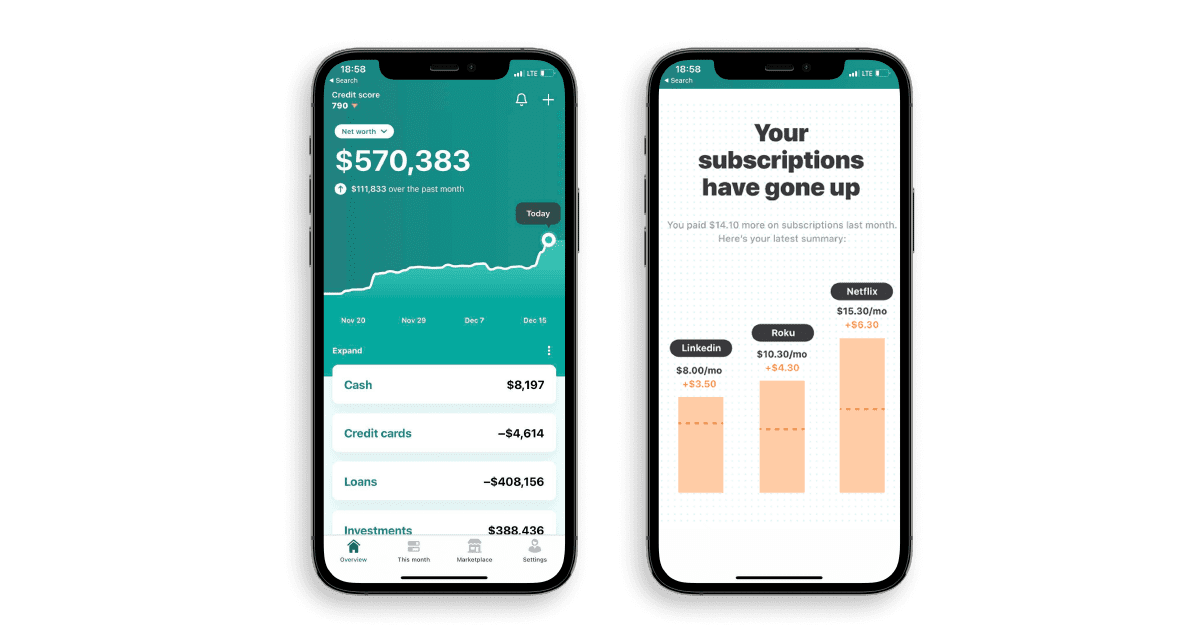

The team at Mint tailored used color grading to boost credibility, using complementary colors viz. green and orange to provide a strong sense of contrast between data points and other fields. This seamless navigation built trust among users.

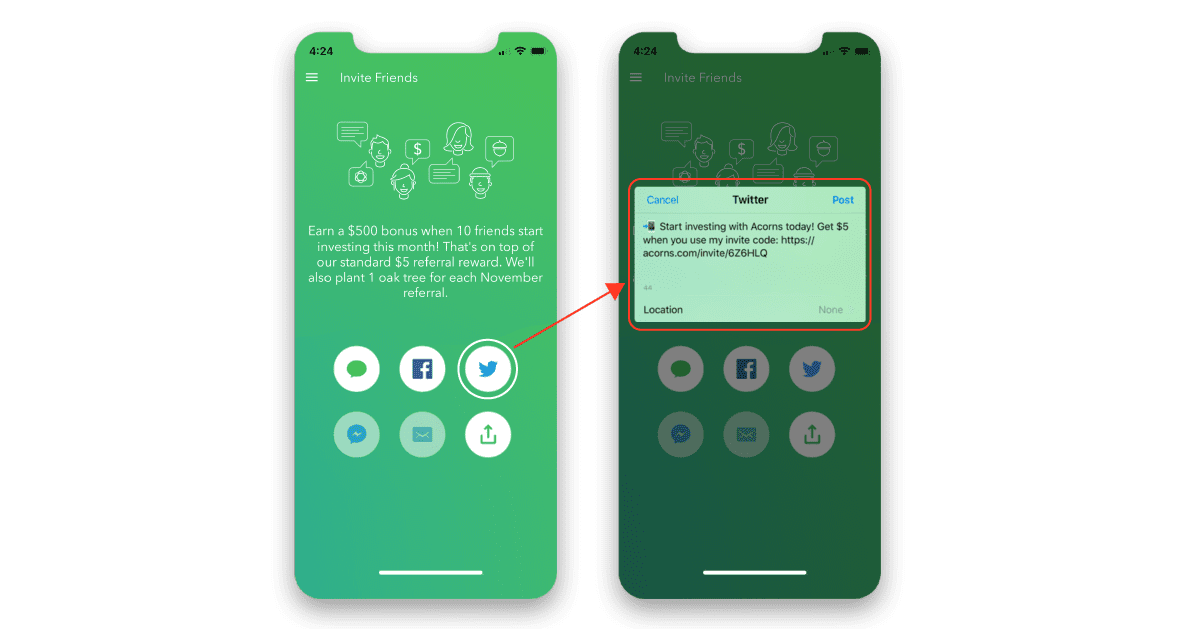

Eliminating new page load for referrals increases chances of referral by 4 times. Acorns provided inline options to share referral codes. Once the user clicks on ‘send message’, the next screen is populated with an auto-filled text message including the unique referral link.

Trusted By Banking and Finance Brands Globally

Frequently Asked Questions

What is the larger scope of mobile finance and what are sub-segments that are being covered here?

The mobile finance industry experienced a pandemic-induced surge in adoption in 2020, with users shifting to digital modes of payment, financial transactions, and banking. The spikes in transaction volumes of mobile banking and trading apps meant that the industry was able to weather the challenges brought on by COVID-19, while paving the way for permanent changes in user behavior. This is evident from the over 4.3 billion downloads of finance apps between September 2019 and August 2020. There is a real change in user mindset and a renewed interest in improving financial outcomes amid the economic uncertainty brought on by the pandemic. Mobile banking and finance apps rank third after social media and weather apps among the most used smartphone applications. In this ebook, we look at mainly four sub-segments within the mobile finance vertical: payment, investment, lending, and banking.

What data trends do you capture in the state of mobile finance, 2021?

In the MoEngage x Apptopia, State of Mobile Finance, 2021, we cover the benchmark and data trends focusing on downloads, usage (daily and monthly active usage data), session, time spent in-app, and new user growth. We look at the change in trends going into 2021 from the last quarter of 2020.

What are the different regions covered in this ebook?

The ebook through its data, emerging trends, and actionable strategies, focuses on regions of North America, Europe, Southeast Asia, India, and the Middle East.

What are the some of the actionable growth strategies for mobile finance brands covered in the state of mobile finance, 2021?

Building a successful mobile finance app that guarantees regular usage, requires an innate understanding of the dynamics of user acquisition and growth. We have extracted real-world insights and use cases from top global financial institutions like Robinhood and Mint, to provide you some actionable strategies you can implement right away:

i) Using referral programs and pre-launch promotion to boost product adoption and usage

ii) Fine-tuning product design according to user demographic to improve credibility

iii) Reducing acquisition costs through a combination of well planned incentive programs and UX optimization

What are the topics covered in this e-book apart from benchmarks and data trends from the finance vertical?

Apart from the data trends, in this ebook we focus on expert insights and successful growth strategies from leading mobile finance brands viz. Visa, Kredivo, Current, Razorpay, Mint, Robinhood, Acorns and more.

Are the trends and actionable strategies covered in the ebook subject to change?

The emergent trends covered in depth, in the state of mobile finance ebook are based on current changes foreseen in the market and are expected to continue in the near future. Similarly, the actionable growth strategies are borrowed from organizations currently implementing these successfully. In short, both the trends and strategies are powered by very recent changes and current situation, so you can implement them for the future without any worry.