Using MoEngage, LINE Bank was able to:

- Achieve an 86% boost in CVR

- Reduce campaign launch time from 2 days to 2 hours

- Eliminate cross-team dependencies

- Gain real-time insights into customer behavior

Boost in CVR

Reduction in campaign launch time

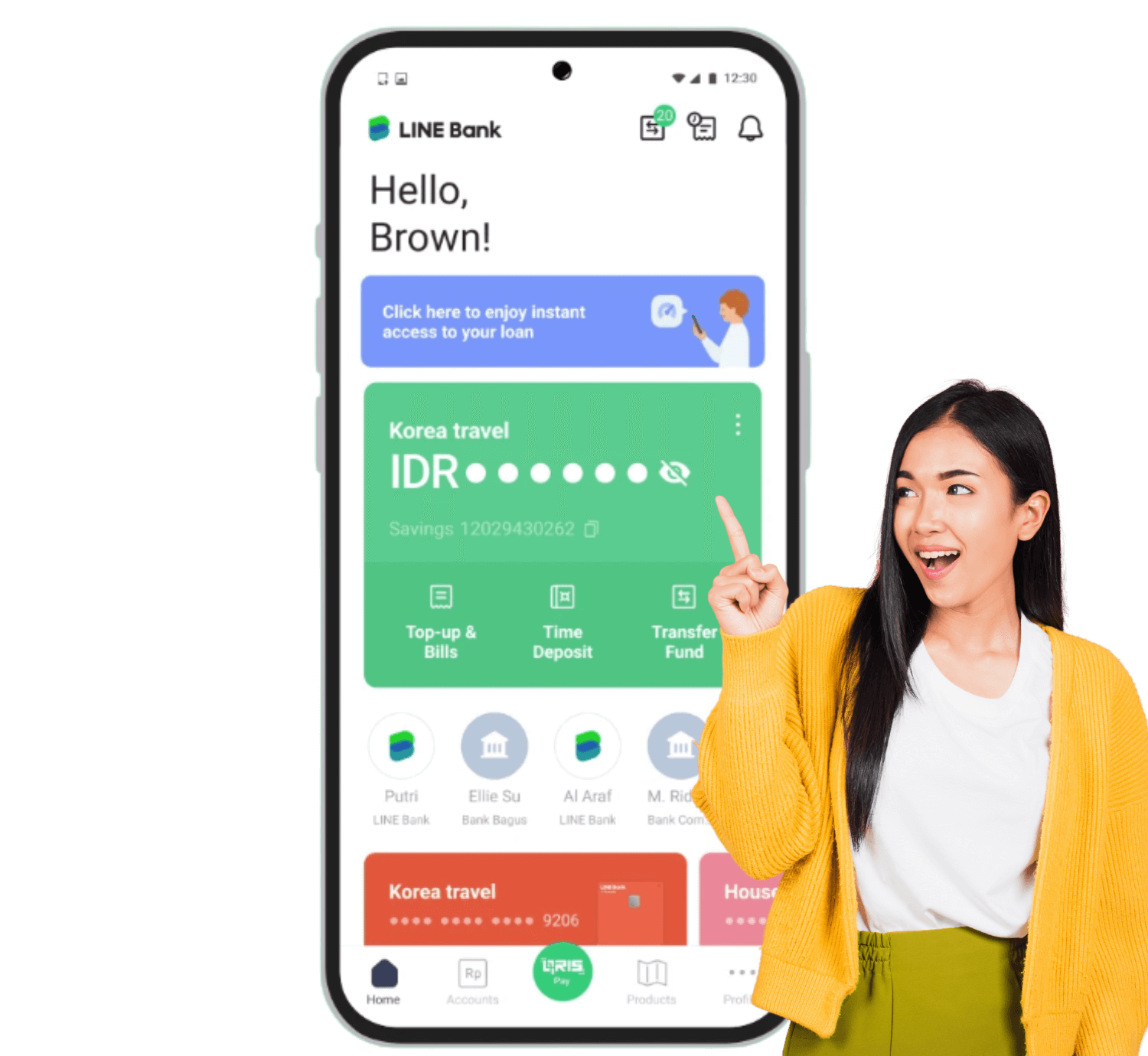

LINE Bank by Hana Bank is a digital banking service provided by PT Bank KEB Hana Indonesia, combining LINE’s social media platform with Hana Bank’s financial expertise. It offers a convenient and secure way to manage finances, including online account opening, cashless payments, and loan services. The service aims to provide a user-friendly banking experience, connecting users’ social lives with their financial activities.

LINE Bank's data was fragmented across disconnected systems, making it impossible to personalize engagement for their young customer base. They sent generic messages to all users, regardless of individual needs. This resulted in tedious marketing processes that took days to execute and failed to deliver the "effortless" banking experience they aimed for, creating a disconnect with their goal of being a "financial friend."

To be a true financial friend, it's not about sending messages; it's about having a conversation. For us, this means understanding the context of each customer. MoEngage provides the features, like a perfect mixture of ingredients, to build that better, more delightful dialogue and truly help solve our customers' financial problems.

Indra Sutanto

Head of Brand and Marketing

With fragmented data, our processes were tedious and personalization was impossible. MoEngage’s Flows feature was a game changer; it allowed us to map the entire onboarding journey and understand customer behavior in real-time. By resolving drop-offs and re-engaging users intelligently, we achieved an incredible 86% boost in our conversion rate.

To solve their core challenge, LINE Bank partnered with MoEngage to unify all customer data onto a single platform. This eliminated data silos and provided a complete, 360-degree view of every customer. With this solid data foundation, they could finally move beyond one-size-fits-all messaging. Using MoEngage’s AI-powered engine, they began recommending the right messages at the right time to the right segments, turning impersonal broadcasts into meaningful, context-aware conversations that catered to individual needs.

LINE Bank leveraged MoEngage’s AI-powered visual workflow builder, Flows, to map and orchestrate entire customer journeys. This tool allowed them to easily set up automated campaigns for onboarding, retention, and loan processes. By visualizing the customer path, they gained real-time insights into what was working, identified drop-off points, and proactively re-engaged users. This automation eliminated operational bottlenecks, giving the team full control and reducing campaign setup time from over a day to mere hours.

Customer Insights & Analytics

Create omnichannel, personalized experiences using AI-powered insights and analytics.

Customer Journey Orchestration

Create unique, seamless experiences at every stage of your customer’s journey.

Merlin AI

Optimize campaigns and drive high ROI with Merlin AI.

Omnichannel Flows

Create connected experiences at every stage of customer journey across channels using Omnichannel Flows.

Using MoEngage, LINE Bank was able to:

Angkas Transforms Digital Engagement, Unifying Data to Boost Rider Conversion and Driver Adoption

Coca Cola Leverages MoEngage to Deliver Hyper-personalized Retail Journeys

Tonik is a digital-only neobank, or all-digital bank, that launched in the Philippines in 2021,....

Four brands in four countries under MoneyHero Group underwent implementation and go-live in less than....

MoEngage is an insights-led platform trusted by 1,350+ global brands like McAfee, Flipkart, Domino’s, Nestle, Deutsche Telekom, and more. MoEngage’s powerful analytics, personalization, and AI capabilities give a 360-degree view of your customers and help you create journeys across digital channels.

© Copyright 2026 MoEngage. All Rights Reserved.

Please wait while you are redirected to the right page...