Using MoEngage, Samco Securities was able to:

- Increase click rates by 5% and open rates by 20%

- Improve Average Order Per User by 40%

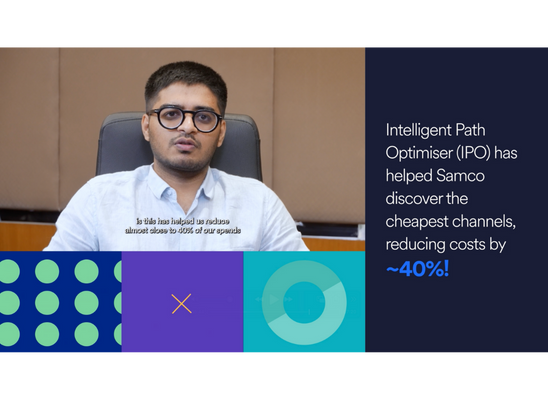

- Reduce (marketing) communication costs by 40% by identifying the cheapest communication channels

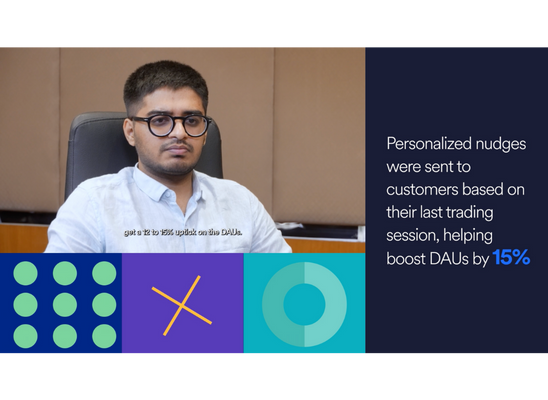

- Boost DAUs by 15% through personalized activation and engagement journeys