Paisabazaar, Angel One, Jar, and Zuno Insurance Discuss How AI is Revolutionizing the BFSI Industry

In today’s financial services industry, customers expect seamless, personalized interactions every time they log in, walk into a branch, or call support. On the other hand, 55% of banks report that they can’t move forward due to their legacy systems hindering progress. That gap between expectation and delivery is widening rapidly, and it’s not just a technological gap—it’s a trust gap.

The numbers make it clearer. A recent survey found that 74% of customers would be more loyal to their bank if it offered personalized tips and insights tailored to their daily spending and saving habits. Meanwhile, 70% of customers consider a consistent experience across channels to be extremely or very important in choosing their primary bank. Yet, 53% of banks running on outdated core systems admit they can’t scale due to data silos and operational bottlenecks.

If you compare those two facts, and you see the problem: demand keeps rising, but delivery is stuck.

So, the very thing customers care about most —an easy, consistent journey —becomes the hardest thing for institutions to provide. And this is where the tension lies. Fintech challengers, unburdened by decades of patchwork systems, can launch personalized offerings in a matter of weeks. Traditional banks, meanwhile, are finding it somewhat difficult to integrate fragmented data and legacy platforms. The outcome is obvious: slower innovation, weaker engagement, and frustrated customers who are quicker than ever to switch.

But change doesn’t have to mean tearing everything down and starting over. Some banks are finding smarter ways forward, building bridges between the old and the new, moving from product-first thinking to customer-first, and paying close attention not just to who the customer is, but when they’re ready to act. That idea of right-time engagement is proving to be a real differentiator.

These themes came out strongly in a recent panel discussion hosted by MoEngage. Leaders from Paisabazaar, Angel One, Jar, and Zuno Insurance spoke candidly about the real challenges they face, from navigating legacy limitations to rethinking customer engagement models. Their experiences provided a more honest look at how financial institutions are navigating a complex market.

The Core Industry Pain Points

1. The Data Problem Nobody Talks About

Financial services companies sit on mountains of data. Every transaction, every click on an app, every call to a service center, every visit to a branch — it all gets logged somewhere. The numbers are staggering. However, the awkward truth, which many executives avoid saying out loud, is that the more data banks collect, the more difficult it often becomes to make sense of it.

You can see the problem in everyday interactions:

- A customer who has been with the same bank for years calls about a loan, and the agent asks for basic details that the bank already has

- A mobile app that knows every account balance still shows random, irrelevant offers on the home screen

- The data isn’t missing. It’s just scattered across systems that don’t talk to each other

Nishant Malsisaria from Paisabazaar put it simply during the panel: “While we may have data sitting with us, we may not have the luxury to be able to use it.” That phrase — “luxury to use it”- captures the strange situation. Banks don’t lack information. What they lack is the ability to connect and apply it in ways that actually improve a customer’s experience.

2. The Siloed Experience Problem

Almost every large financial institution works in silos:

- The lending team maintains one system

- The credit card division keeps another

- Insurance, wealth, and savings products each run their own platforms with their own view of the customer

The result: Fragmented relationships. A single customer might hold a premium account, a mortgage, and two credit cards with the same bank, but when they ask about investments, they are treated as if they are walking in for the first time. The relationship history exists, but not in the right place at the right moment.

As Malsisaria explained: “We have very fragmented businesses… we have lending, we have credit cards, we have a savings business that’s coming up.” This emphasized that each line of business requires different insights. Each ends up working from an incomplete version of the same customer.

3. Marketing’s Generic Problem

The marketing side makes the gap painfully visible. Many financial institutions still rely on demographic buckets like age, income, and city as the foundation for campaigns. What comes out is generic messaging that speaks to nobody in particular.

Prateek Kabra from Angel One described how they used to approach communication. Every single day, the company sends the same newsletter to 10 million customers. No personalization, no timing logic, no context. Open rates hovered at 5–6 percent, which, as Kabra noted, “is actually considered decent for mass emailers.”

That figure masks a larger failure: out of 10 million recipients, more than nine million didn’t even open the message. Not because they didn’t use financial services, but because the content had nothing to do with their actual needs at that moment.

4. The Real Cost of Data Confusion

These problems don’t just waste marketing dollars. They affect the fundamentals of the business:

- Customer acquisition costs remain high when the wrong people are targeted with irrelevant offers

- Retention suffers when long-term customers feel unknown

- Cross-sell opportunities stall because recommendations feel random instead of helpful

- Trust erodes when customers expect their bank to know them better than most other companies

The irony is clear. Banks already know more about customers’ lives than most industries could dream of: spending habits, savings goals, and major life events. Yet the way that data is stored and split makes it almost unusable.

These foundational data problems have prompted many financial institutions to turn to AI as their solution. But as we’ll see next, even the most sophisticated AI implementations face significant challenges.

Why Current AI Solutions Still Fall Short

1. From Broad Segments to Individual Targeting – But With Gaps

The old way of doing customer segmentation now feels outdated. Most banks were still operating with basic categories, including high earners, young professionals, and retirees. Perhaps they could be slightly more specific with things like “small business owners in urban areas.” However, that approach overlooks much of what individual customers actually want.

Prateek Kabra from Angel One described how they shifted from this basic model. Earlier, they would create “four-five different cohorts.” Now they can personalize for each of their users. As he put it: “With these really powerful models coming in, we’ve started seeing scope for hyper-personalization.”

The newsletter is a clear example. The audience is still the same 10 million, but the system decides what to send to each person:

- What stocks did they search in the app

- Which sectors did they invest in

- What they’ve read or clicked before

Even subject lines change person by person. The difference showed up fast. Open rates went from 6% to 15%. That’s 1.5 million consumers engaging instead of 600,000. And, as Kabra noted, repeat usage grew too. Consumers began to expect content that matched their interests.

2. Real-Time Behavioral Understanding – But Trust Challenges Remain

Jar focused more on timing. Prashant Singh explained how they read SMS data to see spending behavior: “You can easily tell this person tends to spend this much money during this hour of the day, during this time of the month.”

From that, their system can tell when someone might be ready to invest and roughly how much. Singh called it finding the “concentration threshold of the person.” That sort of insight would have been unworkable earlier. Now it can happen “sometime on a runtime basis.”

But here’s the challenge: Financial data is different. When people share spending patterns and income details, they’re handing over information that affects loan approvals, credit scores, and insurance rates. The stakes are higher than with other industries.

3. The Trust and Transparency Gap

Most companies handle data permissions through long legal documents and “I agree” checkboxes. Prashant Singh from Jar takes a different approach. His team decided to be “very upfront about what data we are using.”

Singh explained their process: “We not only comply with the platform guidelines of Android, iOS and other platforms we are on, and not only to the NPCI — we basically go one step beyond and we really want people to have full understanding of what data we are storing, how it will be used, and for what purpose it will be used.”

The counterintuitive finding: Making it easier for people to say no actually gets more people to say yes. “We always give a very clear exit option — you can always withdraw your consent,” he said. “Because if they read and then they give the informed consent, that’s a far bigger vote of confidence.”

4. Experimentation Without Infrastructure

Singh’s team found success in unexpected places, but it required a specific mindset. He remembered when caller ring-back tones (CRBT) first launched in India: “The initial idea was that CRBT ring-back tones are essentially a digital product and it’s a gift… So the idea was that you should target a segment which is like SEC A – top of the pyramid kind of people.”

They bought ads on late-night English news shows. They targeted affluent urban customers. The logic made sense on paper.

“Turns out every rickshaw driver in the world was using CRBT.”

The lesson: “In my experiment with AI, I have realized that unless we look for those happy incidents – serendipitous discoveries – we will miss out on it.”

But here’s the problem: Most companies miss these patterns because they’re only measuring what they planned to measure. The infrastructure for identifying unexpected opportunities is often lacking when systems are fragmented.

Now that we understand how AI solutions are limited by underlying infrastructure issues, the next logical step many organizations take is adding specialized tools to fill the gaps. However, as we’ll explore next, this approach of layering point solutions actually exacerbates the fragmentation problem.

The Problem of Fragmented Tools Gets Worse

1. The Multi-Tool Reality

Marketing teams at financial institutions often manage six to ten different platforms:

- Customer data sits in one system

- Campaign management happens in another

- Mobile push notifications use a third-party platform

- Email marketing needs its own solution

Each purchase solved an immediate problem. Yet collectively, they created a bigger one.

Tarun Mathur from Zuno Insurance highlighted what happens when companies continue to add point solutions. He warned about “technical debt, cultural resistance, lack of observability” as barriers to effective AI implementation.

2. How Technical Debt Accumulates

Technical debt accumulates fast:

- Each new tool requires custom integrations

- Data transformations between systems need maintenance

- Cultural resistance grows when teams have to learn multiple platforms to do basic tasks

The lack of observability means nobody has a complete picture:

- The email platform shows high engagement rates

- The mobile analytics indicate low usage

- The customer data platform categorizes the same people as high-value prospects

- These systems can’t reconcile their different versions of customer truth

3. Data Silos Get Worse

Adding more tools usually makes customer engagement harder. Teams spend more time managing platforms and less time understanding customers.

Consider what happens during a typical campaign:

- Export customer segments from the analytics platform

- Upload them to the email system

- Create separate lists for mobile push notifications

- Set up tracking in yet another tool

- Try to measure results across multiple dashboards

Each step introduces potential errors. Data gets stale during transfers. Segment definitions drift between platforms. Attribution becomes nearly impossible.

4. The ROI Measurement Problem

When customer engagement happens across multiple platforms, measuring success gets complicated:

- Did the email campaign drive mobile app usage?

- Did the push notification influence the branch visit?

- These questions matter for budget decisions

- But they’re hard to answer when journey data is scattered

The result: Companies end up measuring what’s easy to track rather than what drives business results. Email open rates, app downloads, website sessions. These metrics tell part of the story. They overlook the broader perspective of customer lifetime value and engagement quality.

Financial services companies feel this problem more than most industries. They have complex product mixes and multi-channel relationships. Customers may research online, apply through mobile devices, and complete transactions in branches. Point solutions can’t track these journeys effectively.

Having identified core problems such as data silos, AI limitations, and fragmented tools, it becomes clear that the solution isn’t adding more technology to the mix. Instead, what’s needed is a unified approach that brings everything together. This leads us to explore how integrated platforms can solve these interconnected challenges.

An Integrated Platform Solution: MoEngage

1. Bringing Data and Engagement Together

Listening to the panel, one theme came up again and again. The industry isn’t short on data. The problem is scattered systems and patchwork fixes. Different perspectives converged on the same root issue: disconnected customer data and engagement systems.

Financial institutions usually don’t suffer from a lack of tools. They have plenty. What hurts them is how those tools stack up over time — one system for email campaigns, another for analytics, another for push notifications, and yet another for call centers. Each solved a short-term need, but together they make the customer experience disjointed.

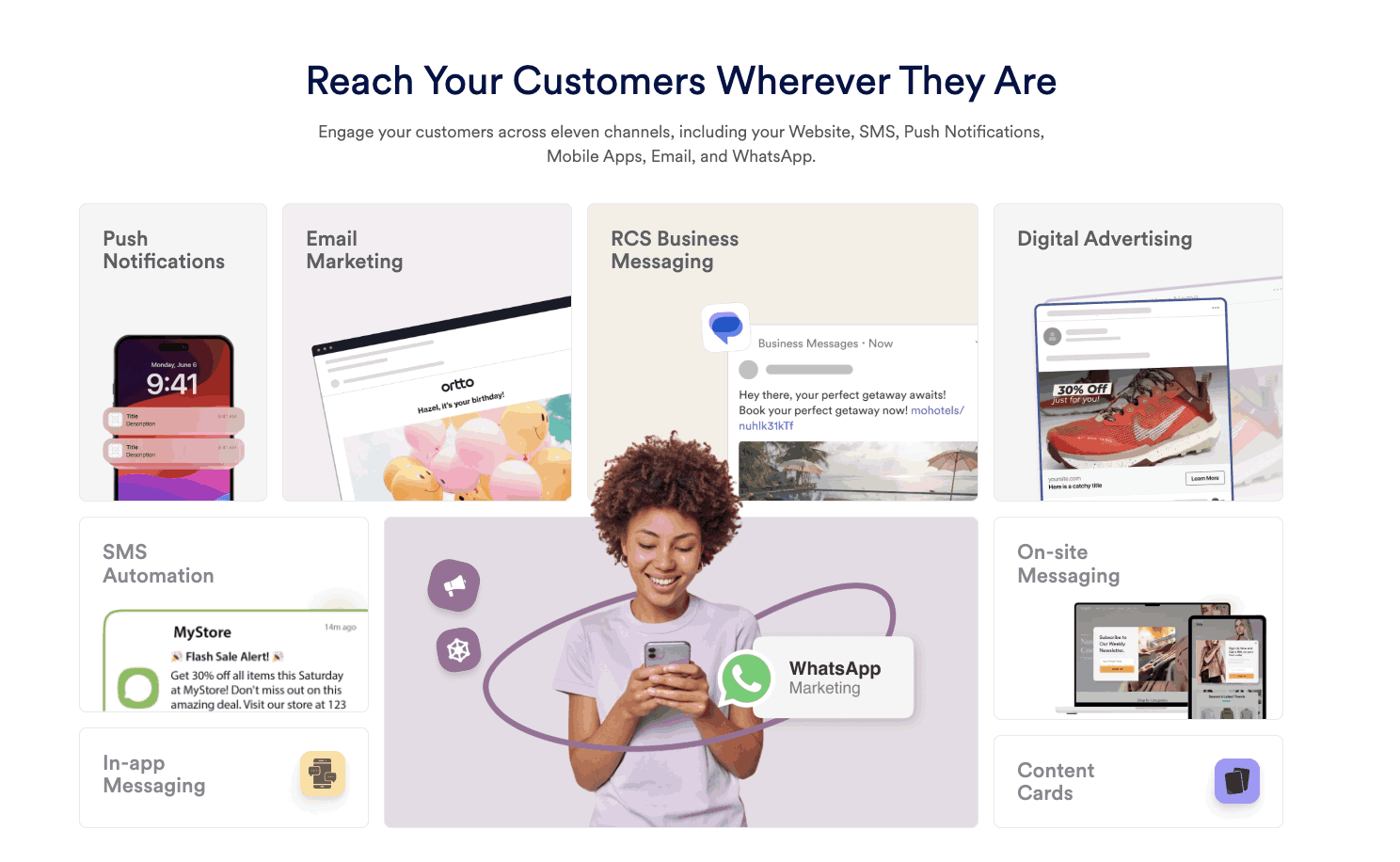

MoEngage was built to close that gap. It combines customer data management and engagement execution in one place, so instead of stitching together five or six systems, teams use a single platform.

2. Data That Stays Connected

The platform pulls in data from all points of interaction:

- Mobile apps

- Websites

- Call centers

- Branches

- Transaction systems

But it’s not just raw capture. MoEngage updates profiles in real-time, ensuring the information reflects a customer’s current activity.

What this means in practice:

- If someone applies for a loan in the app, a call center agent sees it right away

- Emails and notifications reflect that status automatically

- The customer doesn’t need to repeat themselves

- Different teams don’t work in the dark

For many banks, that’s the core issue: they already have the data, but it resides in silos that don’t communicate with each other.

3. AI That Handles the Heavy Lifting

Personalization at scale used to be a theory. With MoEngage’s AI models, it’s routine. The system can detect patterns in behavior, segment customers down to very specific groups, and adjust timing based on when people are most responsive.

Hyper-personalization capabilities:

- Email subject lines shift based on actual interests

- App homepages adjust to highlight relevant products

- Campaigns go out when people are likely to engage, not just when the marketing calendar says so

- Micro-segments like “people who are from Canada but living in Mumbai” become manageable

All of this runs in the background. For marketers, the interface stays simple enough that they don’t need a data science team at their side.

4. Journeys That Don’t Break

Customer journeys rarely follow a straight path. Someone might research an investment online, download an app, call support, and then walk into a branch. If those touchpoints don’t align, the experience feels disjointed.

MoEngage maps these journeys automatically:

- Keeps the conversation consistent across channels

- Abandon a credit card form online? Follow-up can happen by email, push notification, or service call

- Uses whichever channel the customer tends to respond to

- Context carries through each step

The person isn’t treated like a stranger every time.

5. Faster Campaign Cycles with Compliance Built-In

Marketing in financial services often gets stuck in long cycles. Compliance reviews, creative approvals, technical builds — two weeks or more is common.

MoEngage shortens this process:

- Campaign workflows run inside the platform

- AI tools help create variations quickly

- Compliance reviews get support from automated checks that compare new campaigns with already approved ones

- Teams that needed weeks to launch something now move in days

Privacy and compliance features:

- Controls for consent, retention, and audit trails are built into the system

- Customers can view what’s being collected and adjust permissions

- AI models include explainability features showing how personalization decisions are made

- Transparency helps with both regulators and customer trust

6. One Platform Instead of Many

The biggest shift comes from replacing point solutions with a unified approach:

- No more exporting data between systems

- No more reconciling reports from different dashboards

- Marketing, analytics, and engagement all work from the same source of truth

For institutions weighed down by old tech and years of bolt-on purchases, this is a way to simplify without starting over completely.

Conclusion

The discussion made one thing clear: customer engagement breaks down when data is fragmented and systems fail to integrate. AI can only deliver results when it’s built on a unified foundation.

The financial services industry stands at a crossroads. Customer expectations for hyper-personalized experiences continue to rise, while legacy systems and fragmented tools make it increasingly difficult to deliver. The companies that will thrive are those that can bridge the gap between having customer data and actually using it to create meaningful, timely engagements.

As the panel speakers demonstrated, the challenges are real and widespread:

- Data silos that prevent complete customer understanding

- Point solutions that create more problems than they solve

- Trust and compliance requirements that add complexity

- The need for real-time personalization at scale

That’s exactly what MoEngage provides: a single platform that connects data, channels, and intelligence, enabling financial institutions to deliver the experiences customers expect.

The path forward isn’t about adding more tools to an already complex stack. It’s about consolidation, integration, and building customer engagement on a foundation that can actually support hyper-personalization at scale.

Ready to see how it works? Book a demo with MoEngage and explore how unified customer engagement can transform your business.