Aditya Birla Fashion and Retail Limited, RPSG, Asian Paints, and Apparel Group talk About Rethinking Conglomerate Customer Engagement

For companies that manage several brands under one roof, it’s not as easy as it looks. They have access to a wide range of customers, often those who shop across different brands within the group. But making that into a seamless experience? That’s where things fall apart.

Over the last decade, customer acquisition costs have surged dramatically, with increases of approximately 60% between 2014 and 2019 alone, and the trend is expected to continue upward through 2025. Today, acquiring new customers can be 5 to 25 times more expensive than keeping an existing one. Meanwhile, companies that deliver connected customer experiences consistently outperform those with fragmented approaches, seeing higher customer spending, better retention rates, and stronger overall returns on their marketing investments.

Yet despite these clear benefits, most conglomerates haven’t made the shift. Each brand tends to go its own direction, managing its own customer data, marketing tools, and tech choices. As a result, customers who hop between brands are often treated like separate shoppers. They don’t get recommendations or offers that reflect their full relationship with the group. In most cases, they receive fragments and bits of personalization here and there that do not add up.

It’s not that customers aren’t asking for something better. They are. The real issue is getting these brands to share data and work together. Breaking down those walls is not always simple, and it’s something industry leaders are still figuring out.

This blog delves into insights from a recent panel discussion featuring industry leaders from prominent brands, including Aditya Birla Fashion and Retail Limited, RPSG, Asian Paints, and Apparel Group, who are tackling this challenge head-on.

The Current Reality: Silos and Forced Engagement

Here’s something most conglomerates probably wouldn’t say out loud: their data is a mess. Each brand collects customer information in its own way, stores it separately, and treats it as if it were top secret. A customer who shops at three different brands under the same company is often perceived as three entirely separate individuals.

Amit Dhanjani from Apparel Group shared a statistic that caught everyone off guard: “We only see not more than 8-10% of consumers being common between shopping online and offline together.” Everyone talks about how customers move seamlessly between digital and physical stores, but that’s rarely what’s happening.

The Economics Are Brutal

The numbers make this situation even worse:

- Getting a new customer costs 5-7x more than keeping an existing one

- Brands treat loyal customers like strangers when they visit other group brands

- A customer spending significantly at Brand A gets zero recognition at Brand B

- Obvious cross-selling opportunities get missed because brands don’t share information

Example: A shopper who buys work shirts from one brand and gym wear from another is a perfect candidate for weekend casual clothes, but those connections rarely happen.

When Marketing Becomes Annoying

Customers can tell when a brand is in a desperate situation. Nothing signals desperation more clearly than bombarding people with irrelevant offers from brands they’ve never shown interest in.

Varun Rajwade from ABFRL put it plainly: “If I try to thrust saying, ‘Oh, just because you bought in Pantaloons and now I know that you have propensity to buy men’s wear of so and so size, so let me start putting Louis Philippe marketing’ – that’s very forced and it’s actually going to be slightly annoying for consumers.”

Common mistakes conglomerates make:

- Using purchase data to make assumptions about other interests

- Cross-marketing without customer consent or context

- Treating data collection as permission for aggressive targeting

When Group Benefits Actually Work

There are moments when customers welcome connections across brands. The key difference is choice and timing.

Amit explained their successful approach: “In our case, if a customer is shopping at Victoria’s Secret, she has a benefit coming from Charles & Keith if she knows that as a group we’ve got all these brands.”

What works:

- Customers opt in because they see clear value

- Benefits are discovered, not forced

- Timing respects the customer journey

What doesn’t work:

- Aggressive cross-marketing based on purchase assumptions

- Bombarding customers with everything available

- Ignoring customer preferences for brand separation

As Amit emphasized: “It’s important you reach out at the right time, but just don’t bombard it – it will backfire.”

Most companies haven’t yet achieved this balance. They either send every offer to everyone all the time, or they hold back and don’t try at all. Neither approach works well.

The data fragmentation and forced engagement problems are symptoms of a deeper issue: conglomerates lack the foundation needed to truly understand their customers.

The Foundational Challenge: Data Without Intelligence

Every conglomerate executive will tell you they have “tons of data.” That part is true. But collecting data and actually using it are two very different problems.

The Illusion of Data Richness

Most conglomerates sit on mountains of customer information scattered across different systems:

- One brand tracks purchase history in a CRM

- Another captures browsing behavior through website analytics

- A third collects loyalty program data in a separate platform

The result is a fragmented view that reveals very little about actual customer behavior.

Aseem Agarwal from Asian Paints explained the core issue: “It becomes very important that you look at something, a platform or a CDP platform or a lakehouse, where you can actually pull in all the consumer data and start building a consumer 360-degree view.”

The difficulty arises because each brand has developed its own method of categorizing customers, products, and interactions. Brand A might label someone “premium” based on spend levels, while Brand B uses a different benchmark entirely. Once you try to merge these views, nothing lines up neatly.

The Standardization Imperative

Varun Rajwade pointed to something many conglomerates overlook: “Standardization reduces the cost of technology. Standardization means you can go and get bulk discounts, bulk buys, and you again bring down cost.”

This goes well beyond license savings. Without common standards, companies run into:

- Custom integrations for nearly everything

- Systems that fail frequently

- Endless maintenance work

- Integrations that never deliver what was promised

Beyond Data Collection

Even if data is pulled together, the problem of intelligence still remains. Aseem put it plainly: “You would have to standardize data. You would have to standardize product taxonomy. You would have to standardize how consumers’ data is being stored by different businesses.”

But standardization creates its own headaches:

- Each brand has valid reasons for how it structures data

- Customer segments might require different handling

- Product categories often fail to match across group brands

Finding common ground without losing important details is delicate work.

The Cultural Hurdle

Perhaps the biggest obstacle isn’t technical. It’s getting brands to actually share their data. Aseem acknowledged this: “That cultural collaboration angle will also have to come in where brands are ready to share the data.”

Brand managers have spent years building their own customer databases. They understand their customers in ways that make sense for their specific business. The concerns are real:

- What if the unified view dilutes their competitive advantage?

- What if other brands start targeting their best customers?

- Will they lose control over customer relationships they’ve built?

These concerns aren’t entirely unfounded, which makes the standardization challenge even more complex. But without solving it, conglomerates remain stuck with expensive, fragmented systems that deliver mediocre results.

Getting the foundation right is only the first step. The real opportunity arises when unified customer intelligence is leveraged, especially once AI is introduced.

The Personalization Breakthrough

For years, marketers have discussed personalization while primarily offering basic segmentation. You bought shoes, so here are more shoes. You’re 25 to 34, so here is generic content for millennials. AI is finally opening the door to personalization that actually works at scale.

From Segments to Individuals

Aseem described how this shift is unfolding: “While we have been talking about personalization for a long time, I think with the advent of GenAI, I see it becoming a reality now where I could actually really personalize my communication or even maybe I can tell a consumer, ‘Hey, this is how your home should look’ based on their interests.”

The difference is significant:

- Traditional personalization: Put customers into increasingly narrow buckets

- AI personalization: Understand each customer as an individual and adapt in real-time

Consider how this works for a home improvement conglomerate like Asian Paints. Instead of showing everyone the same catalog of paint colors, AI can analyze a customer’s previous purchases, their browsing behavior, even the style of their neighborhood, and generate personalized room designs. Not just “consumers like you bought this” but “here’s what your specific living room could look like.”

Real-Time Decision Making

But personalization isn’t just about generating content. It’s about making the right decision at the right moment across every touchpoint.

When a customer walks into a physical store:

- AI can instantly surface their purchase history

- Show their online browsing behavior to sales associates

- Highlight their preferences for better service

When they visit the website:

- System prioritizes products based on the current life stage

- Offers get tailored to recent interactions

- Content adapts to their specific context

The Orchestration Challenge

Here’s where it gets complex for conglomerates. True personalization requires coordinating decisions across multiple brands and touchpoints simultaneously:

- Customer shopping for furniture online should influence home decor ads from other group brands

- A large purchase from one brand should affect the timing of offers from other brands

- Real-time coordination across all customer interactions

Most conglomerates can’t do this today because their systems don’t talk to each other in real-time. By the time one brand updates the customer profile, the moment for coordinated action has passed.

Beyond Marketing Communications

The personalization opportunity extends far beyond email campaigns and website content. Aseem explained how it’s transforming in-store experiences: “My staff on the ground or staff in the field to be able to really nudge the customer in the right direction, to be really able to know ‘Was the customer really interested in a particular wallpaper or a product?'”

This represents a fundamental shift in how physical retail can work:

- Sales associates can pick up conversations where customers left off online

- Make informed recommendations based on a complete journey across all group brands

- Start interactions with context instead of from scratch every time

Personalization at this scale requires more than just good intentions and smart algorithms. It demands a complete rethinking of how success gets measured across the entire conglomerate ecosystem.

The Engagement Orchestration Problem

Getting all your brands to work together sounds simple in theory. In practice, it’s like conducting an orchestra where half the musicians are playing different songs.

Coordinating Touchpoints Across Brands

When a customer interacts with multiple brands in your conglomerate, each touchpoint should feel connected. But most companies struggle with basic coordination:

- Customer gets an email from Brand A about a sale

- Simultaneously receives push notification from Brand B about a different promotion

- These mixed messages create confusion instead of value

The challenge gets worse with timing. If someone just made a large purchase from one brand, other brands should adjust their approach accordingly. However, without real-time data sharing, Brand B has no idea what Brand A has just done.

Next Best Action Across the Ecosystem

Himanshu Garg from RPSG highlighted the complexity: “At the moment, around the acquisition layer, I have a few of my product team members who are working on AI cross-marketing – those kinds of pieces where the idea is content generatio,n including text and images, how much money to put in what type of ads.”

But the next best action isn’t just about which ad to show. It involves:

- Deciding whether to show an ad at all

- When to introduce a new brand

- How long to wait between touchpoints

- Which channel to use for each interaction

Most conglomerates make these decisions in isolation. Each brand optimizes for its own metrics without considering the broader customer journey. The result is often over-communication, poor timing, and missed opportunities for genuine value creation.

Success Metrics That Actually Matter

Traditional marketing metrics often fail when dealing with complex, interconnected ecosystems. Revenue per brand, email open rates, and conversion rates tell you almost nothing about whether your unified approach is actually working.

Cross-Shopping Rate: The Only KPI That Matters

Varun Rajwade was direct about this: “If I’m looking at a group loyalty program, my number one metric to my mind has to be cross-shopping rate, how many consumers are shopping across multiple brands? Because that’s the reason forthe existence of the group program.”

This makes perfect sense. Individual brands will optimize their own performance regardless. The group’s value comes from connecting customers to brands they wouldn’t have discovered otherwise.

But most conglomerates don’t analyze this properly. They might know that 15% of customers shop across multiple brands, but they don’t know if that’s good or bad. They don’t analyze whether the number is growing. And they definitely don’t connect it to specific initiatives or campaigns.

The First-to-Second Purchase Challenge

Here’s where things get interesting. The hardest conversion isn’t getting someone to buy again from the same brand; it’s getting them to buy from a different brand. It’s getting them to make that crucial second purchase that turns them from a one-time buyer into a repeat customer.

Amit explained: “It’s not the second and the third purchase you see that happening, it’s the first to the second purchase where the maximum gap is. If you’re able to move that from the first to the second, then you can move inside the journey.”

This applies at both brand and group levels:

- At the brand level: Converting first-time buyers to repeat customers

- At the group level: Converting single-brand customers to cross-brand shoppers

Beyond Retention to Ecosystem Growth

Most loyalty programs focus on retention, but Varun pointed to a different model: “If I look at examples like Delta, large group loyalty programs. Delta is one of the largest and most reputable group loyalty programs. The Delta Miles group loyalty program is worth more than the airline, and that’s because they have consistently built a data monetization strategy.”

The lesson here is about thinking beyond keeping customers happy. The real value comes from leveraging customer intelligence to create new revenue streams, partnerships, and growth opportunities that wouldn’t exist at the individual brand level.

Understanding what to measure is one thing. Actually implementing these systems is where most conglomerates hit reality.

Implementation Reality Check

Every conglomerate’s digital transformation starts with grand visions and detailed roadmaps. Most end with modest improvements and lessons learned about why change is hard.

The Cultural Challenge

Himanshu from RPSG described the balancing act: “How can we explore that without creating chaos, without creating disruption, and without destroying business as usual? Because there is also slightly lesser tolerance for abrupt changes within larger organizations.”

Why large organizations move slowly:

- Established processes that actually work

- Teams with deep expertise in current systems

- Customers who expect consistency

- Risk tolerance decreases with company size

This creates a chicken-and-egg problem: you need to demonstrate value to gain buy-in, but you need buy-in to develop the systems that deliver value.

Start Small, Build Success Stories

The solution is proving value incrementally. Himanshu explained: “It’s all about the technology adoption and making these small meaningful changes and creating these success stories which you then take across the brands.”

Why this approach works:

- Lower risk if something goes wrong

- Easier to measure impact

- Creates believers who can advocate for broader changes

- Allows you to learn and refine before scaling

What Not To Do

The panelists were clear about common mistakes:

- Amit: “Don’t over-communicate to the consumer. Just don’t bombard them with everything that you have.”

- Varun: “Don’t buy tech for the heck of it, just because it looks nice. It has to solve a problem.”

- Aseem: “Just add value to the journey. Whatever you do, data should help you really add value; otherwis,e it’s pointless.”

Most conglomerate initiatives fail not because of bad technology, but because they lose sight of customer value in pursuit of internal efficiencies.

The implementation challenges are real, but they’re not insurmountable. The question is whether you have the right platform foundation to build on.

The Path Forward: Integrated Customer Data and Engagement

Most conglomerates have tried the piecemeal approach. They purchase a CDP from one vendor, an email platform from another, analytics tools from a third, and orchestration software from a different vendor. Then they spend months trying to get everything to work together.

Why Fragmented Solutions Fail at Scale

The integration nightmare is real. Each platform has its own data format, its own API limitations, and its own idea of how customer engagement should work. What looks simple in a vendor demo becomes incredibly complex when you’re trying to coordinate across multiple brands and touchpoints.

Consider what happens when you need to execute a coordinated campaign:

- CDP identifies the target audience

- Data gets exported to the email platform

- Analytics tools analyze initial engagement

- The orchestration system decides the next actions

- Results flow back to the CDP for future decisions

Each handoff creates delay and potential failure points. By the time your “real-time” personalization kicks in, the moment has often passed.

The Need for Unified Platforms

Smart conglomerates are moving toward platforms that handle both data and engagement within a single, integrated system. This isn’t just about convenience; it is about speed and intelligence.

When customer data and engagement capabilities live in the same platform:

- Decisions happen in real-time without API delays

- Customer profiles update instantly across all channels

- Orchestration rules can consider the complete customer context

- A/B testing can optimize across the entire journey, not just individual touchpoints

Real-Time Decisioning Across All Touchpoints

The future belongs to systems that can make intelligent decisions at every customer interaction. Whether someone opens an email, visits a website, walks into a store, or calls customer service, the system should instantly understand their context and optimize the experience.

This requires platforms that can process customer signals in milliseconds, not minutes. The difference between showing someone a relevant offer versus a generic one often comes down to how quickly your system can react to their behavior.

For conglomerates, this complexity multiplies. The system needs to consider not just what’s happening with one brand, but how that fits into the customer’s relationship with the entire ecosystem.

The technical requirements are clear, but finding a platform that can actually deliver on these promises is the real challenge.

The MoEngage Advantage: Your Complete CDEP Solution

Here’s the reality most conglomerates face: they need a platform that can handle massive scale, complex customer journeys, and real-time personalization across multiple brands. Most vendors can excel in one or two of these areas. Few can do all of them.

Unified Customer Data & Intelligence

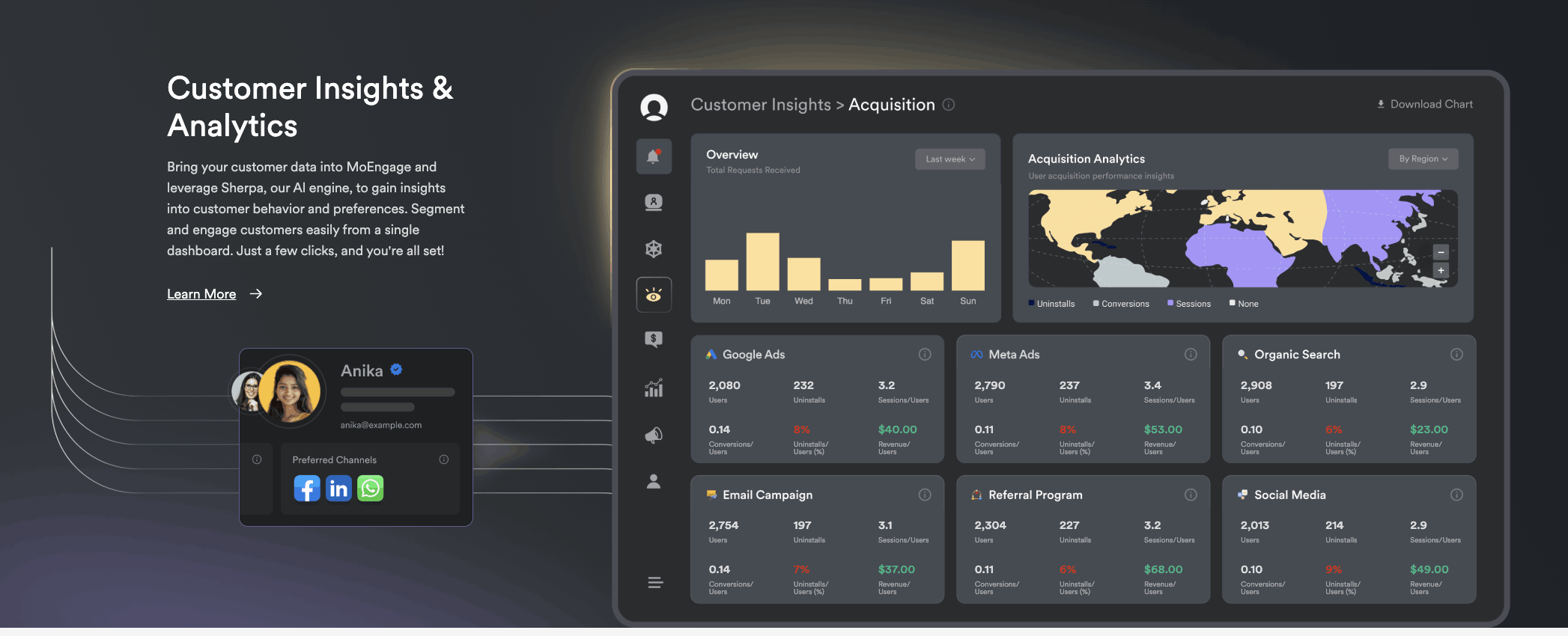

MoEngage’s Customer Data and Engagement Platform (CDEP) solves the foundational challenge that every panelist mentioned: getting a true 360-degree view of your customers.

- Real-Time Customer Profiles: Instead of waiting for batch processes to update customer data, MoEngage creates unified profiles that update instantly across all touchpoints. When a customer makes a purchase in-store, their online experience changes immediately.

- Cross-Brand Intelligence: The platform can track customer journeys across multiple brands within your conglomerate, identifying cross-selling opportunities and preventing over-communication. This addresses exactly what Varun warned against.

AI-Powered Personalization at Scale

Remember Aseem’s vision of telling customers, “This is how your home should look”? MoEngage’s AI capabilities enable this level of sophisticated personalization across every channel.

- Merlin AI: MoEngage’s AI engine, Merlin AI, doesn’t just segment customers with Merlin AI Segment Assist. It predicts individual behavior using Predictive Segments and optimizes experiences in real-time. Whether someone is browsing your website, opening an email, or interacting with your mobile app, Merlin AI’s Campaign Decisioning agent ensures they get the most relevant experience possible.

- Dynamic Content Generation: Create personalized content and on-brand images that adapt to each customer’s preferences, purchase history, and current context without manual intervention, using Merlin AI Copywriter and Merlin AI Designer.

Omnichannel Orchestration

The orchestration challenge that stumps most conglomerates becomes manageable with MoEngage’s unified approach.

- Journey Orchestration: Design automated customer journeys that span multiple brands, channels, and touchpoints. When someone shows interest in furniture from Brand A, the system can intelligently introduce home decor options from Brand B at exactly the right moment.

- Real-Time Decisioning: Every customer interaction triggers intelligent decisions about the next best action. No delays, no batch processing, no missed opportunities.

Enterprise-Grade Analytics

Track the metrics that actually matter for conglomerates, such as the cross-shopping rates that Varun emphasized as crucial for group programs.

- Cross-Brand Reporting: Understand how customers move between your brands, which touchpoints drive the most cross-selling, and where you’re losing potential group revenue.

- ROI Attribution: Connect group-level initiatives to actual business outcomes, making it easier to justify continued investment in unified customer experiences.

Implementation That Actually Works

MoEngage understands that enterprise implementations need to be gradual and prove value at each step, exactly what Himanshu recommended with “small success stories.”

- Flexible Deployment: Start with one brand or one use case, prove the value, then expand across your entire conglomerate ecosystem.

- Expert Support: Implementation teams with extensive experience in complex, multi-brand environments guide you through every step of the process.

The result is a platform that addresses every challenge discussed in our panel, from data unification to real-time personalization to cross-brand orchestration, without the complexity of managing multiple vendor relationships.

For conglomerates serious about unlocking the potential of their customer ecosystem, MoEngage isn’t just another tool in the stack. It is the foundation that makes everything else possible.

Wrapping Up!

The path forward for conglomerates is clear: unified customer data and engagement platforms are no longer optional. They are essential for survival. The brands that learn to deliver seamless, personalized experiences across their entire ecosystem will capture disproportionate value. Those that remain stuck in silos will watch customers drift toward competitors who understand them better.

The technology exists. The strategies are proven. The question is whether you’ll act before your competitors do.

Ready to transform your conglomerate’s customer experience?

Book a demo with MoEngage to see how our Customer Data and Engagement Platform can unify your brands and unlock the true potential of your brand ecosystem.