Unlocking Digital Transformation With a Modern Stack: A MoEngage and EY Perspective

The financial services industry in India is racing through a once-in-a-generation transformation. After years of incremental upgrades, banks and fintechs now face an urgent mandate: move beyond legacy infrastructure and deliver seamless, real-time customer experiences. The pressure is coming from every direction, like rising consumer expectations, regulatory shifts, and the rapid growth of digital-first competitors.

Yet this isn’t simply a story of technology adoption. It’s about building a modern stack that combines data, agility, and customer-first thinking into a single engine of growth. Some firms that were late to start have ended up moving the quickest. They’re catching up by building unified data layers and engagement platforms that can scale.

To explore how this shift is unfolding, MoEngage recently hosted a panel featuring Saurabh Chandra, Partner at EY, and Yash Reddy, Chief Business Officer at MoEngage. The conversation examined the hard realities of modernization: from the complex journeys of public-sector banks to the fast-moving fintechs that are rewriting the rules.

Their insights reveal a clear message for financial services leaders, and the takeaway was straightforward: a digital foundation that can handle constant change matters more than any single platform. Leaders who get that right will be ready for the next wave, whenever it comes.

1. Late Start, Faster Trajectory

India didn’t rush into digital banking the way some Western markets did. But once the shift began, it gathered speed that’s hard to ignore. Over the last few years, digital payments have gone from a side story to the main engine of everyday transactions. Fintech adoption continues to expand, financial inclusion reaches deeper each quarter, and large banks that were once hesitant are now experimenting at nearly the same pace as startups.

Here are the stats that back up this:

- Digital payments in India have increased by over 129 times in terms of transaction volume between FY 2012-13 and FY 2023-24.

- In FY 2023-24, India’s digital payments by value rose from ₹1,370 lakh crore in FY 2017-18 to ₹2,428 lakh crore.

- According to Deloitte’s 2024 Digital Banking Maturity survey, the Digital Banking Maturity (DBM) Index among leading Indian banks jumped from 43% in 2022 to 59% in 2024 — an improvement that puts Indian banks ahead of many global peers in customer-facing digital capabilities.

This rapid growth, however, isn’t unfolding in a single, uniform way. India’s financial ecosystem is vast and diverse, and the path to modernization varies widely depending on the type of institution. Fintechs, private-sector banks, and public-sector giants each face their own unique mix of opportunities and constraints, ranging from the freedom of a clean slate to the complexity of decades-old systems and the challenge of scale.

As Saurabh Chandra of EY highlighted during the panel, understanding these differences is essential to understanding where the industry is headed. His simple but powerful framework breaks the market into three distinct archetypes, each on its own journey toward a modern digital stack.

2. Three Archetypes, Three Journeys

India’s financial services sector isn’t moving in a straight line. Each institution has a unique starting point, distinct constraints, and varying pressures. The speed of change and the approach to digital adoption depend significantly on legacy systems and the available room for experimentation. On the MoEngage–EY panel, Saurabh Chandra sketched three broad archetypes to make sense of this.

- Nimble Fintechs

Fintechs born in the cloud era start with almost no baggage. They can deploy modern stacks, such as data lakes, AI tools, and real-time analytics, without worrying about unwinding decades of legacy systems. Customer engagement tends to be immediate: notifications, offers, and insights reach users almost before they ask for them. That agility enables them to move quickly with new products and set the bar for smooth, seamless experiences. However, that speed can come with trade-offs; governance and scaling aren’t always fully baked from the outset.

- Large Private Banks

Private banks carry decades of history in their systems. Core banking platforms, old databases, batch processes—these aren’t easy to replace. Modernization here is methodical. Data pipelines require cleaning, datasets need governance, and migrations to hybrid or open-source systems occur slowly. The aim is to move quickly enough to meet customer expectations without compromising the reliability and trust that the brand has established. It’s a careful balancing act.

- Public-Sector Giants (PSUs)

India’s public-sector banks and insurers operate at an extraordinary scale; some rank among the world’s largest. That scale brings a different reality: every technology decision carries systemic impact. Platformization is the new buzzword, but caution drives its pace. For them, digital transformation is a marathon, requiring meticulous planning and regulatory alignment to ensure stability while introducing new capabilities.

As Chandra summed it up during the discussion, “To change the whole moving ship is difficult… there’s a humongous room for platformization and change.”

Together, these three archetypes illustrate why India’s financial services sector is both complex and full of potential. Each group’s journey is unique, yet all share a common destination: a modern stack capable of real-time engagement and data-driven growth.

While the journeys of these three archetypes differ, one theme is universal: adopting a modern stack isn’t just about upgrading systems; it requires a fundamental shift in mindset, processes, and organizational readiness.

3. Modernization Is More Than Technology

Digital transformation isn’t just about picking the latest tools. It’s about changing how an organization thinks, how it operates, and how it delivers value to customers. The panel made it clear that even the most advanced technology won’t create impact if people, processes, and strategy aren’t aligned.

Challenges technology alone can’t fix:

- Teams are struggling to act on insights quickly

- Siloed processes across departments

- Leadership without a clear vision for transformation

Yash Reddy from MoEngage put it this way:

“It feels like it’s just more than a technology shift—it’s a change in the ways of working, it’s a change in the operational readiness of the banks and the FS institutions, and it’s a change in strategic mindset as well.”

What helps modernization actually work:

- Streamlined decision-making: Breaking hierarchical bottlenecks to respond faster

- Empowered teams: Giving employees actionable data for near real-time decisions

- Unified collaboration: Aligning marketing, operations, and customer experience toward the same goal

For large banks and PSUs, this mindset shift is essential because of legacy structures and complex hierarchies. Even nimble fintechs benefit from operational discipline to scale effectively.

While mindset and operational readiness set the stage, the real challenge lies in the backbone of any transformation: data. How institutions manage, clean, and unify their data determines whether modernization efforts succeed or stall.

4. Data: The Foundation and the Friction

Everything in modernization comes back to one thing: data. Without clean, accessible, and well-governed data, even the best technology and strategies stumble.

Challenges financial institutions face with data:

- Fragmented systems: Legacy databases, multiple platforms, and disconnected processes create silos

- Data quality issues: Inconsistent, incomplete, or outdated information undermines decision-making

- Scalability constraints: Handling large volumes of transactions and customer interactions in near real-time is difficult without a robust architecture

As Saurabh Chandra from EY observed during the panel:

“Large banks are catching up in terms of data engineering, metadata management, and data quality checks. The power of digital marketing—and broader transformation—depends heavily on getting these fundamentals right.”

Why solving the data challenge is crucial:

- Enables real-time personalization and engagement across channels

- Supports faster decision-making and operational agility

- Provides a single source of truth for analytics, compliance, and customer insights

In essence, data is both the backbone of transformation and its biggest stumbling block. Solving it effectively requires a unified platform that brings together customer data, insights, and engagement capabilities. Without that, even strong strategies can fall short.

5. Why an Integrated Stack Matters

Once mindset, operations, and data foundations are set, the next hurdle is integration. Without a unified system, even strong strategies and modern tools can fall short of their potential. Fragmented platforms, siloed departments, and disconnected data hinder decision-making, lead to errors, and result in an inconsistent customer experience.

The key advantages of an integrated stack:

- Unified Customer View: Combining data from multiple sources, such as transaction systems, CRM platforms, and engagement channels, provides a single, comprehensive view of each customer. Insights become actionable, campaigns are better targeted, and messaging stays consistent across touchpoints.

- Seamless Cross-Channel Engagement: Customers interact across multiple channels, including mobile, web, email, and social media. A connected platform enables the management of these journeys in real-time, allowing for scalable personalization without compromising control.

- Operational Efficiency and Agility: Integration reduces manual handoffs, repetitive tasks, and dependency on multiple vendors. Teams can focus on strategy and innovation rather than reconciling fragmented data and systems.

- Scalability and Flexibility: As institutions grow, launch new products, or enter new markets, a unified platform can handle an increasing number of transactions and complex customer journeys without adding complexity.

During the panel, Saurabh Chandra from EY noted:

“For PSUs and large banks, platformization is not optional. To inject new capabilities and reach customers efficiently, you need a unified system that can scale across the organization.”

Saurabh Chandra from EY explained on the panel:

“For PSUs and large banks, platformization is not optional. To inject new capabilities and reach customers efficiently, you need a unified system that can scale across the organization.”

Integration is more than a technical fix. It connects technology to business strategy. When insights, operations, and customer interactions are linked, institutions can move more quickly, innovate continuously, and deliver experiences that truly matter. Therefore, a modern integrated stack serves as the foundation that enables financial institutions to transition from fragmented efforts to a coordinated, data-driven approach. That is where real growth begins.

With the importance of an integrated stack clear, the next question becomes: how can financial institutions bring data, engagement, and personalization together seamlessly? This is where a unified Customer Data and Engagement Platform plays a pivotal role.

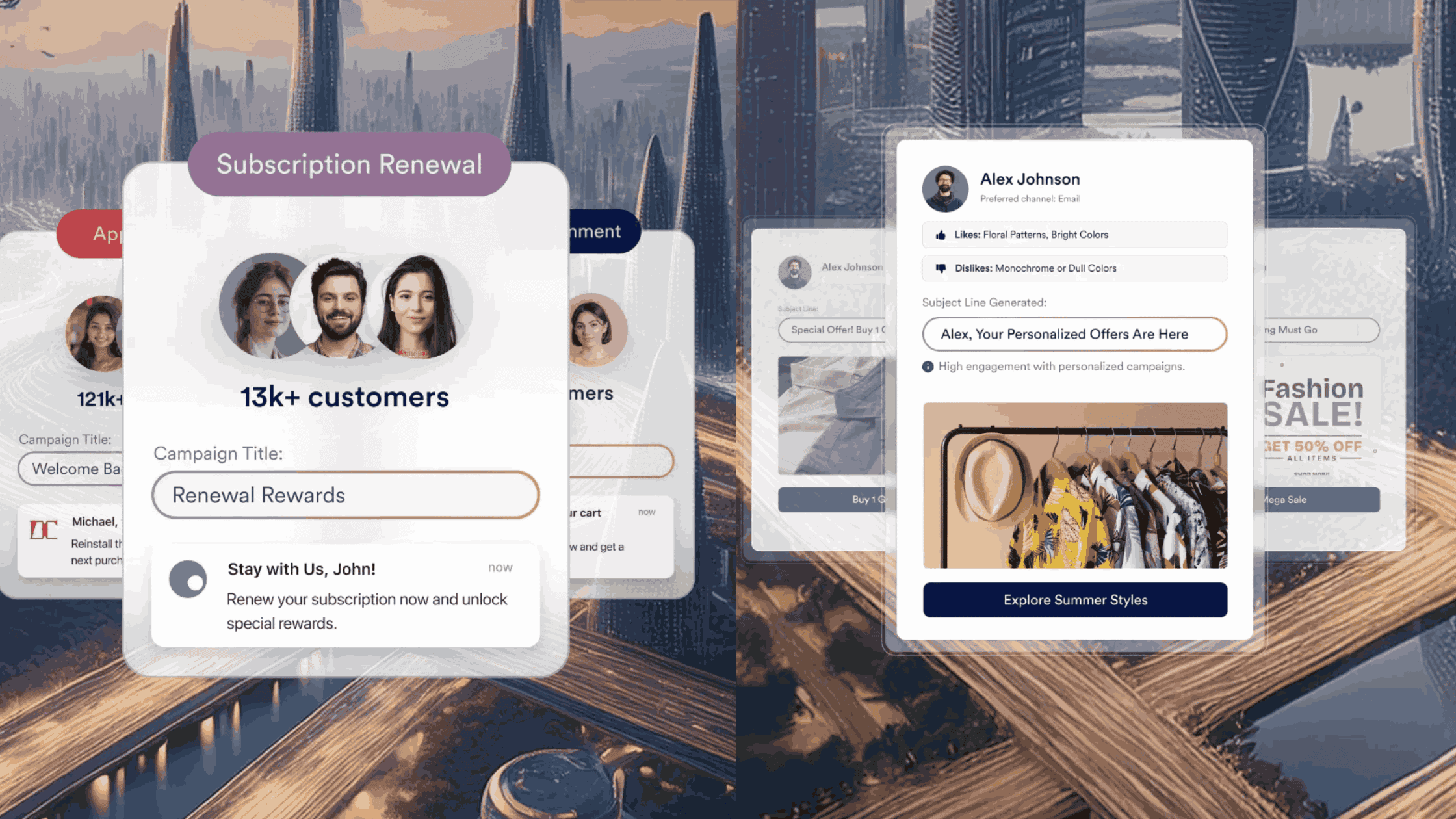

6. MoEngage as the Modern Engagement Backbone

Digital transformation in financial services is not just about adopting the latest technology; it is also about leveraging it effectively. It’s about bringing data, insights, and customer engagement together to create experiences that actually matter. MoEngage, as a Customer Data and Engagement Platform (CDEP), helps institutions achieve this by unifying systems, personalizing interactions, and making every customer touchpoint meaningful.

Unified Customer Profiles for 360° Insights

One of the biggest challenges banks and financial institutions face is the fragmentation of data. MoEngage addresses this by consolidating customer information from mobile apps, websites, CRM systems, and even offline channels into a single, comprehensive profile. With this, teams can:

- Understand each customer’s behaviors, preferences, and past interactions

- Make smarter, data-driven decisions for campaigns and product launches

- Deliver personalized messages and offers that actually resonate

- Avoid the frustration of working across multiple disconnected systems

By creating a comprehensive picture of each customer, financial institutions can move away from reactive marketing to proactive, insight-driven engagement.

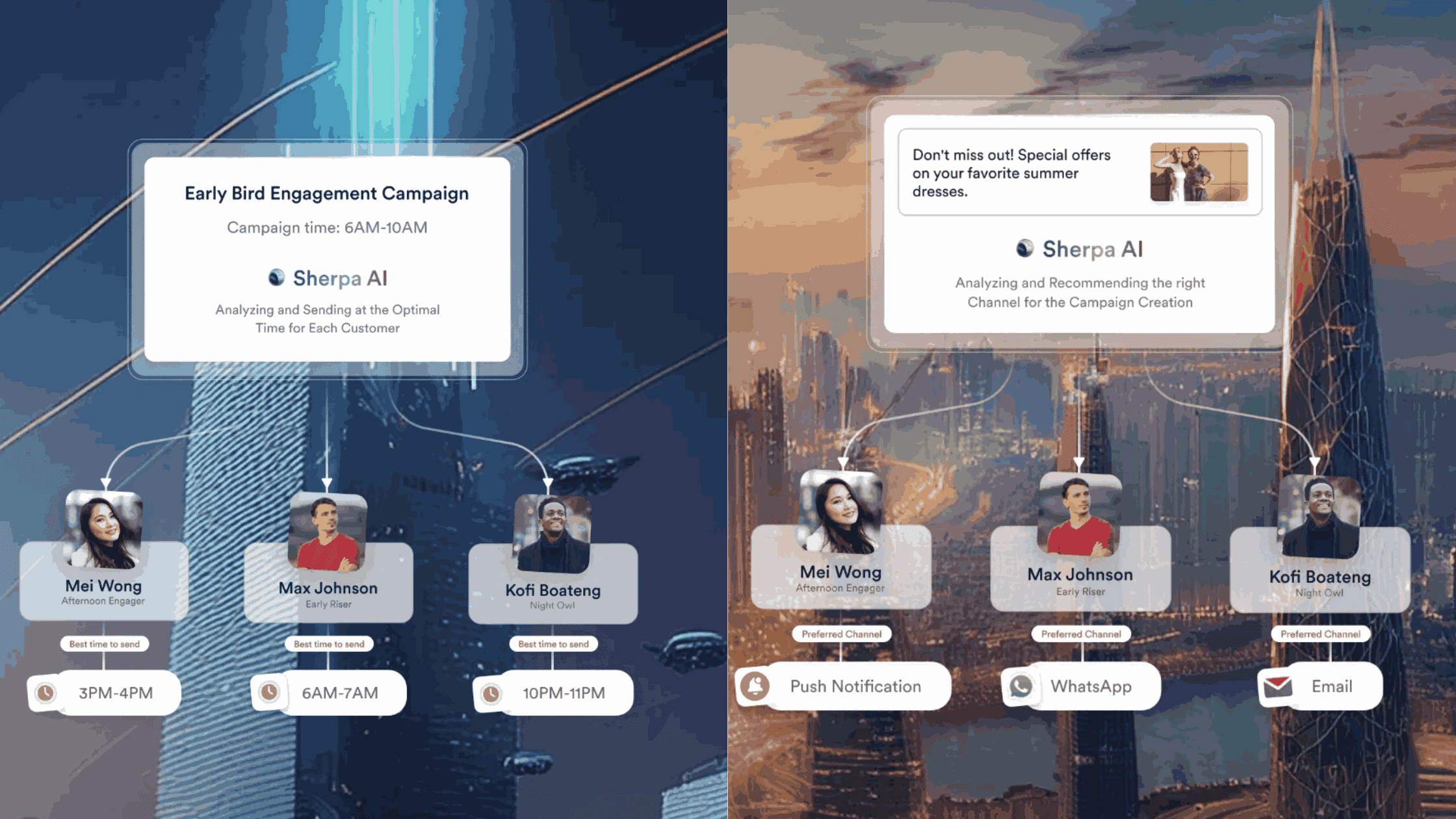

AI-Driven Personalization at Scale

MoEngage utilizes AI to deliver personalized communication beyond generic messaging. It helps institutions predict what customers want and deliver it at the right moment. This means:

- Recommending products and services that are truly relevant to each person

- Triggering messages and notifications based on real-time behavior

- Increasing engagement and conversion by anticipating customer needs

- Moving away from one-size-fits-all marketing toward personalized journeys at scale

This AI-driven personalization ensures that financial institutions are no longer communicating through generic, one-size-fits-all campaigns; instead, they are building relationships at scale.

Cross-Channel Orchestration for Seamless Engagement

Customers don’t stick to one channel, so neither should institutions. MoEngage makes it easy to engage across push notifications, email, SMS, in-app messages, web push, and WhatsApp. With this, teams can:

- Plan consistent customer journeys across every channel

- Run campaigns from a single platform, cutting down on manual work

- Send timely and relevant messages that feel personal

- Build trust and loyalty through seamless experiences

Bringing all channels together helps avoid fragmented messaging and ensures customer interactions remain relevant.

Real-Time Analytics for Smarter Decisions

Knowing how campaigns are performing is critical. MoEngage offers real-time analytics and reporting, helping teams quickly see what works and what doesn’t:

- Track user behavior, funnel performance, and engagement trends

- Run A/B tests and optimize campaigns on the fly

- Gain actionable insights to improve retention and lifetime value

- Make informed, timely decisions instead of guessing

With these analytics, financial institutions can transition from intuition-based decisions to evidence-driven strategies, ensuring that every engagement drives a measurable impact.

Scalable Infrastructure for Growing Needs

Ultimately, MoEngage is designed to scale as institutions expand their operations. It can handle billions of messages each month and millions of active users, ensuring teams can:

- Expand products or services without worrying about tech limits

- Focus on strategy and innovation instead of infrastructure headaches

- Maintain smooth performance during peak times

- Reduce dependency on multiple tools by having everything under one platform

This scalability ensures that MoEngage grows in step with the organization, supporting both current operations and long-term transformation goals.

By combining unified profiles, AI personalization, cross-channel orchestration, analytics, and scalable architecture, MoEngage acts as the backbone for modern engagement. It moves institutions beyond old systems, fragmented data, and siloed operations.

MoEngage is more than a platform. It is a strategic enabler. It turns insights into action, improves operational efficiency, and helps create customers who are engaged, loyal, and brand advocates. It’s not perfect. Implementation takes work. However, it demonstrates how modern engagement can truly function when everything is connected and practical.

7. Conclusion

MoEngage enables financial institutions to connect data, insights, and engagement seamlessly, eliminating the need to juggle multiple tools. From unified customer profiles to AI-driven personalization and real-time analytics, it enables banks and fintechs to understand what customers need, respond in real-time, and maintain that connection as they scale.

If you’re exploring how to replace scattered systems with one engagement backbone, it’s worth seeing in action. Schedule a demo with the MoEngage team to walk through real use cases and understand how it can fit into your digital transformation plans.