🔥 The Customer Engagement Book: Adapt or Die is live!

Download Now

Challenges faced by Fintech and Crypto brands while engaging with their customers

3 indicators of the need to switch to a new engagement strategy

Three-step Approach to Acing Insights-led Engagement

Kredivo’s journey on using Insights to Increase Conversions by 40%

Due to their ever-changing nature, fintech and cryptocurrency brands face specific challenges when engaging with customers in relevant, timely, and meaningful ways. Customer expectations are rising — Fintech brands are competing within their industry and with the hyper-personalized experiences that allow for increased brand trust and loyalty across other verticals. Here are some reasons why Fintech and Crypto brands need a makeover of their customer engagement approach.

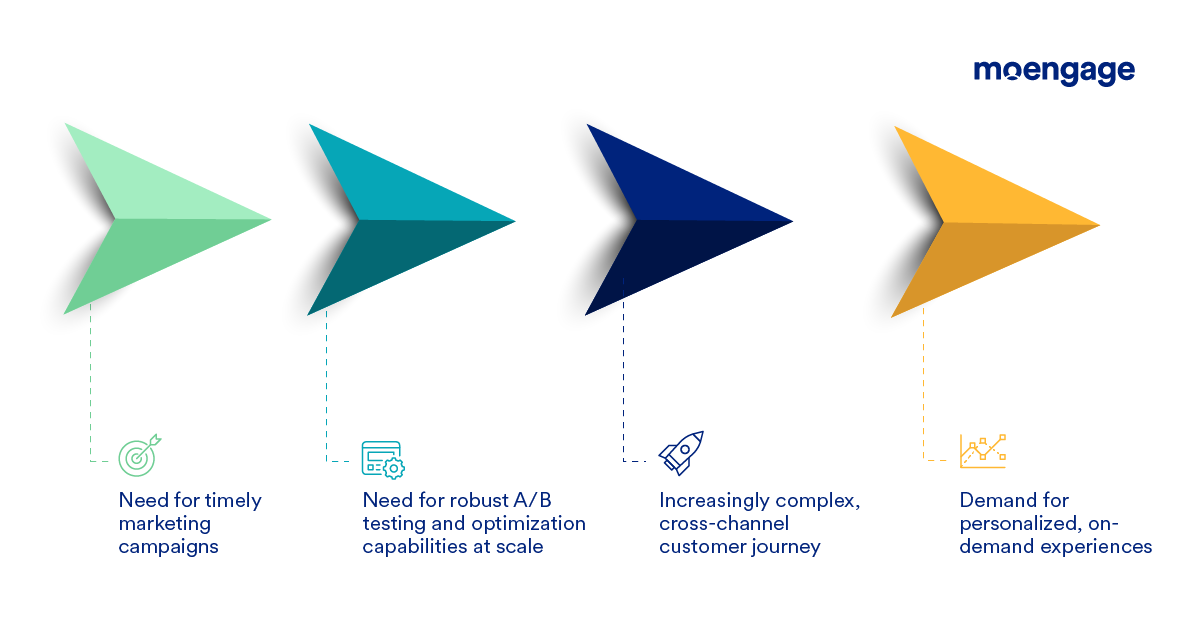

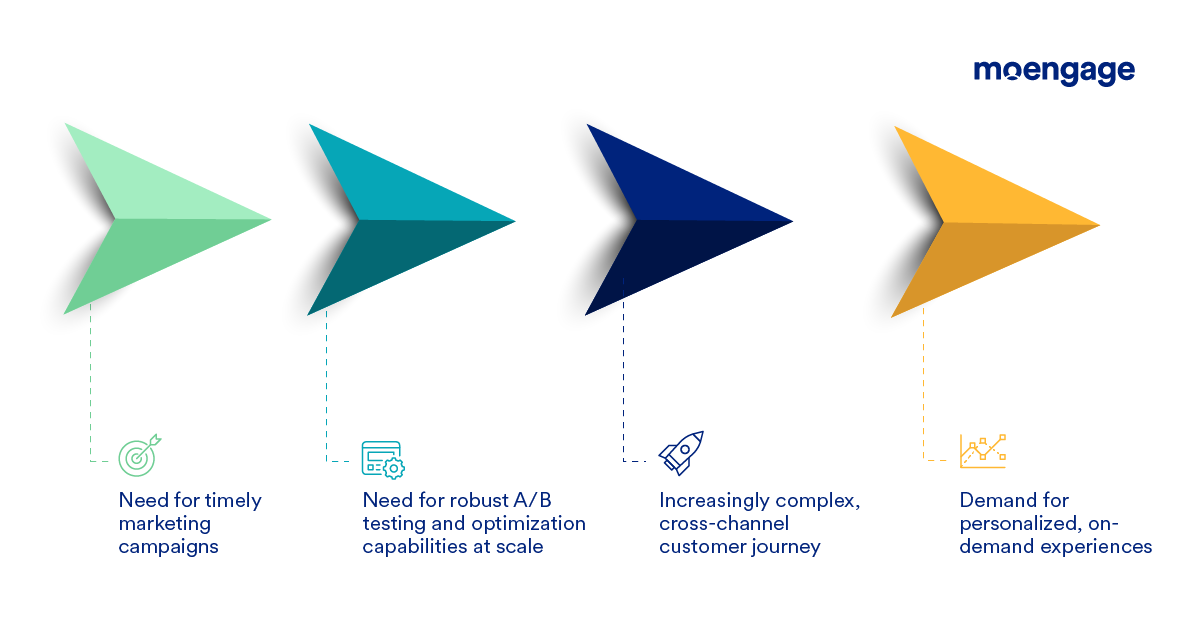

The modern world operates in both a digital and physical space, and that trajectory is beginning to change the fintech landscape. Here are some factors in the Fintech Landscape that warrants a

The increased number of channels the customer uses to interact with a brand has made the customer journey more complex.

Relevant, hyper-personalised experience is crucial to run effective engagement. The cornerstone to successfully personalising is gathering insights on customers, and their journey.

An experience that derives context from the customer's behavior, and identifies customer needs to tailor services in real-time.

What are some of the challenges Fintech and Cryptocurrency brands face?

Customers’ increased willingness to use fintech apps post-pandemic has been a massive growth accelerator. This growth comes with an increased set of complications that threaten to impede the growth if not understood and tackled correctly. Here are some challenges that Fintech and Cryptocurrency brands face while engaging with their customers:

-Chief among these challenges is adhering to strict compliance requirements and the continued need to encourage millennials to be receptive.

-Marketing strategies are often inefficient and slow to keep up with technological advances.

-An increase in the size and complexity of customer data limits A\B testing, personalization and optimization at scale.

Customers switching multiple channels while interacting with the brands make customer engagement in Fintech more complex.

Is the change in approach required to tackle Fintech customer engagement challenges?

The increased customer demand for personalized experiences signals that fintech brands must retire the old strategy that focuses on static segments, personas, and generic lifecycle campaigns.

The three main factors leading to the need for a new approach to customer engagement include

-A changing customer journey.

-An increasing need for data and insights.

-A demand to provide an on-demand experience.

What is the new approach to effectively engaging with customers?

Until now, most brands have employed a campaign-centric approach to engagement due to their tech stack being more campaign and less insight-driven. Customers demand a hyper-personalised experience; to truly deliver, brands need to adopt a customer-centric and insights-led approach.

What is Insights-led Engagement?

Insights-led Engagement is the successful marketer’s method to deliver better customer engagement by evolving from a campaign-centric approach to a customer-centric approach. This approach helps build a delightful and memorable customer experience, leading to the prevention of customer churn and reliable predictions of customer behaviour.

MoEngage is an insights-led platform trusted by 1,350+ global brands like McAfee, Flipkart, Domino’s, Nestle, Deutsche Telekom, and more. MoEngage’s powerful analytics, personalization, and AI capabilities give a 360-degree view of your customers and help you create journeys across digital channels.

© Copyright 2025 MoEngage. All Rights Reserved.

Please wait while you are redirected to the right page...