🔥 The Customer Engagement Book: Adapt or Die is live!

Download Now

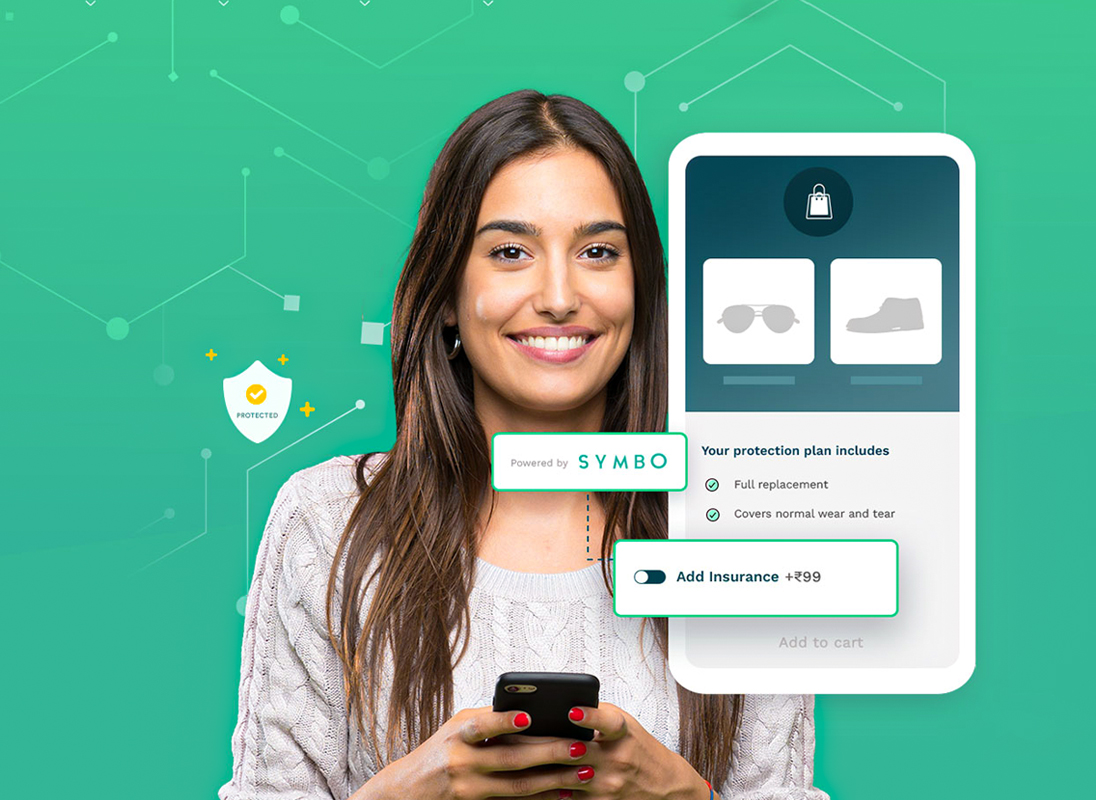

Symbo.co is on a mission to become the world’s largest embedded insurance distribution platform. We work closely with retail, eCommerce, and digital companies who wish to bundle insurance along with the core products they sell, right at the point of purchase. We work extremely closely with our partners to make the buying process simple and also create coverage products that add value to their business. Our proprietary Cover Gateway integrates with the world’s leading insurers to issue policies and manage claims in a digital and seamless manner.

We started using MoEngage to unify all our marketing campaigns into a single dashboard with focus on orchestration, personalization, and data-driven campaign optimization. What I particularly like about MoEngage is that it’s easy to set up, and provides limitless segmentation and engagement opportunities to drive growth.

With MoEngage Flows, Symbo’s onboarding communication could now be sequential, automated, and action based. Using Flows, the Symbo team orchestrated detailed omnichannel workflows based on the key customer attributes at 4 different stages.

• Complete Onboarding automation for new customers

• Active engagement for customers yet to complete KYC

• Automation of rewards for customers who have completed their training and certification

• Re-engagement efforts for customers who have dropped out

Timely personalized reminders to segmented customer bases via MoEngage helped engage and push only those yet to complete KYC, to take action. MoEngage also helped with vernacular support for customers having a language preference by sending out customized communication via Emails, SMS, and IVR.

MoEngage’s capability to identify dormant or dropped customers made it easy to engage them with customized communication. With MoEngage’s reward automation capabilities, Symbo was able to commend customers who completed their certification, while also inducing FOMO in those who were lagging behind.

Pocket FM Achieves 3X User Growth and 20% CTR Uplift Through Personalized Engagement with MoEngage

How Samco Securities Reduced Cost by 40% and Boosts Click Rates by 5%

Razorpay leverages MoEngage Flows to drive merchant engagement and retention

BlinkX by JM Financial Double MAUs with Seamless Customer Onboarding and Engagement Practices

MoEngage is an insights-led platform trusted by 1,350+ global brands like McAfee, Flipkart, Domino’s, Nestle, Deutsche Telekom, and more. MoEngage’s powerful analytics, personalization, and AI capabilities give a 360-degree view of your customers and help you create journeys across digital channels.

© Copyright 2025 MoEngage. All Rights Reserved.

Please wait while you are redirected to the right page...