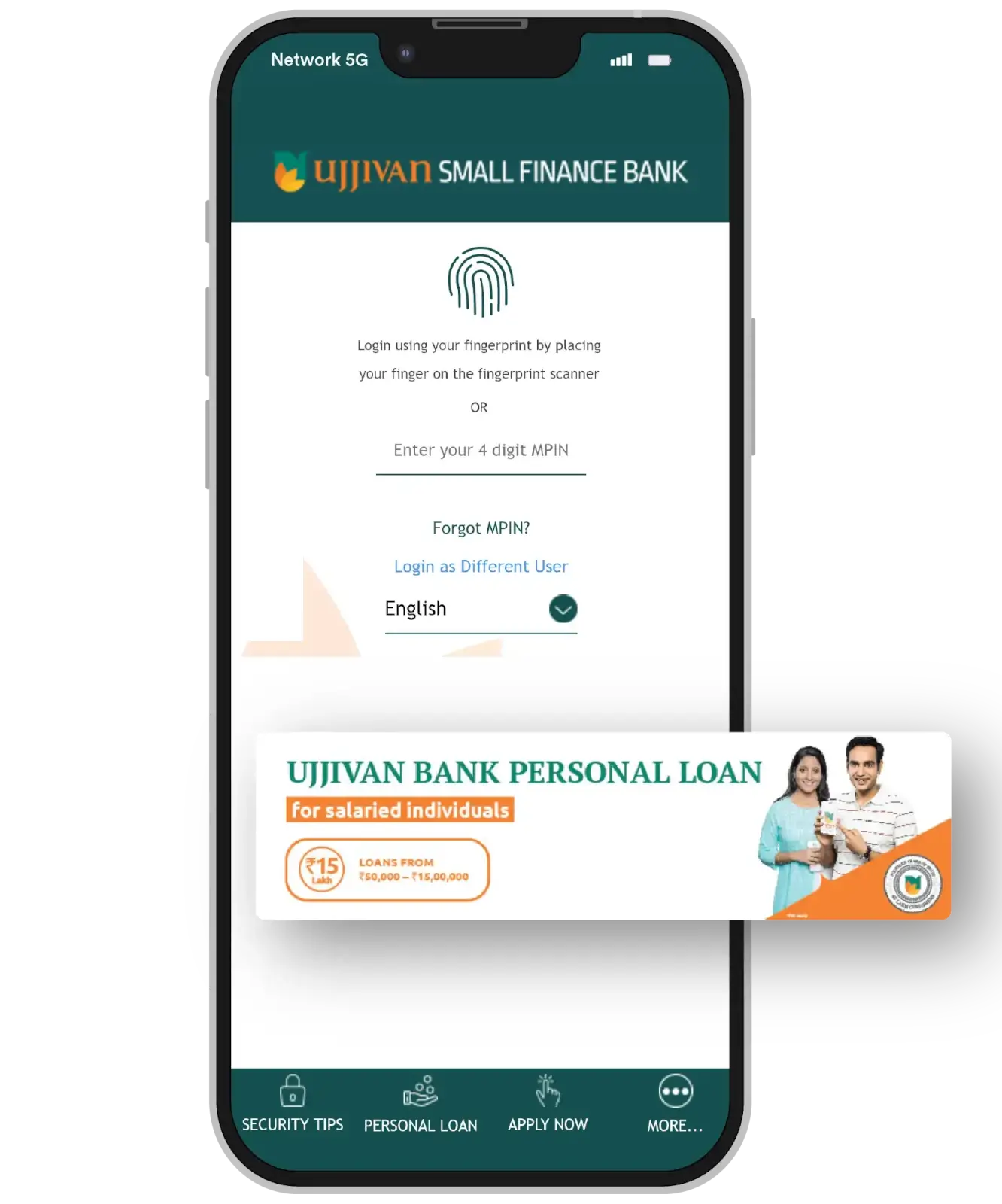

The Ujjivan team collected and analyzed historical month-on-month repayment data and segmented them based on their inconsistency in repayments across digital channels. Post this exercise, they created Flows for the target groups identified.

• 2 Lakh unique customers onboarded to digital modes of payments

• The conversion rate from digital channels rose from just 2% to a whopping 18%

• ₹ 123+ Crores of EMI collected in just 5 months via digital mode

• ₹ 550 Crores worth of total incremental balance generated

Two variations of SMS text were sent to these groups for each payment mode – Digital payment through SETU and Cash deposit via Airtel and Pay nearby. To make the campaign more approachable to the micro-banking segment, regional language was used in the content with a total of 12 languages being used.

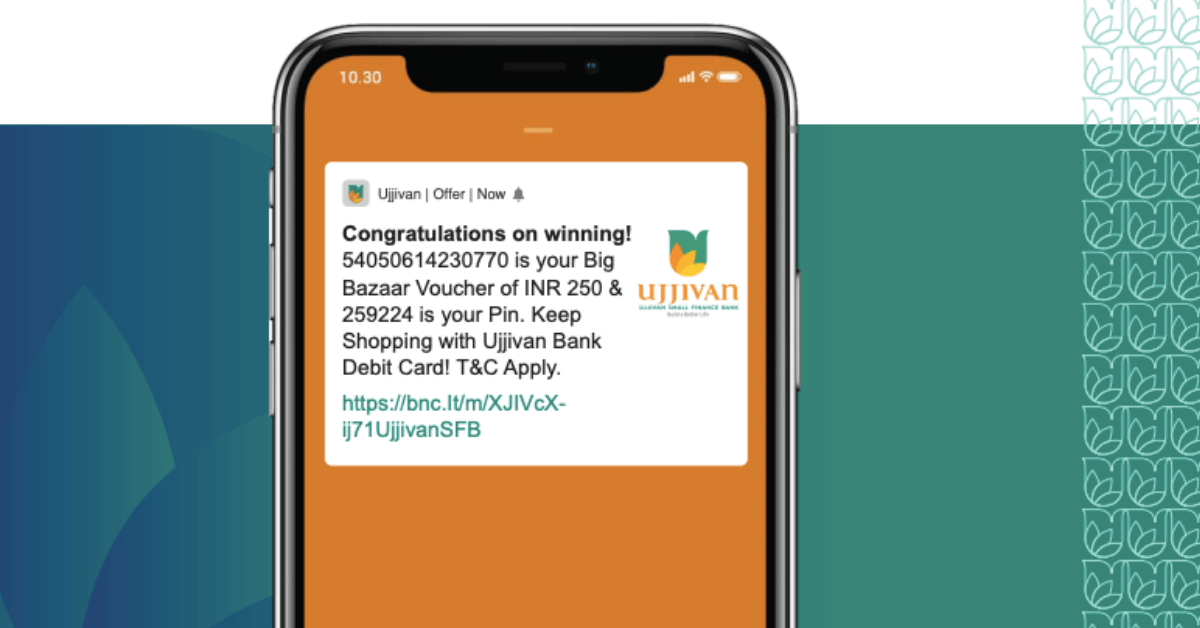

Gamification of campaigns was done to build a balanced base, such as customers making ‘n’ number of digital transactions of ‘x’ amount would receive a gift voucher. Such events were used to understand spending behaviors, segment customers, and run personalized campaigns to drive digital revenue growth.