ICICI Bank, Motilal Oswal, Fino Payments Bank, Axis Securities, and Kotak Securities Talk About Navigating the Customer Journey & Personalization at Scale

Trust takes years to build and seconds to destroy; nowhere is this truer than in financial services. As customers increasingly expect personalized experiences comparable to their favorite streaming platforms or shopping apps, banks and insurers face a unique challenge: delivering customization without compromising the trust that forms the foundation of every financial relationship.

That’s why the conversation around personalization in financial services feels heavier than in other industries. A wrong movie recommendation is an annoyance. A wrong investment pitch can erode trust in seconds. Trust, once it is lost, rarely returns.

Here’s where the numbers get interesting. According to a 2025 report, 61% of customers say they’re unlikely to return to a brand that fails to deliver a decent tailored experience, but only 21% of bank customers actually get personalized advice or guidance.

Still, it’s not impossible. A few financial brands are demonstrating what’s possible when you stop viewing people as segments on a chart and start understanding the emotions that drive financial decisions. That’s where personalization becomes more than just a marketing trick. It becomes the difference between a retiree feeling secure and a young trader feeling empowered.

This is exactly what we discussed during our recent panel discussion with leaders from ICICI Bank, Motilal Oswal, Fino Payments Bank, Axis Securities, and Kotak Securities. In the remainder of this blog, we’ll walk through the key points that emerged, what the leaders shared, and how the industry can move forward.

Why Personalization in BFSI is Different from E-commerce

Personalization sounds simple on paper. However, the reality within financial institutions appears quite different. Unlike a streaming app or an E-commerce store, where the worst-case scenario is an irrelevant recommendation, in banking or investments, one wrong suggestion can damage a customer’s trust. And in this industry, trust is everything.

Let’s unpack the core friction points.

1. Fragmented and incomplete customer view

Most banks and brokers have extensive data. But very few have a full picture of the customer. Savings accounts, loans, trading platforms, call centers, mobile apps, and branch visits; each system records its own information. What they often lack is the stitching together of these slices into a single, living profile that updates in real time.

Without that view, financial institutions are left making assumptions. Sometimes those assumptions are close enough; often they’re not. As Vipul Nirwani from Motilal Oswal cautioned, “If I pitch a wrong product, then they will always have the option to go to someone else.” In a market where switching costs are low, incomplete data directly translates into churn.

2. Customers are not one audience

A bank or securities firm doesn’t serve one customer archetype. It serves many, often with conflicting needs. On one end, there’s the digitally savvy investor who expects instant alerts and advanced insights. On the other hand, there’s the first-time account holder in a semi-urban town who values face-to-face reassurance more than app dashboards.

Both expect personalization. However, what personalization actually means to each person is completely different. Designing messages or product experiences that resonate with everyone without losing impact is challenging. It’s a constant balancing act.

3. The fragile line between personal and pushy

In most industries, a mistimed or irrelevant message is a nuisance. In finance, it feels like a breach. Customers interpret it as poor judgment, or worse, an attempt to mis-sell. That’s why the cost of even a single wrong recommendation is so high.

Aditya Vikram from Axis Securities aptly stated, “Personalization is about building trust, especially in financial services.” If personalization erodes trust instead of building it, the long-term relationship is lost. And unlike retail, where another offer might win the customer back, financial customers rarely forgive repeated errors.

4. Technology debt and operational drag

Even when the intent is there, execution lags. Legacy systems that weren’t designed for real-time decisioning still run critical parts of the business. Customer data platforms are either absent or poorly integrated. Campaigns often run on yesterday’s insights, not today’s behavior.

The outcome is predictable: customers receive messages that don’t align with what they’re doing at the moment. It’s like showing up late to a conversation when the chance to be relevant has already passed.

This mix of fragmented data, diverse customer bases, fragile trust, and outdated tech is why personalization in BFSI is so much harder than in other industries. And it’s also why the discussion has shifted from “can we personalize?” to “how do we personalize responsibly, at scale, and in real time?”

The Key Pillars of Personalization in Financial Services

Personalization in BFSI is complex. It’s not just about sending the right message at the right time; it’s about building trust, understanding context, and aligning with real human goals. From the panel discussion, four pillars emerged as central to making personalization work at scale.

a. Trust and Responsibility

Trust is the currency of finance. A single misaligned recommendation can undo years of relationship-building. Unlike retail, customers don’t always forgive mistakes here. Personalization isn’t only about showing relevant products. It’s also about judgment and responsibility. Every interaction, whether it’s a push notification, an advisor call, or a branch visit, needs to convey trust.

b. Data as the Foundation

Personalization only works when organizations have a clear, unified view of the customer. Data fragmentation across digital apps, branches, call centers, and advisors creates gaps that reduce relevance and effectiveness.

Vipul Nirwani of Motilal Oswal highlighted how they are addressing this: “We have started integrating a CDP (Customer Data Platform). All interactions are being stored in the same cloud, where we’re creating a unified profile. We can bind all the physical and digital transactions and transmit the information to all the platforms at the same time.”

Beyond technology, a strong data culture is essential. As Suresh Mutyala of ICICI Bank emphasized, personalization is effective only when decisions across teams are consistently guided by data, not just in marketing, but also across product, advisory, and operations.

c. Context and Vernacular Relevance

Context shapes how messages are received. Personalization is more than translating content. It involves culture, local nuances, and customer reality.

Prashant Choudhari of Fino Payments Bank explained their approach: “We work with about 11 languages currently – seven being primary and four on a need-to-need basis. Those seven languages work across our entire communication base, whether it’s WhatsApp, SMS, and even our IVR or WhatsApp bot.“

The lesson is clear: BFSI customers are not a homogeneous group. They span metros, tier-2 cities, and remote towns. Effective personalization must meet them where they are, both culturally and contextually.

d. Empathy & Human + Digital Blend

Algorithms alone don’t capture aspirations, fears, or motivations. Emotional triggers, financial goals, and advisory insights must be integrated into the personalization strategy.

Nishant Agarwal of Kotak Securities referred to this as identifying “killer scenarios” and using micro-segmentation to understand customers’ trading behavior, lifecycle stage, and relationship status. The goal is to blend human understanding with digital efficiency, so recommendations feel relevant, timely, and empathetic, rather than mechanical.

Operationalizing the Key Pillars

Knowing the pillars is one thing. Making them work for millions of customers is something else entirely. In BFSI, personalization at scale is messy. Multiple touchpoints like apps, branches, advisors, and call centers have to work together, and every interaction carries risk.

Key operational levers:

Data-driven recommendations: Platforms push relevant insights to the touchpoints that interact with customers. This ensures messaging is tailored to individual needs and behavior patterns, without relying on manual guesswork.

Micro-segmentation & lifecycle mapping: Nishant Agarwal (Kotak Securities) described how micro-segments capture trading styles, user lifecycle, and relationship status to detect “killer scenarios” — points where the customer may disengage.

The takeaway: Personalization isn’t just about having data; it’s about activating it across the right channels in real-time, so every customer feels understood, engaged, and valued.

However, making this operational across millions of users presents a bigger challenge: fragmented data and disconnected channels. Without addressing this, even the best recommendations lose their impact. That’s where integration comes in.

Overcoming Fragmentation: The Need for Integration

Scaling personalization quickly exposes a challenge that every BFSI organization faces: fragmented data and disconnected channels. Information often lives in silos, such as mobile apps, websites, CRM systems, and branch databases. Without a unified view, even the best personalization strategies fail.

Why integration matters:

Unified customer profiles: Data from all touchpoints must be consolidated so that interactions are context-aware. Customers experience continuity whether they check portfolios online or speak to support over WhatsApp.

Real-time orchestration: Messages need to reflect current behavior. A campaign triggered by a recent transaction should consider what the customer is doing right now, rather than relying on outdated information.

Cross-channel consistency: Every alert, notification, or recommendation should feel coherent across digital and physical touchpoints. Fragmentation undermines trust and engagement.

Prashant Choudhari (Fino Payments Bank) highlighted the operational complexity:

“We work with about 11 languages currently – seven being primary and four on a need-to-need basis. Those seven languages work across our entire communication base, whether it’s WhatsApp, SMS, and even our IVR or WhatsApp bot.“

The takeaway is clear. Integration is not just a tech challenge. It requires operational discipline, structured processes, and systems designed to deliver timely, relevant, and culturally aware personalization at scale.

Once integration is solved, the pieces start to fall into place. Data, context, trust, and empathy converge to form a seamless and cohesive personalization experience — the goal every BFSI brand is pursuing.

A Cohesive Approach to Personalization

What this looks like in practice

- Trust through consistency: Every interaction aligns with the customer’s goals and context, reinforcing reliability.

- Data-driven insights in action: Real-time analytics guide messages and product recommendations across channels.

- Context and vernacular relevance: Communications resonate whether the customer is in a metro or a smaller town, reflecting local language, culture, and behavior.

- Empathy + digital blend: Messaging combines data-driven intelligence with a human understanding of customer needs.

Nishant Agarwal (Kotak Securities) captured the essence of this cohesive approach:

“By identifying each and every one and taking manual tasks to identify the small things where customers are getting lost, but identifying and plugging those small gaps is where you start becoming more relevant to the customer and more contextual to the customer.”

The big picture: when trust, data, context, and empathy converge, personalization feels seamless. Customers experience interactions that are relevant, timely, and genuinely helpful.

And that naturally leads to the question: how can BFSI brands achieve all of this consistently at scale? How do they unify data, orchestrate campaigns, and ensure personalization at every touchpoint? This is where a single integrated platform like MoEngage comes in.

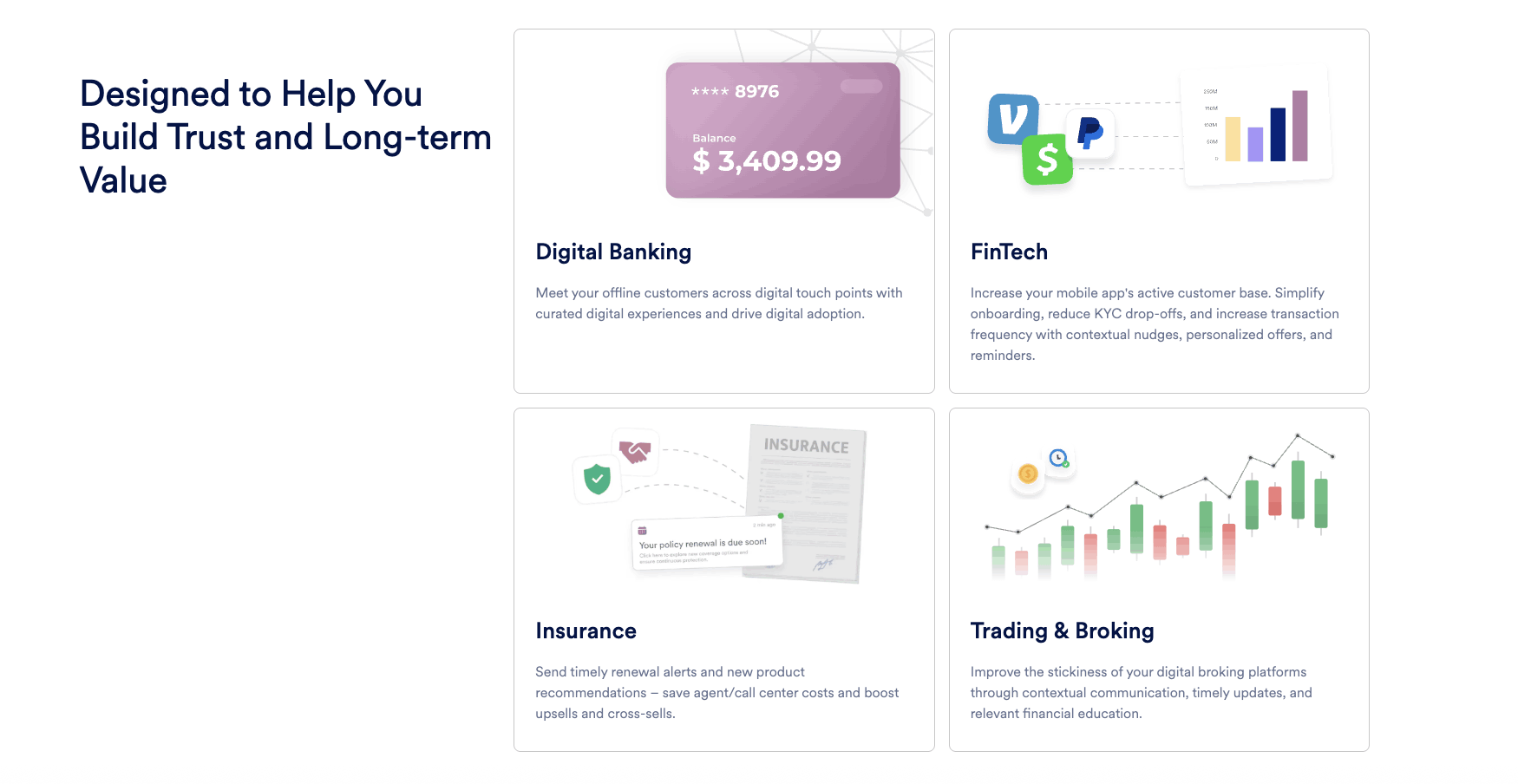

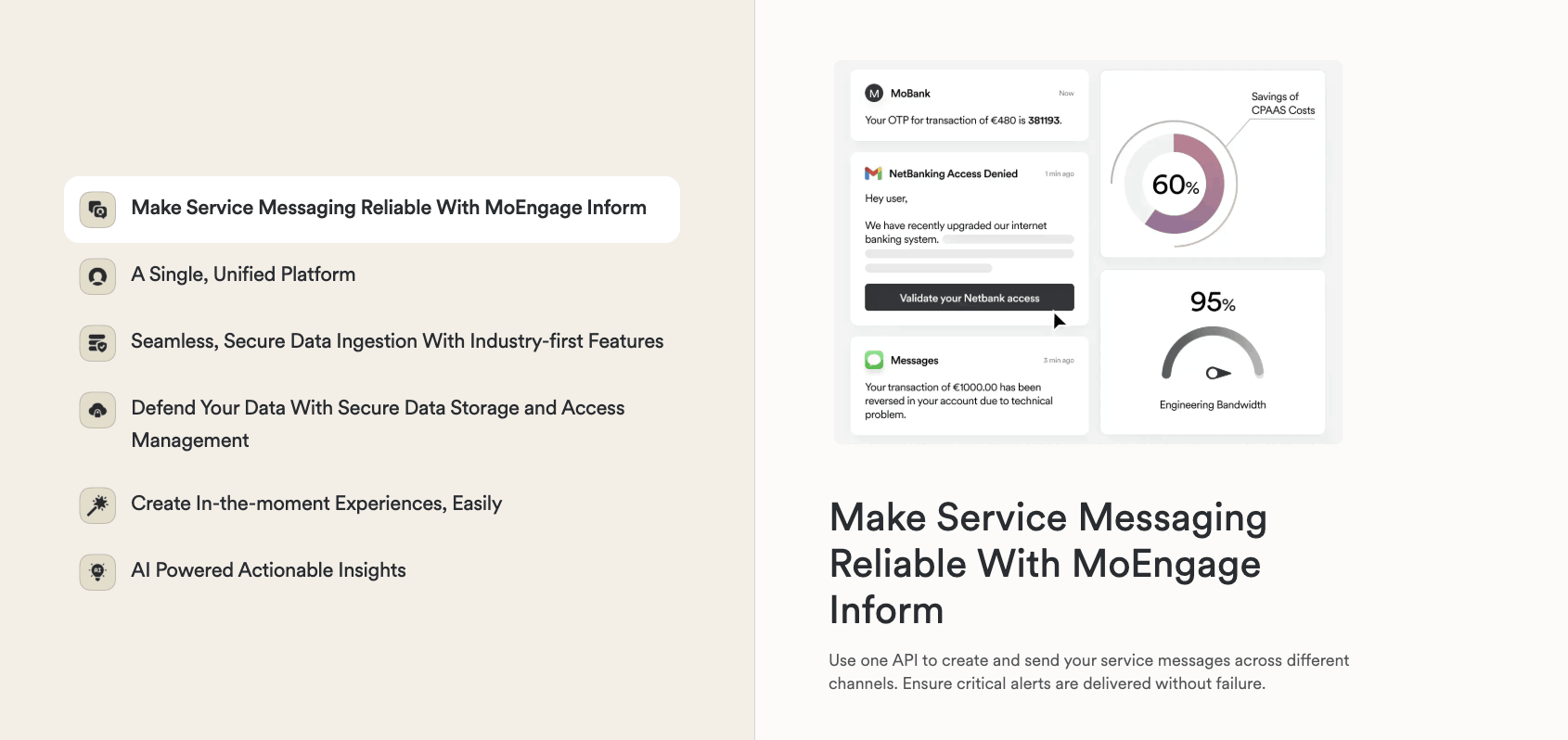

MoEngage: Making Personalization Work at Scale for BFSI

Having explored the challenges and foundational pillars of personalization in BFSI, it’s evident that achieving cohesive, trust-driven, and context-aware engagement requires more than just strategy; it demands the right technology. This is where MoEngage comes in as a single, integrated platform that combines customer data, behavioral insights, and multi-channel engagement under one roof. It’s the toolkit that lets banks and brokers turn concepts into reality.

Unified Customer Data Platform

The foundation of everything is getting the data right. MoEngage’s Customer Data Platform consolidates all customer touchpoints, including mobile apps, websites, call centers, and even branch interactions, into a single unified profile. You finally stop guessing which channel the customer last interacted with, or which offer they’ve seen. Everything lives in one place, updated in real time, so every team and every channel speaks the same language to the customer.

Real-Time Behavioral Segmentation

Once you have unified data, it’s essential to act on it immediately. MoEngage enables real-time behavioral segmentation, letting BFSI brands respond to what customers actually do, not what they did last month. Did a customer check their SIP investments three times in a week? Or attempt a trade but drop off at checkout? These micro-moments now inform precise, contextually relevant messages — the difference between a generic push notification and a message that actually helps.

Cross-Channel Orchestration

Personalization only works if it’s consistent. Customers don’t care if one message comes via app push and another via email; they just notice when things don’t add up. MoEngage’s cross-channel marketing ensures that emails, push notifications, in-app messages, SMS, and even web banners work together. You can plan campaigns that flow naturally across channels, and the platform ensures that customers receive relevant messaging at the right time, without conflicting or repetitive nudges.

Predictive Analytics

Here’s where the platform gets smart. MoEngage uses predictive analytics to anticipate customer behavior, whether it’s identifying who might churn or who’s likely to invest more if given the right nudge. BFSI brands can now act before a problem even arises, reaching out with tailored offers or advisory messages that feel proactive, not reactive.

Contextual Personalization

It’s not just data and timing; it’s context and human understanding. MoEngage’s contextual personalization takes into account language, location, device, and even past interactions. This means a customer in Raipur gets messages that resonate culturally, while a customer in Mumbai sees something that feels relevant to their life and financial journey. It’s the difference between generic and genuinely helpful.

AI-Powered Automation

All of the above is great, but scale matters. MoEngage brings AI-powered automation to the table, letting BFSI brands send timely, personalized messages without manual intervention. It’s like having a team of digital advisors working 24/7, ensuring relevance, consistency, and precision across millions of customers.

Putting it Together

With these capabilities, MoEngage doesn’t just solve one piece of the puzzle. It tackles unified data, segmentation, orchestration, predictive insights, contextual relevance, and automation, all within a single platform. BFSI brands can finally deliver personalization at scale, without juggling multiple tools, messy integrations, or fragmented campaigns.

It’s no wonder that brands that use MoEngage see not just higher engagement, but increased trust, loyalty, and customer satisfaction — exactly the outcomes that the panelists highlighted as critical for BFSI personalization.

Conclusion

Personalization in financial services is challenging. There’s data everywhere, millions of customers, multiple touchpoints, and expectations that change constantly. It’s rarely enough to send the right message. Timing matters. Trust matters. Understanding people matters, beyond just their transactions.

MoEngage helps make sense of all that. With a unified customer data platform, real-time segmentation, cross-channel orchestration, predictive insights, and contextual personalization, it brings everything together in one place. Suddenly, what used to feel like patchy, disconnected campaigns becomes coherent, relevant, and human.

To see how this works in practice, there’s a simple next step. Book a demo and explore how your brand can make personalization at scale actually feel personal.