Decoding The Pulse Of The Connected Indian Shopper In The Festive Season 2021

Reading Time: 4 minutes

India has witnessed a very different Festive Season the last couple of years – one with lockdowns and social distancing. This year, as the country recovers from the second wave of COVID-19, the festive celebrations make a grand re-entry with improving vaccination counts, increased focus on family get-togethers, return of the cricket season, and huge E-commerce sales.

This Festive Season, marketers have a tremendous opportunity this season to make a mark in the minds of consumers and bag massive mindshare.

In their latest report, ‘Decoding the Connected Indian Festive Shopper in 2021’, InMobi unraveled the current consumer shopping sentiments, their expectations from online and offline brands, and discussed the best ways for marketers to guide connected consumers during the moments of truth. Here are some of the key highlights from the report.

Festive Season 2021: shopping trends and opportunities

Consumer sentiment and Festive Season plans

Despite a few tough months in 2021, Indians display their celebratory spirit to indulge in festivities. While 72% of Indians are looking forward to shopping, 62% are keen on shopping online, making this a massive ‘Digi-fest.’

Interestingly, an Indian shopper is set out to spend an average of INR 21,230 on festive shopping this year which is a whopping 42% increase from last year.

Culture reflects the myriad shopping choices of the diverse Indian consumer. While shoppers from the Northern and Western parts of India prefer purchasing Automobiles and Gadgets this festive season, the shoppers from the Southern and Eastern regions are looking forward to indulging in Clothing, Home Appliances, and Jewelry.

A measured shopping approach

While 72% of consumers are indulging in shopping, the rest, 28% are adopting cautious optimism. The lasting effects of COVID-19, reduced budgets, safety concerns, and the lack of the right offers are cited as the major reasons not to shop this festive season.

This leaves brands with an opportunity to reach out to these consumers and ensure they communicate the latest offers and product information to help consumers make informed and value-focused purchases.

Meet the diverse Indian shoppers this Festive Season

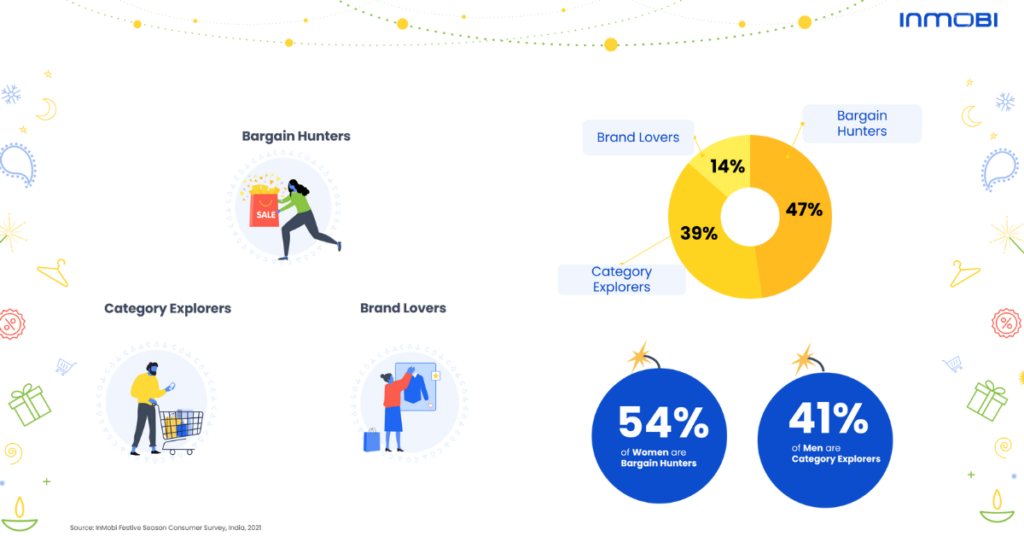

This festive season, diverse Indian shoppers fall into three buyer personas:

- Bargain Hunters: The price-conscious consumers who haven’t planned their purchases and are on the lookout for the best offers in the market.

- Category Explorers: Shoppers who have decided on categories but are yet to decide on the products or brands.

- Brand Lovers: The Shoppers who have already decided on the brands and products they will purchase.

With close to 47% of ‘undecided’ or ‘completely unplanned’ festive shoppers, brands can tap into the shopping moments that matter for these consumers.

While Bargain Hunters champion apparel and groceries, home appliances and beauty products are most loved by Category Explorers. Notably, big-ticket items such as Jewelry and automobiles are cult favorites of Brand Lovers.

Bargain Hunters are always looking for the best deals and shop most during the big sale periods and 63% of Category Explorers will make their purchase before Dussehra.

While Category Explorers plan to do their research by September itself, they are much more likely to make their purchases only after a considerable period of research, analysis, and exploration.

68% of Brand Lovers shop a month before Dussehra. They have higher budgets than most shoppers in Festive Seasons owing to their affinity for brands. An average Brand Lover is expected to spend an average of INR 30,240, whereas a Category Explorer is set out to spend INR 19,105 on an average.

The ultimate checklist for Shopping brands to plan a blockbuster Festive Season in 2021

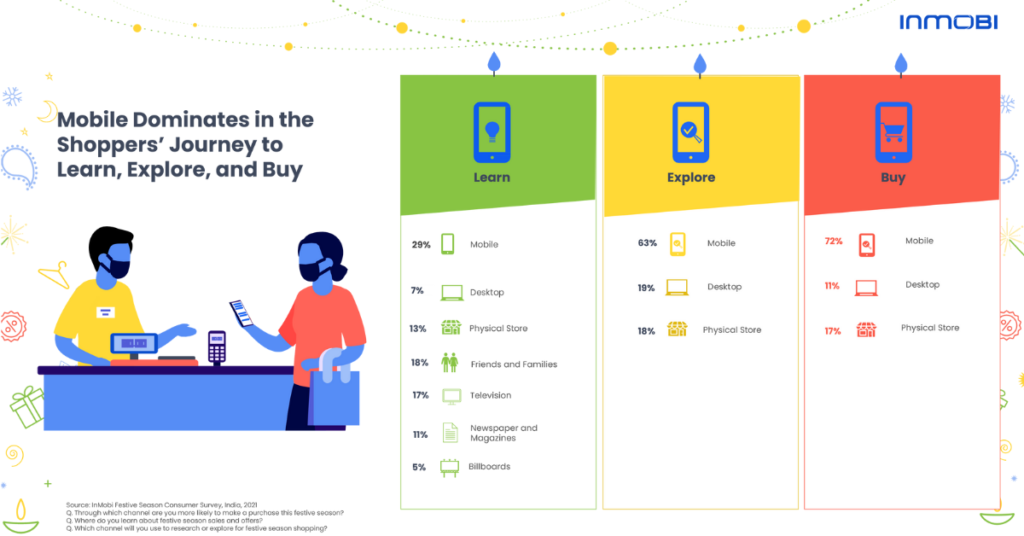

With mobile being a primary screen for Indians to learn, explore and buy, how can marketers leverage the ‘Mobile-fest’ to deliver safe and relevant festive shopping experiences for the Indian consumer?

Here’s our take:

1. Get your audience strategy right

The first step to getting the festive strategy right is by adapting to the new normal consumer habits. With the right mix of demographic, appographic, location, and inferred data, marketers can understand the changing dynamics of the Indian festive shopper and identify the most relevant consumers for their brand.

| 💡 Appographic Targeting is a way to reach your audience based on app interest. This technology helps marketers and advertisers promote their app to new users based on app interests by leveraging audience insights that go beyond ownership and category. |

2. Guide families with Household Targeting

With changing roles of family members in a household, shopping is no more an individual decision in India. Brands must try to identify the initiator, influencer, decision-maker, and buyer. With advanced cross-device attribution and online to offline experiences, shopping brands can go a long way in guiding families along the shopping journey and driving purchases.

3. The three-step Creative Formula

- Step 1: Spark curiosity by leveraging custom creatives and driving meaningful conversations

- Step 2: Drive reach and engagement by using immersive and interactive videos

- Step 3: Re-Engage high-intent audiences by using data to create personalized experiences

4. Capture Purchase Intent across offline and online touchpoints

Consumers are seeking contactless experiences more than ever. To drive digital store-like experiences and to capture purchase intent, brands must highlight features such as Store Tours, 360-degree views, shoppable carousels, and much more.

Armed with these festive season insights, marketers must leverage mobile to understand, identify, engage and acquire audiences. Read Inmobi’s latest report, Decoding the Connected Indian Festive Shopper in 2021, to delve deeper into consumer behavior across India and optimize your brand’s mobile-first campaigns this festive season.