From Compliance to Connection: Navigating the UAE’s 2026 E-Invoicing Era

As we navigate the opening days of 2026, the UAE’s business landscape is undergoing a fundamental shift. For years, we’ve discussed a digital-first future, but 2026 marks the Great Transition – the moment where back-office compliance and front-end customer experience finally converge.

To my marketing, growth, and retail business leaders in the UAE: If you still view an invoice as a static PDF attached to an email, you are missing the most significant data goldmine of the decade. The UAE’s mandatory e-invoicing rollout is not just a tax department requirement; it is the final bridge across the online-offline gap.

The 2026 Reality: Regulating Guesswork Out of Existence

The UAE has transitioned to a Decentralized Continuous Transaction Control (CTC) model, leveraging the global Peppol network. Under this mandate, every transaction must be structured in a specific XML format (PINT-AE) and transmitted through an Accredited Service Provider (ASP).

This ASP not only delivers the bill but also reports the transaction to the Federal Tax Authority (FTA) in near real-time. While finance teams focus on the 50+ mandatory data fields now required for compliance, savvy marketers recognize this as the final piece of the omnichannel puzzle.

In this first deep dive of 2026, we examine how the e-invoicing mandate and other significant developments this year are reshaping customer engagement in the Middle East.

1. Activating Dark Offline Data: From Ghosts to Guests

Historically, the moment a customer walked out of a physical boutique in Dubai Mall or a hypermarket in Abu Dhabi, they became a ghost to the digital marketing team. This led to the ultimate marketing fail: retargeting a loyal customer with ads for a premium watch or a set of running shoes they literally just bought in-store twenty minutes ago.

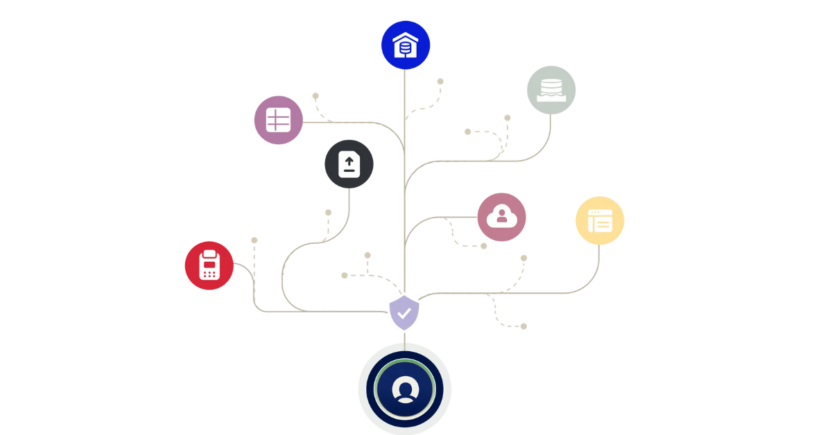

- Deterministic Certainty: Previously, we relied on probabilistic guessing – trying to link a browser cookie to a person. By flowing PINT-AE data directly into the MoEngage Data Management hub, we move to deterministic certainty.

- The Strategy: We no longer view a purchase as the end of a funnel. Instead, the system treats the FTA-validated transaction as a real-time trigger.

- Retail Industry Example: Take a Leaf Out of the Azadea Group’s Playbook. If a customer buys high-end running shoes offline, the system can instantly suppress introductory ads and instead trigger a personalized invitation to a local marathon or a Luxury Care Guide tailored to their specific purchase, all within milliseconds.

2. The WhatsApp-First Service Architecture

In the Gulf, WhatsApp is the virtual majlis where business happens. By 2026, consumers will have officially lost patience for clunky customer portals or logging into websites to find a receipt.

-

Contextual Convenience:

At MoEngage, we believe in embedding the e-invoice as a rich media event directly within a conversational thread.

-

Merlin AI & The Engagement Window:

Using Merlin AI to analyze historical patterns, the system doesn’t just blast a message; it identifies the specific engagement window – the time of day a customer is most likely to interact with their phone.

-

Retail Industry Example:

Mirroring the success of Mashreq Neo, a retailer can transform a dry tax document into a premium concierge service. Within the same WhatsApp thread where they received their invoice, a customer can initiate a return, track a delivery, or browse a curated complete-the-look gallery tailored to their just-purchased item.

3. High-Octane Segmentation through Warehouse Syncing

The new tax regulations are forcing businesses to clean their data rooms. This isn’t just about staying out of trouble; it’s about finally knowing who your customers actually are.

-

Behavioral Affinities:

Rather than letting transaction data sit in a siloed finance ERP, the winning strategy is Warehouse Syncing.

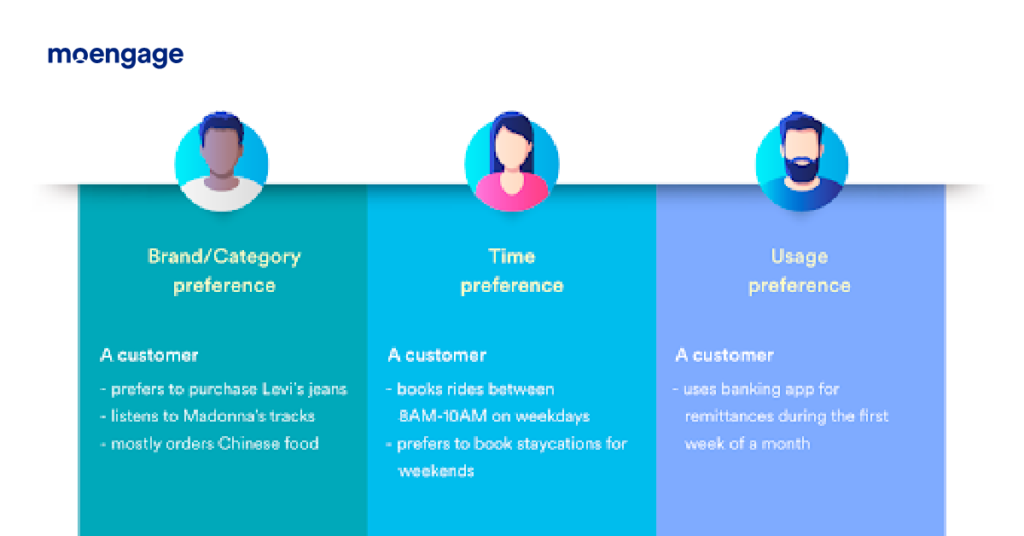

Flowing machine-readable XML data into a centralized platform allows you to create Behavioral Affinities based on verified wallet-share, not just website clicks.

Flowing machine-readable XML data into a centralized platform allows you to create Behavioral Affinities based on verified wallet-share, not just website clicks. -

Retail Industry Example:

If you know exactly what a customer bought offline, you can build lookalike audiences for your digital ads rooted in real revenue. You can identify High-Value Gourmet Shoppers who prefer browsing on Friday mornings and target them with bespoke offers before they even plan their next trip to the store.

4. Data Sovereignty as a Competitive Advantage

With the UAE’s Personal Data Protection Law (PDPL) now in effect, “Where is my data?” has become a standard customer question. E-invoicing data is highly sensitive, containing detailed transaction history and personal identifiers.

-

Compliant Orchestration:

MoEngage ensures security through local UAE-based data centers. By aligning with FTA standards and PDPL mandates, you transform compliance into a foundation of trust that enables deeper data sharing and more intimate customer relationships.

Adapting to the Change: Your 3-Step Playbook for 2026

- Connect Your Corners: Don’t wait for the mandatory July deadline. Start integrating your ERP and POS systems with your Customer Data and Engagement Platform (CDEP) now so that your data flows directly into engagement journeys.

- Move to Behavioral Affinities: Shift beyond basic demographics like “Female, 28, Dubai”. Use verified transaction data to understand true behavior and lifetime value (LTV).

- Localize the Automated Experience: The UAE is a unique blend of global luxury and deep-rooted traditions. Ensure your AI understands regional nuances, from cultural occasions like Ramadan to local shopping habits.

The MoEngage Perspective: Your Data is Your Dialogue

The 2026 e-invoicing mandate isn’t a hurdle – it’s a bridge. By unifying your online and offline data, you can finally see the 360-degree view of the consumer that was once a myth.

The UAE is moving fast. The businesses that will dominate the late 2020s are those that see 2026 not as a year of compliance, but as the year they finally truly meet their customers.