8 Omnichannel Banking Trends You Should Keep Tabs On

Banking isn’t limited to a branch office, a mobile app, or a website anymore. As omnichannel banking trends continue to reshape customer experiences and expectations, customers now demand seamless movement within the banking ecosystem.

For example, an SMS integration helps the customer with their inquiries, and email follow-ups nudge them to move ahead in the customer journey. That’s how omnichannel marketing works in banking.

To stay ahead in the game, banks must connect their brick-and-mortar locations to seamless digital experiences across channels. The priority should be to create omnichannel customer experiences where every touchpoint knows the customer’s progress and communicates with them based on the unified knowledge of the customer.

In this post, we’ll discuss the latest omnichannel banking trends and the emerging technologies that empower them.

8 Omnichannel Banking Trends to Stay on Top of

Today, omnichannel banking is a chance for modern banks to win customer loyalty. From super apps to AI-fueled personalization, banks are reinventing how customers interact with and experience financial services. The challenge is to keep up with the rapid innovations defining this space.

To help you cut through the noise, we’ve grouped these omnichannel banking trends into different categories, highlighting where banking is heading and what’s reshaping the industry today. So grab a coffee and let’s dig into the future of omnichannel banking.

Mobile Apps are Becoming Banking Superheroes

Mobile apps have evolved into much more than digital wallets or transaction hubs. They’re the nerve center of banking experiences, the one-stop shop where customers expect banks to do everything seamlessly. From financial planning tools to integrated payments, mobile apps are where the future of banking resides.

1. The Rise of Super Apps

Mobile apps are moving toward the “super app” model, creating ecosystems for customers to manage everything from banking to investments, rewards, and even bill payments.

Why is this important? Because mobile banking, while convenient, is only the top channel in an omnichannel marketing strategy, not the only channel.

Customers may prefer mobile for its accessibility. According to the American Banking Association (ABA), 55% of consumers now prefer mobile banking over traditional methods. But at the end of the day, they demand consistency. A transaction they start in the mobile banking app should feel interconnected with other channels they interact with, such as email, SMS, or even in-branch visits.

For instance, if a customer sets up a savings reminder within the app, that data should influence follow-up communication. Send an SMS congratulating them when they reach a milestone, or email them a progress report toward their financial goals.

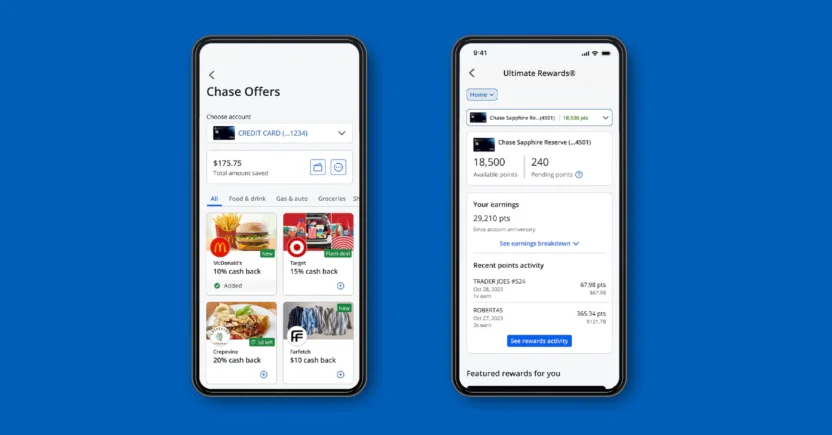

Look at trendsetters like JPMorgan. Beyond standard banking features, their Chase Mobile® app integrates budgeting tools and rewards platforms that allow customers to redeem points for travel or cashback. But those same features are promoted via email campaigns and SMS alerts, ensuring customers discover app benefits no matter where they’re engaging with the brand.

Source: https://www.chase.com/digital/mobile-banking

For banks, the message is clear: Stop thinking of mobile apps as standalone platforms. Instead, weave them into the larger omnichannel ecosystem to amplify their power.

2. Real-time Personalization Through Mobile Apps

Every tap, swipe, and scroll in a banking app tells a story about a customer’s needs, habits, and goals; and if you’re listening carefully, you can turn these stories into personalized, omnichannel experiences.

As a matter of fact, customers want their financial interactions to feel connected, no matter which device, platform, or channel they’re using at the time. And there are omnichannel banking statistics to back up this trend. Accenture’s Banking Consumer Study 2025 states that 72% of customers consider personalization a major factor when choosing a bank.

This means that today’s customers will no longer settle for generic messaging. Personalization connects the dots between your app’s real-time insights and your email, SMS, or even in-person strategies. So, as a marketer, you need to ask yourself:

- Are you using your app data to tailor content across all channels?

- Do your push notifications align with your email campaigns?

- Can a customer’s app activity trigger dynamic, cross-channel engagements?

For example, let’s suppose your banking app delivers real-time reminders about due bills. Expand that by sending push notifications to your customers, suggesting how to avoid late fees. Then, supplement those with an email summarizing their monthly spending habits, and follow up with an SMS highlighting financial habits they can improve. This holistic approach not only works to retain your customers, but also actively reinforces your omnichannel marketing strategy.

Customer Experience is a Battlefield

Customer experience (CX) wins hearts, wallets, and market share. Period. Whether it’s seamless onboarding or frictionless customer support, the goal is to simplify everything for customers to the point that banking just works.

3. Frictionless Onboarding

If customers need to fax documents or sit in endless queues to open an account (yes, it still happens…), you’ve officially lost the race.

Modern customer onboarding should be frictionless and fast, incorporating tools like biometric verification, digital signatures, and gamified micro-steps. But ultimately, this experience needs to reflect across channels for it to truly resonate with customers.

Why? Because life happens.

A customer may begin their onboarding journey on a mobile app during their lunch break but get interrupted before completing it. Later, they might prefer to finish the same process on their desktop when they’re home and have access to their financial documents. Here lies the omnichannel challenge: does your onboarding process let them pick up right where they left off? If not, frustration kicks in, and it can cost you hard-earned signups.

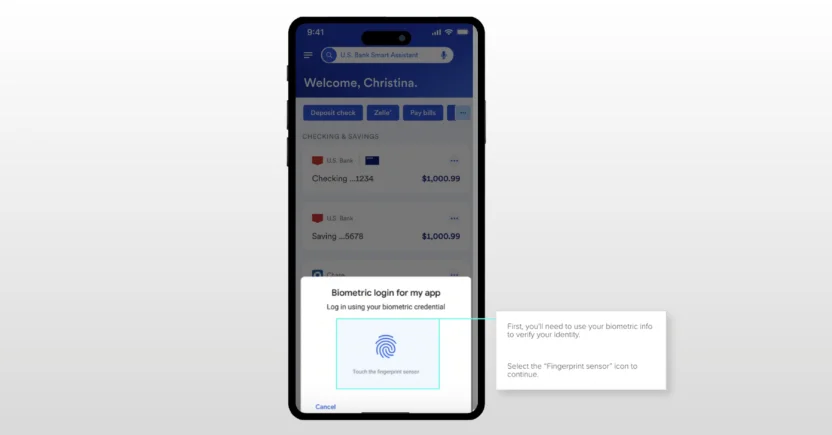

US Bank, for instance, offers an interactive onboarding experience to new customers, guiding them on a desktop through the biometric verification setup process in their mobile app. Customers notice (and appreciate) when they can start signing up in a mobile app, pick it back up on their desktop without resetting their progress, and even confirm certain steps in-branch if needed. This cross-device consistency creates a “start anywhere, finish anywhere” experience that customers associate not just with convenience, but with trust.

Source: https://digitalexplorer.usbank.com/content/125/how-to-set-up-biometrics-for-android

The future of onboarding isn’t just about speed, but also about consistency across channels. Customers need to feel like your brand is with them every step of the way, from one device (or location) to another. Tell your customers that starting on mobile doesn’t mean they can’t finish on another channel, and you’re already one step closer to earning their loyalty.

4. Proactive Customer Support Using AI

Banks, Financial Services and Insurance (BFSI) brands are fueling customer growth through AI-driven personalization, including customer support agents and chatbots. The trick here is to integrate AI-led support within an omnichannel ecosystem that values customer convenience above all else.

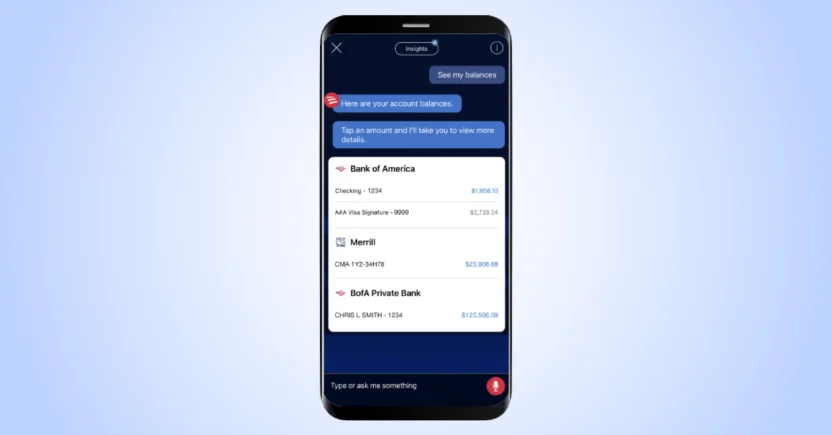

AI agents and AI-powered customer support tools, like Bank of America’s Erica, must become another layer in your omnichannel framework. Erica doesn’t just wait for customers to ask questions. It proactively warns them about upcoming bills, suggests budgeting goals, and even highlights unutilized rewards.

In fact, Erica handles over 1.5 million interactions every day, successfully solving over 98% of them without human intervention. However, it’s not just about the chatbot itself; it’s about how Erica integrates across BofA’s email, mobile, and notification strategies to ensure customers stay informed in a seamless, omnichannel way.

Source: https://info.bankofamerica.com/en/digital-banking/erica

For banks, this opens up countless opportunities. Use insights from chatbot interactions, for instance, to craft follow-up campaigns that address common pain points or remind customers about actionable steps. If a chatbot detects unusual account activity and sends an alert via app notification, this should trigger a follow-up message via email or SMS, reinforcing the same action (e.g., “We noticed unusual activity in your bank account; confirm if this charge is valid”).

You can also segment customers based on their support history and deliver personalized recommendations through omnichannel campaigns. For example, if a customer inquires about a loan via chatbot, follow up with an SMS or email sharing tailored loan offers.

The Artificially Intelligent Takeover

Artificial intelligence is the present, and it’s obliterating inefficiencies in ways we couldn’t have imagined a decade ago. From predictive analytics to fraud detection, AI is becoming the silent superhero of omnichannel banking trends. Let’s see how.

5. Predictive Banking Experiences

AI-powered predictive models let banks anticipate customer needs before they even arise. But when it comes to omnichannel strategies, predictive analytics doesn’t just inform what message to send or when to send it; it tells you where to send it.

Let’s take the example of overspending. Your banking app might analyze a customer’s spending habits and send them a push notification that reads, “You tend to overspend in the last week of the month. Here’s how you can save $150 this time!” Simple and impactful. But that same predictive insight could be leveraged to decide whether sending a push notification, an email, or even an SMS would be more effective for this customer.

Not every customer responds to the same type of communication, you see. Predictive analytics can help you match the right message with the right channel, dynamically selecting the one most likely to drive action. For a customer who’s unlikely to open push notifications, the same overspending alert could be sent as an email instead, or even as an SMS if the situation requires urgency.

BFSI marketers can take this a step further with platforms like MoEngage (shameless plug here!). With its Most Preferred Channel (MPC) feature, you can reach out to customers on the channels they’ve engaged with before. This is how you can master the art of sending the right message on the right channel at the right time.

Giants like Bank of America are pioneering predictive insights with AI algorithms (BofA’s CashPro Forecasting) that analyze spending habits and deliver advice to customers. This kind of proactive engagement powers higher adoption rates for financial products, too. If you can predict a need across multiple touchpoints, you can solve it (and upsell along the way).

6. Fraud Detection and Prevention in Real-Time

What’s worse than losing money to fraud? Realizing your bank didn’t notify you on time to stop it.

Modern fraud detection systems use AI to identify suspicious activity and send real-time alerts synced on multiple channels, helping customers prevent massive losses. But not all alerts are created equal, and where messages are sent matters just as much as when they’re sent.

Here’s how this works in an omnichannel system:

- Critical Alerts: If a customer’s credit card is being used in a suspicious location, send an urgent SMS or push notification immediately — channels that demand attention in real time.

- Low-risk Suspicious Activity: For minor anomalies, an email might be enough, especially if it includes detailed steps for verifying the legitimacy of a transaction.

This isn’t just theoretical. By partnering with Google, HSBC uses an AI-driven Dynamic Risk Assessment system that monitors 1.35 billion transactions across 40 million customer accounts.

We’re finding two to four times more financial crime than we did previously, with much greater accuracy. Historically, we had a high number of false positives, meaning that we were calling customers unnecessarily to ask them about what turned out to be completely legitimate activity. Now, we have 60% fewer false positive cases.

— Jennifer Calvery, Group Head of Financial Crime Risk and Compliance at HSBC

This shows that customers aren’t just evaluating your bank based on how fast you detect fraud. They’re paying attention to how you communicate it and when you intervene.

As a BFSI marketer, you can integrate messages triggered by fraud detection systems into your omnichannel campaigns. Follow up a critical fraud alert with a personalized email ‘next steps checklist’ that guides customers through securing their account. Use SMS to offer hotline support for customers flagged with high-risk alerts, ensuring a direct line of resolution.

Cross-selling is Smarter (and Cooler)

Today, sales focuses on anticipating needs and solving customer problems without feeling pushy or invasive. In the omnichannel era, smarter cross-selling drives organic revenue growth while enhancing the customer journey.

But what sets the smartest cross-sellers apart? They know how to leverage data, tailor messaging to individuals, and most importantly, deliver it through the right channels at the right time.

7. Contextual Cross-Selling with Data

Let’s start with the basics: cross-selling in the banking industry means offering complementary products that align with a customer’s profile and financial goals.

Imagine a customer with a savings account whose spending and behavioral data suggest they’re ready to start investing. Instead of blasting generic campaign emails to every account holder, you use risk profile data to recommend mutual funds tailored to their preferences. And if they’ve shown interest in ESG (environmental, social, and governance) initiatives, you can suggest sustainable funds that echo their values. This isn’t just cross-selling; it’s contextual cross-selling.

Now, how you deliver these recommendations matters as much as the recommendations themselves. Executing this successfully requires an omnichannel approach.

Let’s say a customer makes a one-time financial product purchase, like a certificate of deposit (CD). You can use SMS or push notifications to inform them about bundled services or loyalty benefits. Frame the messaging to suggest how to maximize the value of their existing investment.

Here’s a more full-fledged example of this omnichannel banking trend. Suppose a customer applies for a home loan via your website. Instead of cluttering their loan application experience with upselling recommendations, your back-end systems register this transaction as a trigger in your omnichannel banking platform. From there, the customer receives a follow-up email highlighting related products like home insurance or renovation loans. This alignment among data capture, customer behavior, and channel strategy ensures that cross-selling feels helpful.

8. Financial Wellness Ecosystems

Here’s a bold prediction: The future of cross-selling is about positioning your bank at the center of your customer’s financial wellness journey. What does that mean? Well, instead of just pushing solutions, banks need to offer everything customers need for integrated financial planning.

Take Royal Bank of Canada (RBC)’s NOMI Insights as an example. NOMI helps customers identify savings opportunities, set budgets, forecast cash flow, and avoid overspending. Everything is deeply integrated into their primary banking channels, ensuring customers receive tips and actionable intelligence where they’re already managing their finances.

Why is this a game-changer for BFSI marketers? Because it creates a huge opportunity to fine-tune cross-sell strategies within an omnichannel framework.

First of all, sending financial wellness-related messaging through context-appropriate channels is crucial. Customers don’t want push notifications interrupting their evenings to pitch heavy financial advice. Instead, reserve push notifications for real-time budget warnings or savings goals reminders, while detailed budgeting tools and insights can be sent via email or featured prominently within your app’s dashboard.

Secondly, financial wellness ecosystems thrive on trust. Use omnichannel content strategies, like email newsletters, app-based tutorials, or even in-branch seminars, to educate customers on topics like retirement savings plans. Then build in subtle cross-sell opportunities that feel organic and relevant to the context. For instance, after a customer interacts with in-app budgeting tips, dynamically suggest higher-yield savings accounts or investment options that align with their spending patterns.

Such omnichannel approaches position your bank as a partner in your customer’s financial well-being. Partners guide, educate, and solve problems. And in doing so, they generate cross-sell opportunities organically.

Emerging Technologies Empowering Omnichannel Banking Trends

Omnichannel banking stitches multiple touchpoints together seamlessly, turning what used to be a scattered patchwork into one cohesive customer experience.

Of course, this kind of magic doesn’t happen on its own. Behind the scenes, a handful of emerging technologies are doing the heavy lifting, empowering omnichannel banking trends to anticipate customer needs, personalize engagements, and scale smarter.

Ready? Let’s break down the key technologies you should know about.

1. Predictive Analytics

AI-powered predictive analytics uses historical and behavioral data to forecast what a customer might do next. As a result, banks can predict customer behavior, slice and dice data into actionable insights, and use the data to shape personalized experiences that actually make sense.

For example, say a customer frequently transfers money overseas. AI picks up this behavior and flags it as a cross-sell opportunity for a lower-fee international payment gateway. The omnichannel component comes in when you want to know where to send the message.

Suppose your analytics flag a customer at risk of leaving for a competitor. With predictive analytics integrated into your Customer Engagement Platform (CEP), you can analyze their preferences, channel interactions, and behavior to piece together the perfect strategy. You send an email campaign featuring incentives like fee-free account management, paired with an app alert offering personalized financial advice. This precision is about crafting the right message for the right channel, maximizing your efforts to retain customer loyalty.

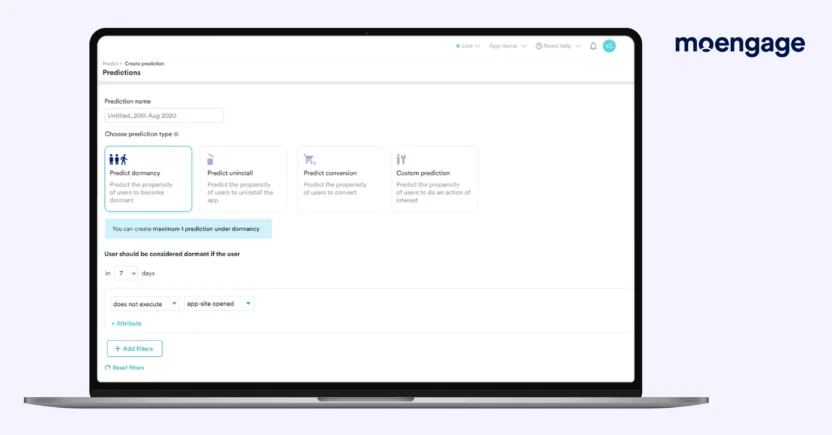

Platforms like MoEngage’s Predictions help you segment customers into hyper-targeted groups, such as those likely to switch banks or customers nearing a spending threshold.

The result? Highly strategic omnichannel messaging that feels personal and engages the customer, wherever they are.

2. Journey Orchestration Platforms: Seamless Transitions Across Every Channel

The challenges of omnichannel customer journeys in banking are endless. For one thing, you need to make customers feel like every step in the journey is connected, regardless of whether it starts in a mobile app, continues via email, and ends in a branch. And that’s no easy feat in an organization that handles the finances of thousands of customers.

Enter customer journey orchestration platforms. They ensure that no matter how customers interact (app, branch, website, or even SMS), the messaging feels consistent, timely, and personalized. These platforms track where a customer is in their engagement journey and ensure the transitions are smooth as silk.

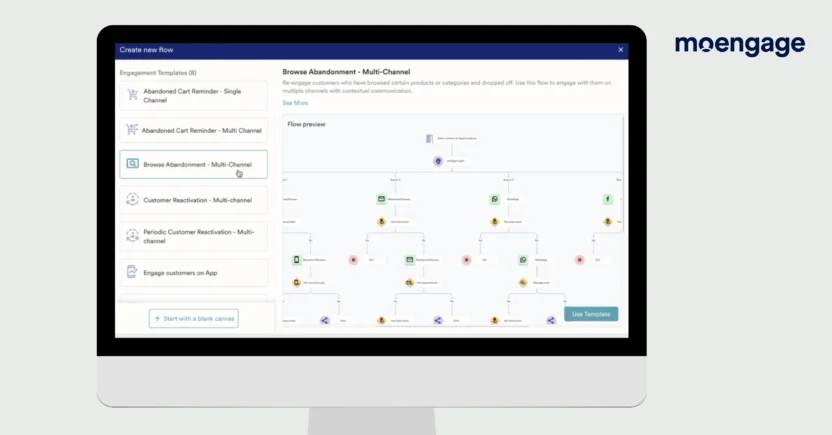

MoEngage Flows takes this one step further. It’s a customer journey builder that lets banks easily design, automate, and optimize these omnichannel customer experiences.

For example, let’s say a customer gets stuck midway through a credit card application on your banking app. MoEngage detects the drop-off and triggers a follow-up: an SMS reminder within an hour, an email outlining next steps later that day, and a final in-app pop-up the next time they sign in. All synchronized like clockwork, so customers never feel lost in the shuffle.

3. Real-Time Notification Platforms

If AI-powered analytics is the brain of omnichannel banking, then real-time notification engines are its voice. These systems send hyper-relevant messages to customers at the exact right moment, making interactions feel timely and natural instead of forced.

Want proof? Let’s circle back to Bank of America’s Erica AI assistant. It leverages real-time notifications to warn customers about overspending or send reminders about billing deadlines. Tools like MoEngage enable banks to access this same kind of personalization power, without needing BofA’s billion-dollar development budgets.

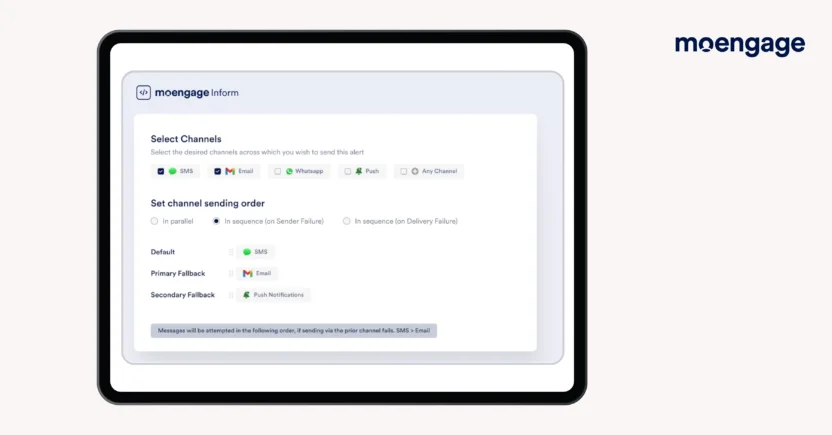

MoEngage’s real-time notification feature integrates across push, email, in-app, and SMS, ensuring your message comes through on the channels your customers use most. Did someone miss their credit card payment? Notify them instantly with options to pay now. Did customers complete onboarding? Trigger a ‘welcome’ message that highlights savings plans in seconds.

Banks can use MoEngage Inform to send real-time transactional alerts in less than 3 seconds. Fintech startup Beem, for instance, unified their customer data across various touchpoints using MoEngage, leading to 38% more CTR from SMS messages and 34% average email open rates. And thanks to MoEngage Inform, Payactiv achieved 9x more conversions from email notifications.

4. CDPs (Customer Data Platforms): The Source of Truth for Personalization

Quick question: What’s a bigger mess—your junk drawer full of old phone chargers, or customer data spread across disconnected systems? If you said the latter, congrats, you get it.

To unlock the full potential of omnichannel banking trends, you need to integrate your Customer Engagement Platform (CEP) with a Customer Data Platform (CDP). CDPs offer a unified repository for customer insights from all your channels. It’s a 360-degree view of each customer, ensuring interactions across mobile apps, branches, and emails feel seamless (and personalized).

Let’s say a branch manager speaks to a customer about refinancing their mortgage. Later, the same customer checks their bank app and sees a targeted recommendation for a lower-rate mortgage product, perfectly aligned with the earlier branch conversation. That’s CDP-fueled omnichannel perfection.

But it doesn’t stop there. CEPs integrated with CDPs help BFSI marketers make smarter decisions about where to send messages. For example, need to re-engage a customer who abandoned their online loan application? Predictive data from your CEP-cum-CDP might recommend a push notification first. Or do you have a high-value customer celebrating a major financial milestone? Your CEP and CDP data might suggest a personalized email thanking them for their loyalty and showcasing offers on premium banking services.

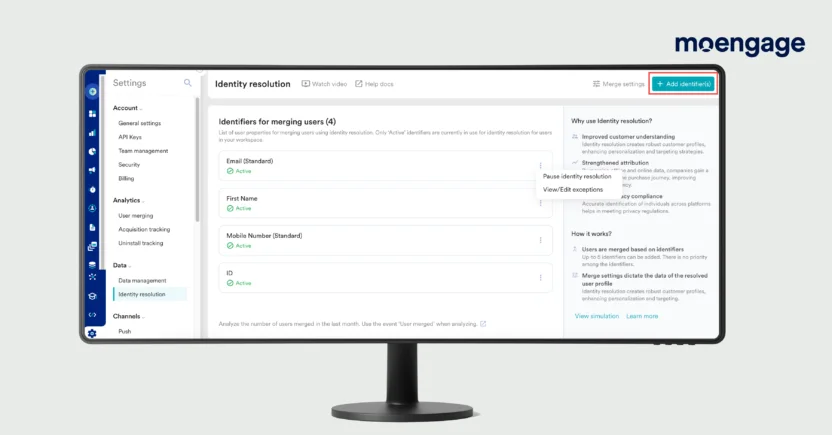

With MoEngage’s Unified Identity and seamless integrations with numerous CDPs, banks can unify customer data from apps, emails, SMS campaigns, and even offline channels. This central view ensures that every interaction feels like a natural continuation of the customer’s previous experience, no matter where it happens.

5. AI-Driven Personalization Engines

Generic messaging in 2025 is unforgivable.

Customers expect every interaction to feel designed specifically for them, whether it’s a push notification, an in-app message, or a suggestion within an email. Enter AI-powered personalization engines. They analyze spending patterns, click behaviors, and lifestyle affinities to deliver messaging, offers, and recommendations that align perfectly with customer preferences.

But here’s the catch: true omnichannel personalization requires that these engines optimize content for every channel you’re using.

Let’s say a customer is browsing for credit cards on your website. Your personalization engine can suggest relevant credit card comparisons based on their history (“Looking for cashback? We’ve got you covered”) while saving the data for use on other channels. Later, when that customer logs into their mobile app, they should see the same contextual suggestions, making it feel like a continuation of their previous web journey.

Similar principles apply when a customer consistently engages with budgeting tools in your app. The AI engine could highlight savings accounts that align with their financial goals. This recommendation might appear as an in-app banner, and if unclicked, could trigger a follow-up email to drive action.

Channel-specific optimization matters, too. You need to deliver the right product in a way that resonates with the medium. That’s why AI-powered engines should factor in the best practices for each channel. A push notification, for example, might feature concise, time-sensitive language (“Act now to save $50 on your first credit card spend!”). Meanwhile, the email follow-up can go deeper, including detailed benefits, a comparison table, and rich imagery.

MoEngage’s AI-driven personalization ensures the right products hit the right channel at the right time. It makes sure that channel-aware content looks and performs its best, whether it’s a mobile notification, app offer, or desktop email. It’s about making customer interactions smarter and contextual by building on omnichannel banking trends, which is exactly where AI personalization wins the day.

Gain the Edge on Your Competition with MoEngage

There’s no doubt that fast-emerging omnichannel banking trends are reshaping customer experiences and expectations at lightning speed. In such a scenario, embracing omnichannel banking strategies is necessary. Banks that create hyper-personalized, consistent, and tech-enabled experiences across multiple touchpoints are the only ones that can foster customer loyalty and growth.

MoEngage’s Cross-Channel Marketing Platform boosts customer retention by providing AI-powered consistent experiences across all channels. Schedule a demo to see how your bank can benefit.