🔥 The Customer Engagement Book: Adapt or Die is live!

Download Now

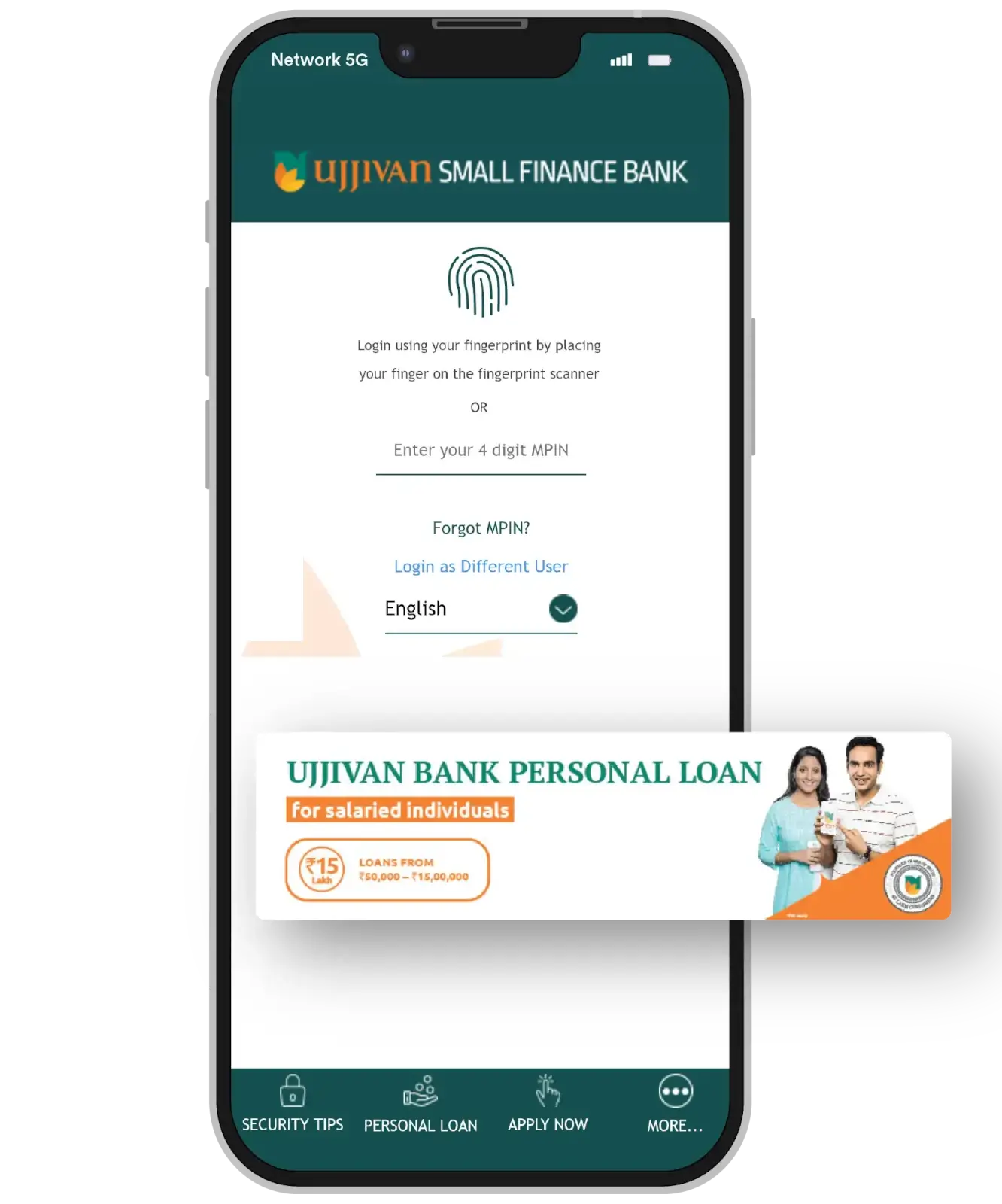

Ujjivan Small Finance Bank is a state-of-the-art, mass-market bank that serves the unserved and underserved customers who are currently outside the formal banking system. The bank currently caters to more than 57 lakh customers.

Traditional EMI collection via physical meets for micro-banking customers was affected by the pandemic-induced restriction of movement. Ujjivan Small Finance Bank realized the need for driving digital adoption and an insights-led engagement platform to achieve that.

Using MoEngage, we sent targeted campaigns to those who weren’t transacting digitally, urging them to pay their dues online. As a result, we saw over 4.5 lakh customers onboarded to digital payments, more than ₹123+ Crores of EMI collected and a jump in conversions from digital channels from just 2% to 18%!

Apart from setting up payment integrations and networks, Ujjivan Small Finance Bank encouraged digital repayments by segmenting customers and running targeted campaigns using SMS as a channel. The Small Finance Bank also gamified engagement campaigns to build balance base. The team segmented customers based on: - Monthly Average Balance (MAB) - Recent expenditure pattern - Average monthly balance movement, and - Probability to respond to offers sent earlier Different pools were created like Champions, Loyal Customers, Potential Loyal Customers, and more. Ujjivan Small Finance Bank then utilized exclusive offers to encourage higher deposits and customers to pay bills online.

The traditional EMI collection process via physical meets for micro-banking customers was affected by restriction of movement owing to the pandemic. There was a need for digitizing the EMI payments which not only was more convenient but also saved time.

With a substantial retail base, one of the key opportunities was to increase the balance base for the bank to have float. The Small Finance Bank identified customers who are more likely to build balance, based on past expenditure patterns and ran engagement campaigns (leveraging gamification) to increase balance.

The Ujjivan team collected and analyzed historical month-on-month repayment data and segmented them based on their inconsistency in repayments across digital channels. Post this exercise, they created Flows for the target groups identified.

• 2 Lakh unique customers onboarded to digital modes of payments

• The conversion rate from digital channels rose from just 2% to a whopping 18%

• ₹ 123+ Crores of EMI collected in just 5 months via digital mode

• ₹ 550 Crores worth of total incremental balance generated

Two variations of SMS text were sent to these groups for each payment mode – Digital payment through SETU and Cash deposit via Airtel and Pay nearby. To make the campaign more approachable to the micro-banking segment, regional language was used in the content with a total of 12 languages being used.

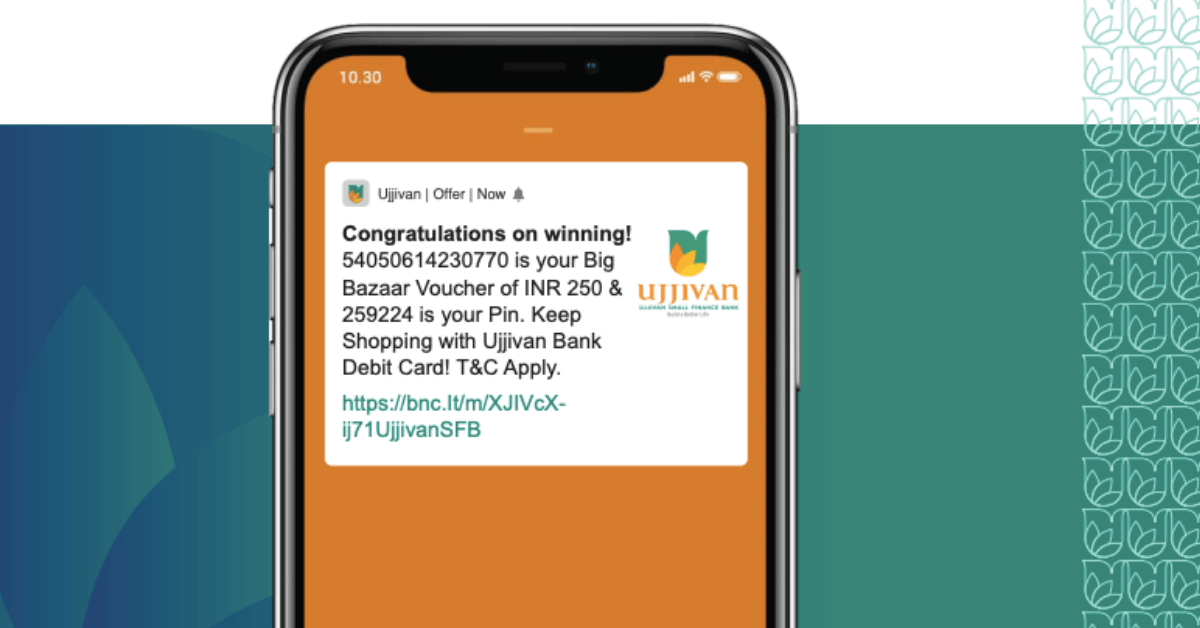

Gamification of campaigns was done to build a balanced base, such as customers making ‘n’ number of digital transactions of ‘x’ amount would receive a gift voucher. Such events were used to understand spending behaviors, segment customers, and run personalized campaigns to drive digital revenue growth.

Pocket FM Achieves 3X User Growth and 20% CTR Uplift Through Personalized Engagement with MoEngage

How Samco Securities Reduced Cost by 40% and Boosts Click Rates by 5%

Razorpay leverages MoEngage Flows to drive merchant engagement and retention

BlinkX by JM Financial Double MAUs with Seamless Customer Onboarding and Engagement Practices

MoEngage is an insights-led platform trusted by 1,350+ global brands like McAfee, Flipkart, Domino’s, Nestle, Deutsche Telekom, and more. MoEngage’s powerful analytics, personalization, and AI capabilities give a 360-degree view of your customers and help you create journeys across digital channels.

© Copyright 2025 MoEngage. All Rights Reserved.

Please wait while you are redirected to the right page...