Federal Bank, HDFC, Canara Robeco Asset Management, and PL Capital Discuss Scaling Customer Experiences with an Agile Martech Stack

The financial services industry is undergoing a reckoning. Customers want quick answers, seamless digital experiences, and personalized advice. However, the reality within most institutions is different; they often have layers of legacy systems, scattered data, and teams that can’t move as quickly as the market. That friction shows up every day.

The numbers make it clearer. Over 55% of banks say their old tech is the biggest barrier holding them back. On the other hand, nearly 70% of customers say that consistency across every channel—branch, mobile app, and call center—is what determines their loyalty. Put those two facts next to each other, and you see the problem: demand keeps rising, but delivery is stuck.

For banks still running on old cores, scaling feels like dragging weight uphill. Data sits in silos. Small changes take months. Meanwhile, fintech players are spinning up new products in weeks. This gap can no longer be seen as just a technical hurdle; it is existential. If customers walk away, there’s no product roadmap long enough to win them back.

So what’s the way forward? Not a full rip-and-replace. That’s too slow, too risky. The smarter path is to bridge the old with the new: make customer data flow, utilize behavioral signals in real-time, and shift the focus from pushing products to listening for the right moment to engage. Right time matters as much as real time.

This exact tension was the backdrop for a panel discussion with leaders from Federal Bank, HDFC, Canara Robeco Asset Management, and PL Capital. Each of them has faced these challenges firsthand. Their stories show just how complex this shift is, but also where the blueprint for success is emerging. In this blog, we’ll delve into the conversation and highlight the key insights that emerged from it.

The Data Dilemma: Breaking Down Silos in Legacy Financial Institutions

The problem of legacy data is not new, but its urgency has reached a peak. As Indraneel Pandit, CDO of Federal Bank, pointed out in our discussion, “This is a problem which most banks of any vintage face, or any organization of any vintage faces, not just banks.”

At the core, it isn’t only about old systems. It involves decades of knowledge and processes being locked away in places that don’t communicate with each other. Think of what a 90-year-old institution deals with: customer records split between paper files, mainframe databases, and newer digital platforms. Each one holds a piece of the picture, but none of them speaks the same language.

“The problem is data resides in silos,” explained Indraneel Pandit, CDO of Federal Bank. “Whatever you say about engagement and generative AI and AI and everything, data is the key, right? It doesn’t function without data. If it’s garbage in, it’s garbage out. You don’t give it any data, you don’t get any insights.”

What makes this challenge complex is that it is not only technical. Much of the critical customer understanding often resides in the minds of veteran employees, who are familiar with how past systems were designed. The most intelligent banks recognize this human element. As Pandit described, “Our tagline is ‘Digital at the fore, human at the core,’ and that’s very consciously put there.”

That is why the way forward is not ripping everything out. It is about connecting what exists and making it usable. More and more banks are creating unified architectures that tie data lakes to intelligence engines, allowing engagement platforms to finally see the complete customer story. The goal is not perfect data. The goal is to have data that is reliable and available in the moment when decisions matter.

Strategic Data Ownership: The Foundation of Modern Financial Engagement

Legacy systems slow banks down, but fixing the old pipes alone is not enough. The bigger shift is in mindset. Modern institutions are realizing that real progress comes from owning their data and, with it, their customer relationships.

The challenge is clear when you look at today’s financial ecosystem:

- Payments, lending, insurance, investments, wealth services — all competing for the same customer attention.

- Merchants and third-party platforms are using bank data to cross-sell loans or offers that banks themselves should be leading with.

As Anjali Thakur, Senior Vice President at HDFC, explained:

“Because we are such a large bank and we own the data of about 8 crore plus customers, we need to harness it. Because now everyone else is disintermediating and taking away… all the merchants are now using our data patterns to tell them and sell them a loan, which traditionally banks should be doing, right?”

That realization pushed HDFC to take a bold architectural decision: to own the data, the product, the servers. As Thakur put it, “So there is control on data and product.” This was not only a technical move, but also a strategic one. It was a way to reclaim the customer relationship before it slipped completely into the hands of intermediaries.

Once ownership is established, behavioral intelligence unlocks broader opportunities. Instead of focusing on isolated transactions, banks can begin to recognize intent. For example:

- A customer exploring investment options may be ready for a credit line increase.

- A steady saver may be the right candidate for wealth management services.

- Tagging customers into cohorts allows continuous experiments that sharpen engagement over time.

The strongest institutions view this foundation not as the ultimate goal, but as a launchpad. Data ownership gives control. Behavioral intelligence turns that control into insight. Ongoing experimentation keeps engagement relevant at scale.

The Experimentation Imperative: Building for Rapid Innovation

Owning the data is one step. Acting on it is another. And that’s where most banks feel the real weight. Insights are only useful if you can turn them into action quickly. On paper, it looks clean and logical. In practice, it becomes messy, especially with systems that were never designed to communicate with each other.

The Plug-and-Play Reality

Some institutions have begun to accept this and are reconfiguring their tech stacks to prioritize speed. As Anjali Thakur explained, “Then we started adopting technology that would be plug-and-play. Therefore, hosting on our own servers but looking at that can be a plug-and-play model from communication, so that we have the right to experiment.”

This philosophy may sound simple, but it reveals a critical insight: the right to experiment. In a traditional setup, even a small customer journey tweak could take weeks. Sometimes months. By then, the moment has passed. Modern engagement means trying, learning, and adjusting in near real time.

The Integration Challenge

However, even with that mindset, the underlying wiring behind the scenes makes things difficult. Different systems speak different languages:

- Payments running on one set of rules

- Credit card platforms use another customer ID system

- Debit card transactions are tracked differently again

- Loan systems manage their own separate profiles

As Thakur candidly shared: “I know there’s a payment, we have a credit card system, we have a DC system. Now I know the spend at an aggregate level, but we don’t know sometimes at a user level.”

The Speed Problem

In fact, this fragmentation not only creates data inconsistencies but also kills the momentum for innovation. When a bank identifies a valuable customer behavior pattern, the ability to act on that insight becomes constrained by:

- Technical integration cycles that can span months

- Data reconciliation across multiple systems

- Campaign coordination across different platforms

- Performance measurement requires manual data compilation

The institutions that thrive are those building what Thakur described as “two journeys”: understanding customer behavior within individual platforms while simultaneously working toward unified customer intelligence. But this dual approach, while necessary, exposes the fundamental limitation of fragmented systems and why the industry is rapidly moving toward unified engagement platforms.

The Fragmentation Trap: Why Point Solutions Fall Short

The dual-journey approach highlighted in the previous section—managing individual platforms while building toward unified intelligence—exposes a fundamental flaw in how most financial institutions approach customer engagement. What appears to be a reasonable interim solution often turns into a long-term trap. Instead of simplifying engagement, it multiplies the complexity.

Tool Proliferation Risk

Most banks start with good intentions: one tool for email marketing, another for mobile push notifications, a third for SMS campaigns, and yet another for in-app messaging. Each vendor promises seamless integration, but the reality is far different.

As our panel discussion revealed, even institutions with strong technical teams struggle with basic customer identification across systems. As Anjali Thakur from HDFC candidly admitted: “I know the spend at an aggregate level, but we don’t know sometimes at a user level.” How can you possibly orchestrate coherent customer experiences across multiple engagement platforms with such fundamental data gaps?

The Hidden Costs of “Integration”

The promise of API-based connections between tools sounds compelling until you experience it firsthand:

- Data mapping inconsistencies: Customer ID formats that don’t align

- Attribution conflicts: Different tools claiming credit for the same conversion

- Latency issues: So-called real-time engagement slowed down by sync delays

- Governance complexity: Managing data privacy across multiple vendors

What was meant to speed things, is slowing everything down.

The Orchestration Issue

Perhaps most critically, managing customer journeys across fragmented tools becomes exponentially complex. Consider a simple cross-sell scenario:

The Reality: A customer shows interest in investment products through their mobile app, receives an email from your CRM system, gets a push notification from your mobile engagement platform, and sees a different offer when they call customer service.

The Problem: Each system operates with partial customer data, creating disjointed, sometimes contradictory experiences.

Cost of Complexity

As Indraneel Pandit, CDO of Federal Bank, noted, successful digital transformation requires maintaining institutional knowledge while building new capabilities. But fragmented systems force teams to become integration specialists rather than customer experience innovators.

Teams spend more time:

- Reconciling data across platforms rather than analyzing customer behavior

- Managing vendor relationships rather than optimizing engagement strategies

- Troubleshooting connections rather than experimenting with new approaches

- Creating workarounds rather than building scalable solutions

This fragmentation trap explains why many institutions find themselves in the same position described by our panelists: they know they need to act on customer insights, but are constrained by the very tools meant to enable them.

The answer is not tighter integration. It is removing the need for integration altogether by shifting toward unified platforms where data, journeys, and measurement live natively in one place.

Unified Martech Platforms: The New Standard for Real-time Engagement

The fragmentation trap points to a deeper truth. The challenge is not just technical; it is architectural. Banks do not need more integrations; they need to eliminate the need for integration altogether. That shift is pushing the industry toward unified customer engagement platforms.

Why Integration Isn’t Enough

For years, the assumption was that connecting multiple systems could deliver a single experience. In reality, it rarely does. Even something as basic as customer identification becomes messy when data flows through half a dozen platforms.

Indraneel Pandit, CDO of Federal Bank, captured this challenge perfectly: “Whatever you say about engagement and generative AI and AI and everything, data is the key, right? It doesn’t function without data. If it’s garbage in, it’s garbage out.”

The answer is not building cleaner pipes. It involves removing the pipes altogether and adopting a native platform design.

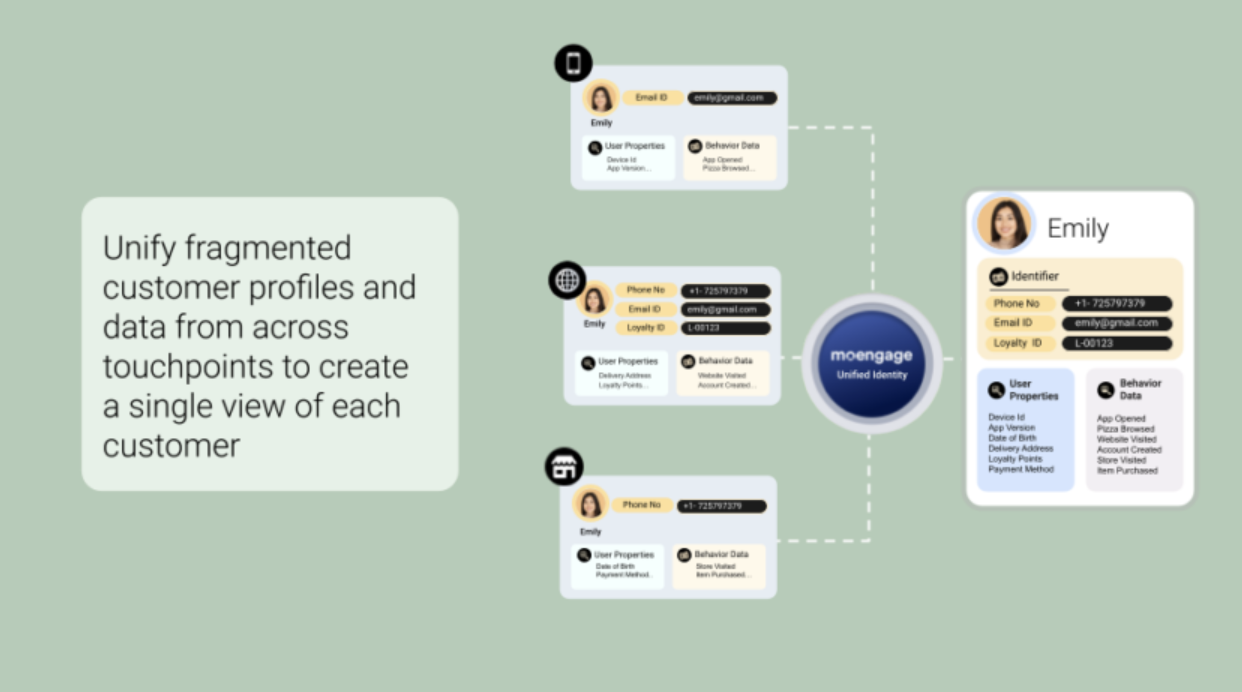

Single Source of Truth for Behavioral Intelligence

When customer data resides within a single system, behavioral intelligence transitions from theory to practice. It means:

- Real-time profiles that update instantly

- Unified identity across every channel and touchpoint

- Behavioral triggers that activate without delays

- Journey orchestration that is not blocked by sync cycles

- Attribution clarity with all activity measured in one place

Contextual Engagement at Scale

This is how institutions can finally act at the moment. Anjali Thakur from HDFC described it in practical terms: “If a customer comes to my pay section, can I, within my instrument—whether it’s a credit card or a PayZapp wallet—nudge him toward the right choice for his behavior so it’s a win-win?”

The only way to deliver this level of contextual decision-making is with platforms built for behavioral intelligence from the start.

What Makes Experimentation Work

Remember Thakur’s emphasis on “the right to experiment”? Unified platforms don’t just enable experimentation, they make it effortless:

- Instant campaign deployment without technical integration cycles

- Real-time performance monitoring across all channels simultaneously

- Rapid iteration based on behavioral feedback

- Cohort analysis that spans the entire customer journey

Omnichannel Orchestration That Actually Works

The promise of omnichannel has been undermined by multichannel execution. The difference is critical. True omnichannel looks like this:

- Unified journey mapping so every touchpoint informs the next

- Cross-channel intelligence so mobile activity shapes email content instantly

- Consistent personalization from a single engine across all interactions

As Pandit noted about their approach: “We are moving very rapidly towards a unifying architecture which does all the nice things that all of us hear about—omnichannel and single interface, modular, etc.”

The question is no longer if unified platforms are necessary. It is which ones can deliver on these promises right now—data unification, behavioral intelligence, rapid experimentation, and real-time orchestration across every channel.

The MoEngage Solution: Where Unified Martech Meets Customer Intelligence

The challenges our panelists highlighted, including siloed data, complex integrations, fragmented experiences, and the struggle to act on behavioral signals in real time, are not unique to their institutions. They reflect a broader set of issues across the industry, and solving them requires a different way of thinking about customer engagement.

MoEngage was built specifically to address these exact challenges through a unified Customer Data and Engagement Platform (CDEP) that eliminates the fragmentation trap entirely.

Breaking the Fragmentation Cycle

Instead of relying on multiple vendors and heavy integrations, MoEngage delivers native unification through its comprehensive architecture. MoEngage’s Data Management capabilities address the fundamental challenge of data quality and accessibility. The platform provides:

- Single source of truth for all customer interactions across online and offline touchpoints

- Real-time data ingestion that processes customer actions instantly without sync delays

- 360-degree customer profiles that unify behavioral, transactional, and preference data

- Advanced data warehousing integration with zero-copy personalization for enterprise security

Behavioral Intelligence at Scale

MoEngage’s Customer Insights platform transforms behavioral data into actionable intelligence that enables contextual customer engagement:

- Predictive Segmentation: AI-powered cohorts that identify customer intent before they express it

- Real-Time Behavioral Triggers: Instant activation of personalized campaigns based on customer actions

- Cross-Channel Attribution: Clear visibility into customer journey progression and conversion paths

- Advanced Analytics: Deep-dive insights that reveal hidden engagement and drop-off drivers

Campaign Orchestration Without Limits

Modern financial institutions need agile technology architectures that enable rapid innovation and testing. MoEngage delivers this capability through:

- No-code campaign builder enabling rapid experimentation across all channels

- A/B testing framework that operates simultaneously across email, mobile, web, and in-app

- Real-time optimization with automatic campaign adjustments based on performance data

- Instant deployment cycles eliminate technical bottlenecks that slow innovation

Financial Services-Specific Solutions

For financial institutions specifically, MoEngage offers industry-tailored capabilities that address regulatory requirements while enabling aggressive personalization:

- Enterprise-grade security meeting financial services compliance standards

- Risk-based segmentation for appropriate product recommendations

- Lifecycle-based engagement tuned for financial services customer journeys

- Cross-sell intelligence that identifies optimal timing for product introductions

Omnichannel Excellence Without Complexity

For institutions, a unified omnichannel experience is no longer optional. MoEngage’s Omnichannel Marketing Platform makes it possible without the usual overhead, using its comprehensive channel orchestration capabilities:

- Journey Builder: A visual designer to map customer paths across touchpoints

- Behavioral triggers: Actions on one channel drive engagement across others

- Consistent personalization across email, mobile, web, SMS, WhatsApp, and in-app

- Seamless transitions so customers move between digital and physical channels without friction

Advanced Personalization Capabilities

MoEngage enables brands to “drive up to 40% higher conversion rates by orchestrating highly personalized experiences” through:

- Individual-level personalization that goes beyond basic demographic segmentation

- Contextual content delivery based on real-time customer state and preferences

- Dynamic journey optimization that adapts customer paths based on behavioral feedback

- Predictive recommendations that anticipate customer needs across the entire lifecycle

Proven Results in Financial Services

MoEngage’s effectiveness is demonstrated through measurable results with financial services clients:

Operational Excellence

- 93% faster campaign go-live time: TATA AIG reduced campaign go-live duration by 93% and manual efforts by 90% using MoEngage’s automation and workflows.

- From 1 month to 1 hour: campaign execution: GoTyme Bank eliminated data silos and accelerated campaign launch time dramatically by unifying journeys on a single platform.

- Unified engagement dashboard: MoEngage’s financial services solution enables teams to manage journeys, analytics, and personalization across email, push, and in-app from one console, thereby reducing dependency on multiple vendors.

- Automated journey optimization: OptimizeFT used MoEngage Flows to streamline multi-channel journeys, improving conversion and retention with minimal manual intervention.

Business Impact

- Enhanced customer lifetime value through behavioral intelligence and predictive engagement

- Improved conversion rates via contextual, right-time messaging

- Reduced operational costs through platform consolidation

- Accelerated innovation cycles enabling rapid response to market opportunities

The Integration That Eliminates Integration

Most platforms promise to integrate with existing tools. MoEngage takes a different approach: it eliminates the need for integration altogether. By replacing fragmented stacks with native unification, it delivers what financial leaders have been asking for: omnichannel engagement powered by real-time behavioral intelligence.

As institutions work to overcome silos, fragmented experiences, and slow innovation, MoEngage clears the path. Its purpose-built platform design makes unified engagement not just possible, but practical.

The Future Belongs to Unified Customer Data and Engagement Platforms

The insights from our panel discussion paint a clear picture: financial institutions are at a critical juncture. Legacy systems and fragmented tools that once seemed sufficient now hinder growth and customer satisfaction. The institutions that will thrive are the ones bold enough to step away from the integration trap and embrace unified platforms purpose-built for modern engagement.

It’s no longer about figuring out clever ways to link up disconnected tools; it’s about removing the need for them altogether. Customers expect brands to know them in real-time, communicate with them consistently across channels, and adapt quickly as the baseline for competing.

Financial institutions that continue stitching together multiple vendors will always trail those running on unified platforms. The technology is already here, the advantages are proven, and the opportunity is significant.

The only question remaining is timing. Will your institution lead this transformation or scramble to catch up?

Ready to see how unified Customer Data and Engagement Platforms can redefine your financial services experience? Book a demo and explore MoEngage today!