One Account, Many Users: MoEngage’s Guide to One-to-Many Identity Management

Reading Time: 6 minutes

Imagine that your 2-year-old is obsessed with Peppa Pig. She watches Peppa Pig all day and refuses to wear anything but her Peppa Pig pajamas and socks.

As a busy parent, you’re mildly miffed with this obsession, but you are hopeful that she will outgrow Peppa Pig in a few months.

That’s the case until you receive three notifications from your favorite streaming service about Peppa Pig and PAW Patrol, all on the same day.

In the world of customer engagement, this is a common but cardinal blunder. A case of mistaken identity within the same family account.

The Shared Account Dilemma

Consumer brands often come across situations where they have one paying account holder (the ‘parent’) and multiple end-users (‘children’).

The Parent is the primary account holder who typically holds the commercial and administrative responsibility. This is the person who subscribes and pays the bills, or owns the policy (in case of insurance).

The Children are the individual end-users who use the service, are covered by the policy, or frequent the app under the same primary account.

|

Challenge: How to send the right message to the right person and the right time? If you’re the primary subscriber of a streaming service, you don’t want to miss out on the bill payment deadline because you were instead bombarded with multiple notifications of ‘If you watched this, you will like…’. If you are a marketer unable to resolve the shared account dilemma, the price you pay include:

Solution: MoEngage’s identity management capabilities can help you deal with complex and multi-layered customer relationship scenarios without breaking a sweat. |

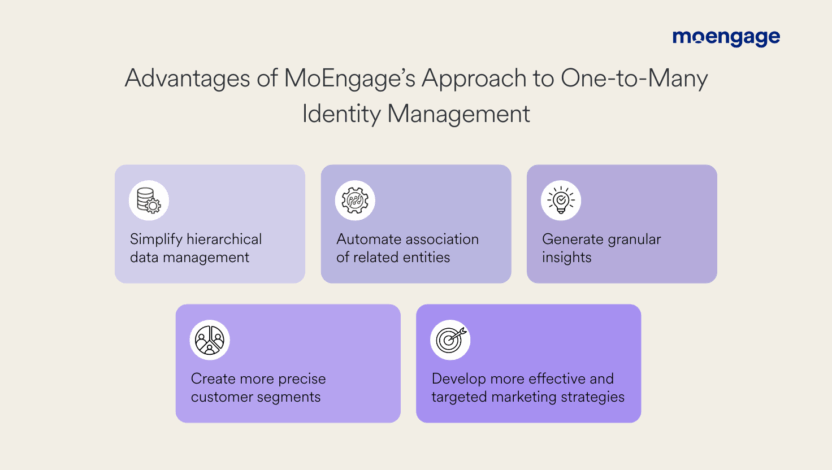

MoEngage’s Blueprint for Structuring the Hierarchical Relationships

MoEngage’s strategy for managing complex relationships, like a family account with multiple profiles, is centered on a flexible yet connected user data model. Instead of forcing all profiles into a single parent account record, it treats each entity as a distinct user while maintaining their relational hierarchy.

How does this work?

1. Core Principle: Every Profile is a Unique User

The foundational concept is that every single profile is created as a separate and unique user within MoEngage.

- Individual Identity: This immediately solves the problem of individual control. Each profile can have its own distinct attributes, such as a unique email address, name, and user preferences.

- Targeted Communication: Because each profile is a unique user, you can send personalized emails, push notifications, and in-app messages directly to that individual.

- Independent Preferences: This structure elegantly handles the unsubscribe use case. When one family member unsubscribes, only their user profile is marked, leaving the communication preferences of all other profiles on the account untouched.

2. Connecting the Dots: Mapping Parent to Child

While each profile is a unique user, MoEngage connects them by mapping the secondary user profiles back to the primary account profile.

This creates a relational link that allows the system to understand that secondary/ children accounts belong to the parent account profile. This mapping is the key that unlocks advanced, aggregated use cases.

3. Data Flow: Workflows and User Profile Objects

MoEngage uses a combination of real-time event tracking and automated workflows to aggregate data from child profiles onto the parent’s profile.

Parent-Child Use Cases in Action

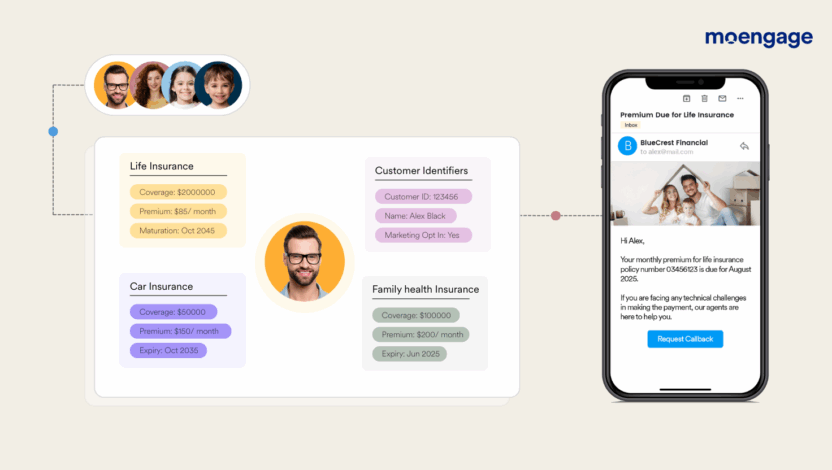

Insurance Industry

The requirement:

Separate the policyholder from the insured member(s) while also creating a unified view of a single individual across industries.

Challenge 1:

Send the right message to the right family member at the right time

The Solution: The ‘Individual Member Profile’ within a Master Policy

This model treats each person covered under a policy as a distinct individual with their own profile, contact information, and preferences, all linked to the main family policy.

How it works:

- Profile Creation: When Alex buys the family policy, MoEngage creates a primary profile for him as the ‘Policyholder’. Individual sub-profiles labelled ‘Insured Members’ for his spouse and two children would be created.

- Unique Identifiers: Each member profile (Alex, his spouse, each child) is given a unique member ID and can have its own contact details (phone number, email address) and login credentials for the app.

How can MoEngage help marketers send sensitive claim updates to the right individual?

Scenario: Alex makes a reimbursement claim for an emergency room visit done for a health scare. Alex did not inform his children about this visit.

When Alex’s claim is processed, the claims department directs the update to Alex’s specific member ID. The system then uses the contact information (e.g., email address or phone number) strictly associated with Alex’s profile.

This ensures that Alex’s spouse and children are not alerted, maintaining privacy.

How can MoEngage help marketers encourage dependents to use wellness features in the app?

With MoEngage, marketers have complete insights into the usage patterns of the dependents (spouse and children, in this scenario). If the spouse has logged into the app but hasn’t updated the number of steps taken or calories consumed in the last 30 days, marketers can send personalized push notifications directly to the spouse’s device.

Since this information is not relevant for Alex, he does not receive the notifications.

Challenge 2: One person, multiple policies

The Solution: Build a unified customer view.

MoEngage’s advanced data management capabilities, like unified identity, consolidate all data points for a single individual, regardless of how many different products they own.

Additionally, insurance can be categorized as an Object on MoEngage. If one insurance policy expires, its parameters can be passed on using Object Support.

How it works:

- Data Ingestion: The platform unifies data from the disparate systems that houses data regarding health insurance, car insurance, property insurance, and life insurance.

- Identity Resolution: It uses key identifiers like Alex’s full name, date of birth, mobile number, and email address to recognize that the policyholder for the car insurance , the life insurance, and the family floater is the same person.

- Profile Consolidation: It merges these into a unified profile for Alex.

The Result:

When a customer service agent pulls up Alex’s profile, they see a holistic view:

- Policyholder: Alex

- Insured Members: Isla (spouse), Carmen (child 1), Leo (child 2)

- Policies Held:

- Family Health Insurance (Expiry: Oct 2030)

- Car Insurance (Expiry: Aug 2035)

- Life Insurance (Maturation: 2045)

Fintech/Payment

The Solution: Role-based profiles and communication rules

The system must clearly define the roles and permissions for each user linked to an account and then apply specific rules for communication.

How it works:

- Role Definition: The system has predefined roles:

- Primary Account Holder: The primary account holder has full control, is responsible for payments, receives all billing communications.

- Authorized User/Add-on Member: The add-on members have limited permissions (can transact), cannot see primary holder’s full statement, and is not responsible for making payment.

- Campaign Tagging: Every automated campaign can have a specific tag.

For example, a Payment_Due_Alert campaign can be tagged exclusively for Primary Account holders, while a Promotional_Cashback_Offer can be tagged for both authorized users and the primary account holder.

Execution: When the payment due date is 5 days away, the system triggers the Payment_Due_Alert and sends an SMS/email only to the primary account holder. Simultaneously, it might send a promotional offer (“Use your card at these restaurants for 20% off!”) to the authorized user to encourage spending.

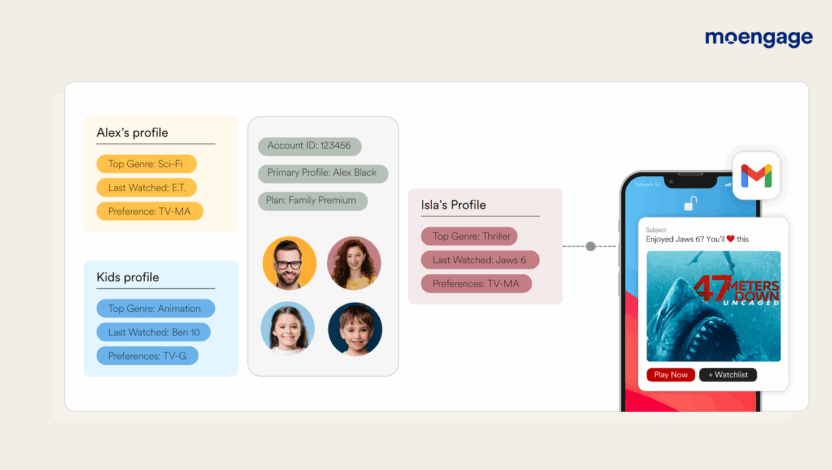

Media and Entertainment/Streaming

The Solution: Independent user profile under a single subscription

How it works:

- Profile Creation: The primary subscriber creates the main account using their email and payment details. The service then immediately prompts them to create separate profiles for different family members (eg: ‘Alex’, ‘Kids’, ‘Isla’)

- Collecting Rich Data for Each Individual: With MoEngage’s Object Data, the primary subscriber’s profile will contain nested attributes that in turn function as a separate container for user attributes such as viewing history, ratings, and preferences. What Alex watches does not influence the recommendations for Isla.

- Personalized Algorithms: The recommendation engine runs independently for each profile, analyzing its unique data to suggest relevant movies, shows, or music.

- Billing and Admin Layer: Billing, subscription changes, and account-level settings are tied exclusively to the primary subscriber’s login credentials.

How can MoEngage send individualized content recommendations for different members?

Since MoEngage collects nested attributes for each individual user, content recommendations are built individually for different members based on their behavior, preferences, and viewing history.

If ‘Isla’s’ profile is full of thrillers and true-crime documentaries, she’d get recommendations for similar content.

Conclusion:

The complexity of shared accounts is no excuse for poor personalization.

Treating every user as an individual is paramount, as a “one-size-fits-all” approach leads to confused customers and missed opportunities. The solution, as we’ve seen, is to recognize each user’s identity while maintaining their relationship within the group.

MoEngage provides the blueprint for this.

By creating distinct user profiles within a hierarchical structure, brands can deliver truly personalized experiences, all the way from sensitive insurance updates to tailored content recommendations. This ensures the right message reaches the right person, transforming potential communication blunders into moments of genuine connection.

To understand how MoEngage’s one-to-many identity management capabilities can help your business, feel free to book a demo today.