🔥 The Customer Engagement Book: Adapt or Die is live!

Download Now

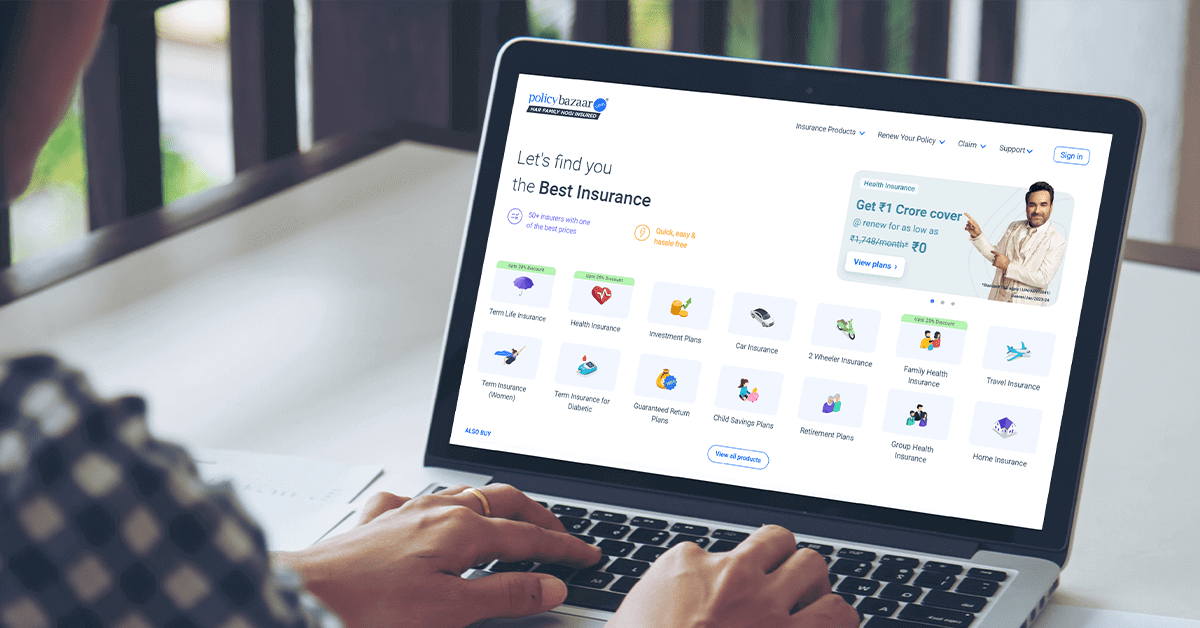

Policybazaar was founded in 2008 with one objective: bringing transparency to insurance. The founders wanted to reimagine insurance, so they started by simplifying all the information around insurance plans to end rampant mis-selling and prevent policy lapses. Today, the brand is one of India’s largest online insurance marketplaces. With a customer base of over 90 lakhs+ individuals, the Fintech brand has sold over 19 million policies since its inception, and this number is only growing.

The main driver of revenues in the insurance industry is the renewal aspect of the equation. Like any other insurance brand, Policybazaar clocks a premium known as Annual Premium Equivalent (APE) every time a customer renews their policies each year to maintain coverage. Since these renewals are an essential part of the equation, Policybazaar was on the lookout for a tool that could not only help them drive the bottom line but also give it the insights required to enrich customer experiences effectively.

Being the country’s largest digital marketplace, technology is at the forefront of all our key decisions at Policybazaar. We are a team of extremely data-driven people and were looking for a marketing automation tool that could not only help us bring advanced customer journeys to life but also offer a robust analytics engine. MoEngage delivered on all those fronts and also provided the capability of tapping into a plethora of insights that we could use to optimize our campaigns efficiently.

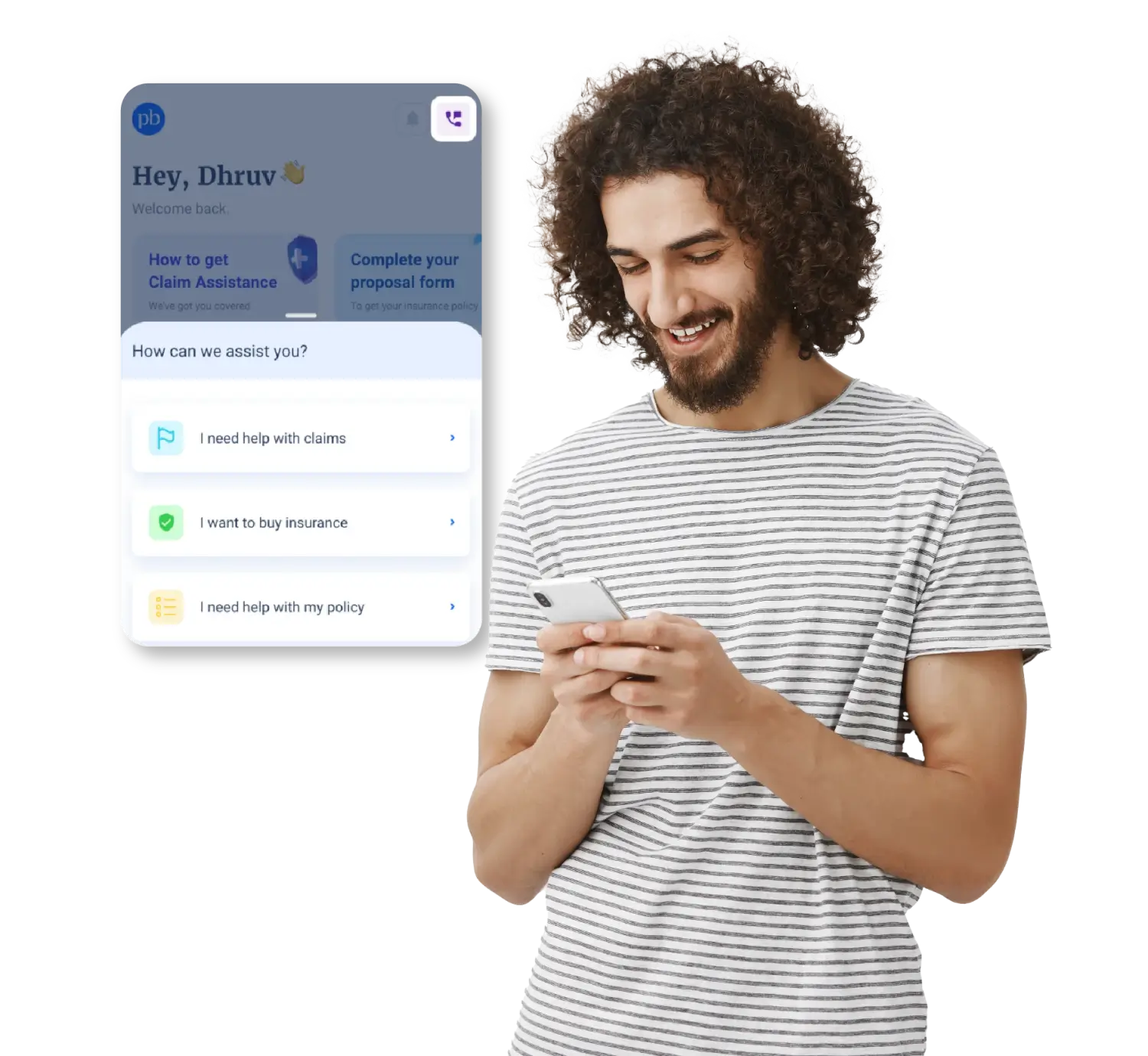

An average Policybazaar customer has a multitude of insurance options to choose from based on what their requirements are. This includes but isn’t limited to Motor, Health, Investment, 2-Wheeler, and much more! What does that mean for the brand? A completely different approach to communications for each of those customer cohorts! Using MoEngage’s supreme segmentation capabilities, Policybazaar crafted campaigns specific to the insurance needs of its customers, and the impact can be seen across multiple attributes! n line with the same, for a brand to access insights to build definite and detailed customer segments and then cater effectively to those segments – all while keeping in mind where they’re at in their journey is a bit of a task. Using MoEngage’s Flows, Policybazaar is able to manage over 18-19 Flows that help the brand fetch customers continuously using drip campaigns in a more integrated manner across multiple channels.

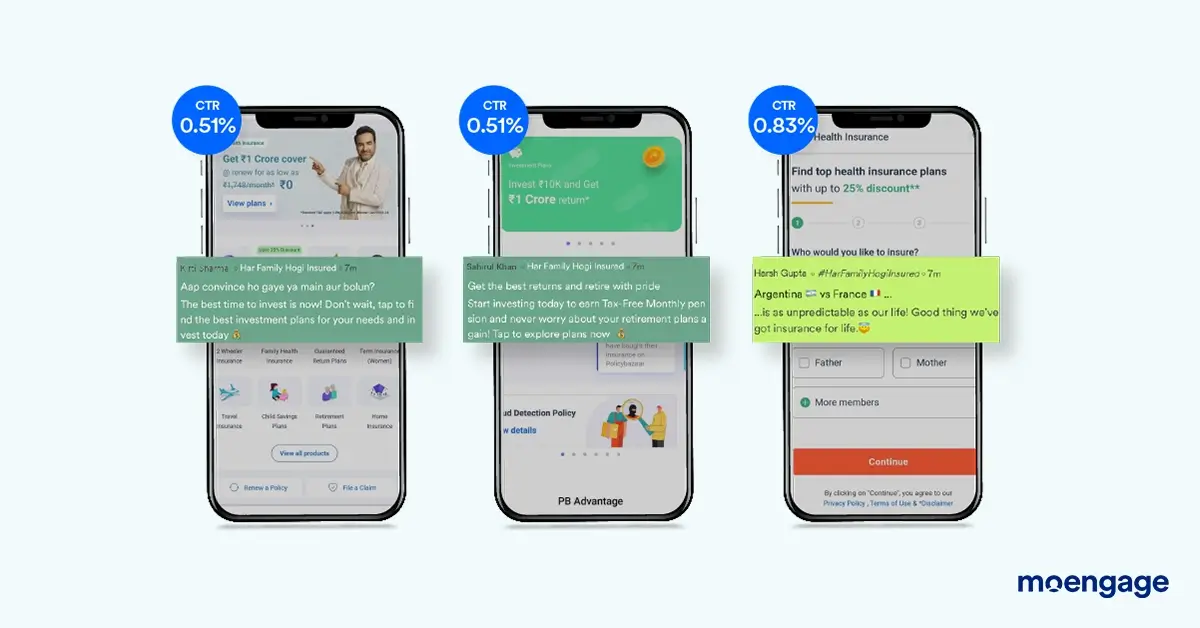

To begin with, Policybazaar, primarily utilized Emails and SMS’ to communicate with their customers. But that can only take you so far! The fintech brand started exploring push as a communication channel with MoEngage and saw great results! Using Stylized Push Templates by MoEngage, Policybazaar started sending out interactive and relevant stylized push campaigns! Consequently, these campaigns saw great clickthrough rates.

MoEngage harnesses AWS's powerful infrastructure for its real-time engagement platform, ensuring 99.99% uptime and scalability. This partnership caters to over 1,350 clients, managing billions of profiles and messages daily, highlighting the reliability and global reach of MoEngage with AWS.

MoEngage integrates with AWS CDS (SMS, Email, WhatsApp) to provide brands with Message Orchestration, journey management, and Advanced AI for marketing campaign optimization, ensuring high security and deliverability. Additionally, MoEngage offers a Warehouse Native integration with Amazon Redshift, featuring zero-copy data personalization for secure, direct data access without data movement.

Using MoEngage, Policybazaar:

Pocket FM Achieves 3X User Growth and 20% CTR Uplift Through Personalized Engagement with MoEngage

How Samco Securities Reduced Cost by 40% and Boosts Click Rates by 5%

Razorpay leverages MoEngage Flows to drive merchant engagement and retention

BlinkX by JM Financial Double MAUs with Seamless Customer Onboarding and Engagement Practices

MoEngage is an insights-led platform trusted by 1,350+ global brands like McAfee, Flipkart, Domino’s, Nestle, Deutsche Telekom, and more. MoEngage’s powerful analytics, personalization, and AI capabilities give a 360-degree view of your customers and help you create journeys across digital channels.

© Copyright 2025 MoEngage. All Rights Reserved.

Please wait while you are redirected to the right page...