Current Uses Growth Marketing to Ace Banking for Millennials & Gen Z

Reading Time: 16 minutes

To say millennials/Gen Z (MZ) are significant economic drivers and immensely valuable to the banking system is a massive understatement. The MZ in the U.S. is expected to inherit $68 trillion from their boomer parents by 2030. With one of the biggest wealth transfers in history, MZ in the U.S. will observe a fivefold increase in their wealth. This would reflect in MZ’s expected revenue contribution increase from $15.7 to $27 billion in the next four years. While most modern (and traditional) banks/fintech brands have been trying to tap the MZ demographic, one has struck gold. The U.S.-based, mobile-only challenger bank, Current, has not only hit jackpot but also acquired the Midas touch in the process.

|

🎯 The millennials and Gen Z in the U.S. are expected to inherit $68 trillion from their boomer parents by 2030. 🎯 With one of the biggest wealth transfers in history, millennials and Gen Z in the U.S. will observe a fivefold increase in their wealth. |

Current built a millennial/Gen Z brand image using inclusivity, honest messaging, and word of mouth from key opinion leaders. As Stuart Sopp, CEO of Current, mentions in a chat with Tearsheet, the bank sought to serve MZ as well as underserved segments like people living paycheck to paycheck and teens.

| Bonus Content

👉 State of Mobile Finance in 2021 👉 Banking in the Era of the Connected Customer 👉 Guide to a Winning Customer Experience in Financial Services in 2021 |

The challenger bank was able to achieve this using lower or no fees and early direct deposit. Before diving deep into Current’s growth strategy and ingenious usage of influencer marketing, let’s look at the USP.

Services provided by Current and its key differentiators as a challenger bank

- Faster payments of up to two days: Apart from 24/7 support and free withdrawal from 55,000 ATMs globally, one of the biggest differentiators between a challenger bank like Current and traditional banks is the speed at which funds are processed into accounts. Current prides itself on being able to send paychecks up to two days faster through direct deposit. This feature has genuinely added value for not just people living paycheck to paycheck but also for gig-economy workers, teens, among other demographic. Instead of holding onto your money and delivering on the date specified by your employer, Current makes the funds available to you right away. With a current premium checking account, you don’t have to worry about falling short on your bills and repayments and avoid late penalties and overdraft fees.

- Up to $100 of free overdraft: Worried about running a deficit in your bank account by withdrawing more money than your account holds? With Overdrive™, premium current members are allowed access to up to $100 using the Current debit card with no overdraft fees. This feature comes in handy when you need that extra amount. No minimum balance and hidden fees: One of the major reasons which discourage people from banking with a particular financial institution is minimum balance requirements and hidden fee structure. With Current, you don’t have to worry about maintaining a minimum balance or paying additional fees which you weren’t privy to while opening the checking account.

- Redeemable points that don’t expire: Every in-store purchase made through the Current card earns you points. These redeemable points are available to all users, while premium users can earn more points at specified locations. The purchases however need to be made at participating retailers, which can be found on the points map. The points earned can be redeemed for cash or premium subscriptions and the best part is they don’t expire and there’s no minimum purchase amount!

- Instant gas hold refunds: Gas stations generally charge you a large amount (up to $75) upfront while authorizing your card, as they’re unaware of the final transaction amount. The authorized amount is then matched against the final settlement and the remaining amount is credited to your account in 3-5 business days. With a current paid account, the authorizations are credited almost instantly, reflecting in the hold amount in your account.

- Personalized spend insights and Savings Pods: Current offers mobile banking with instant spending notifications and sends personalized insights to track how much you spend and where. Current also allows you to move money into Savings Pods to keep aside for vacations or even expenses like groceries. The bank allows the creation of one pod for a basic checking account and up to three pods for premium members. Using Current Pay, instant and free money transfers are made possible along with support for Apple Pay and Google Pay payments.

- Teen bank accounts for under-18s: One of the most sought after and unique among their offerings, teen banking account allows parents to set up allowances for their teenagers, set spending limits and categories, block transactions from specific clients, and more. Apart from the security provided by EMV chips on every debit card, and touch/face ID privacy controls, parents can assign chores to their kids and set rewards for successful completion. Through initiatives and features like these, Current encourages financial literacy and independence among teenagers.

3 Lessons to emulate from Current’s successful growth journey

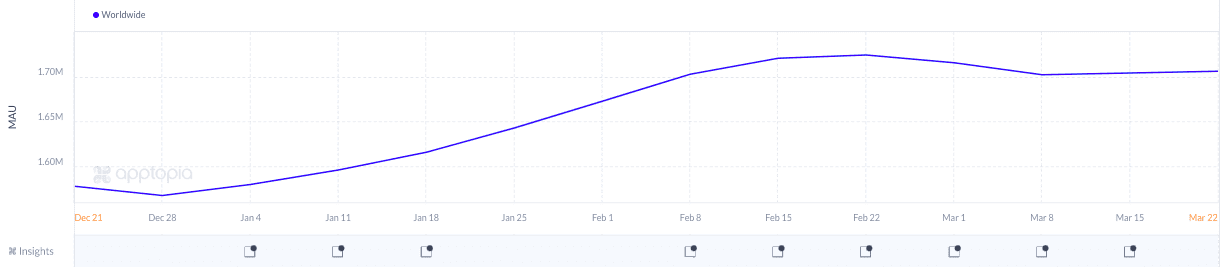

Current has crossed 2 million users, noticing an influx of over 200,000 new users in April and May 2020 at the peak of the COVID-19 pandemic. The week-wise Monthly Active Users (MAUs) trend over the course of the last 3 months is indicative of the growth to come in the future.

Current has achieved this growth through its purpose-driven brand actions, unique functionalities and practical features, devotion to banking underserved communities, honest and open communication, and brilliant usage of influencer marketing. Let’s take a dive into some of the key lessons you can learn from Current’s growth journey:

1

Leveraging endorsement from key opinion leaders in favor of old school advertising

Influencer marketing is one of the most crucial aspects of Current’s go-to-market strategy. The challenger bank realized that In order to reach their desired audience, i.e millennials, and Gen Z, they need to target platforms where the audience spends most of the time – social media channels. Understanding the need for a specialized marketing technique for the MZ audience, Current focused on messaging and the creative by working closely with the influencers.

When it comes to banking and monetary matters, especially for millennials and Gen Z (MZ), the key is building trust. If done well, influencer marketing can generate a steady pipeline of users who trust the brand; but on the flipside, wrong messaging can come across as nothing but an advertisement plug which can further damage the brand image.

|

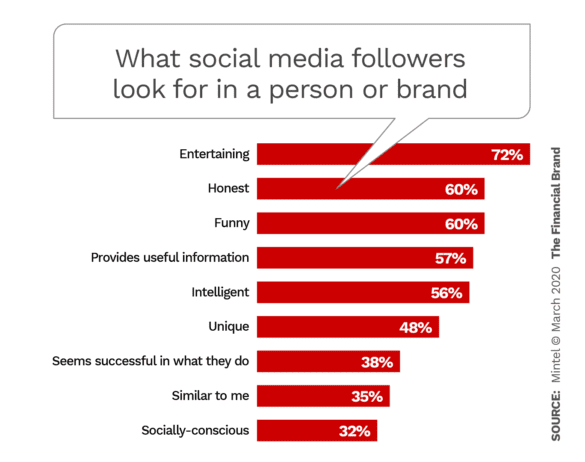

🎯 According to influencer marketing research conducted by Mintel, traits like ‘Entertaining’, ‘Honest’, and ‘Funny’ are placed higher than traditional financial attributes like ‘Provides useful information’. 🎯 This further illustrates the point that honest and trustworthy messaging are the key criteria for any banking institution running influencer campaigns. |

The MZ demographic has grown rather distrusting of ad placements on TV networks or social channels such as Facebook and Twitter. The fact that anyone can run ads doesn’t help the narrative either. This is where the key opinion leaders or influencers come into the picture. If a personality who’s credible and trustworthy endorses a product/service, it is far more legitimate. Despite the growing skepticism towards advertising and marketing, social media influencers are a well-accepted and authentic source of information.

|

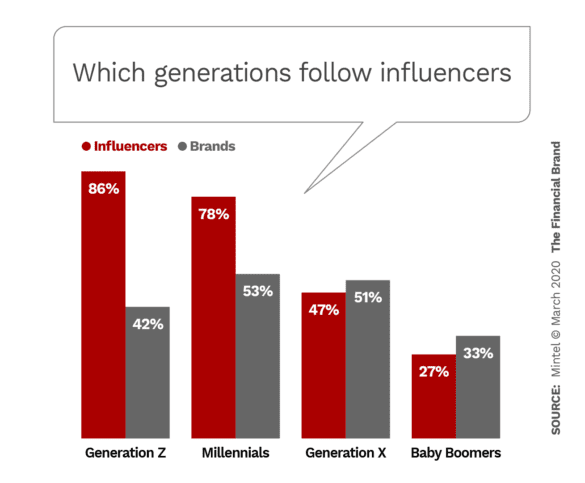

🎯 Mintel’s research indicates that only 10% of adults follow a financial services brand on social media. 🎯 The research further shows older consumers following brands more compared to millennials and Gen Z who tend to follow influencers more. |

Current works with influencers like Kyle and Jade (with 90.5 million likes and 4 million TikTok followers) and Kelz Washington (38.2 million likes and 2.9 million TikTok followers) to talk about the brand’s purpose and vision of inclusive banking for underserved communities and its customer-first culture. While very few older people would be aware of these personalities, they are wildly popular among Gen Z, edging past celebs like LeBron James in terms of influence.

How does Current choose influencers to work with?

According to research conducted by Comperemedia, Instagram influencers can be divided into the following leagues based on their follower count:

- Mega: 1 million followers or more

- Macro: 500,000 to 1 million

- Mid-Tier: 50,000 to 500,000

- Micro: 10,000 to 50,000

- Nano: Below 10,000

|

🎯 The Mintel research further indicates that most financial institutions tend to work with mid-tier influencers (accounting for 63%) followed by the micro category (accounting for 19%), and then the other leagues. 🎯 The research also indicated that big financial institutions like Wells Fargo and American Express tend to spend most of their influencer marketing budget on mid-tier and micro-influencers. |

The underlying reason might be twofold. Firstly, the extra effort put by micro and nano into engaging with their followers, and secondly, they are more economical while reaching the engagement numbers. While mid-tier, micro, and nano influencers bring that familiar closer-to-home voice, it is not necessary to depend on them alone. As a part of their relevant and on-brand communication, Current partners with influencers of varying follower counts from 50,000 to over a million.

So, the question arises how does Current decide whom to work with? The trick is to work backward by starting with understanding the audience i.e. who they are, what’s their location, and where they spend their time. After careful analysis of the target audience, it’s time to understand their preferences and who/what they care about.

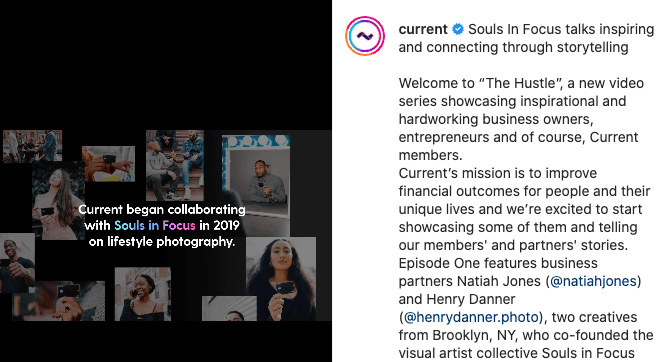

One of the examples comes from a video series run by Current called ‘The Hustle’, aimed at documenting and showcasing inspirational entrepreneurs, content creators, photographers, and visual artists from the black community.

The episodes feature initiatives like:

- Souls In Focus, a visual artist collective co-founded by two creatives from Brooklyn, NY to tell stories through and for the black community.

- Byas & Leon, an independent clothing store in Brooklyn, NY, started by Rony Byas and Harvey Leon in January 2019. The store is committed to crafting ethical and sustainable fashion wear while supporting other black-owned brands in their store.

- Whose Your Landlord (WYL), a community-based real estate company educating renters about their rights, resolving eviction disputes, and ensuring everyone is informed and protected.

Through these episodes, Current is communicating its core objective of improving financial outcomes for people and their communities. Current leverages the influencer’s credibility and relatability to showcase the brand’s purpose and build trust among existing and new users.

You might be wondering that these influencers aren’t strictly from the finance or banking background but then again Current’s audience base is so broad that they need not stick to a niche category like finance influencer.

Influencer marketing is a long game and finding the right personalities to promote your vision is just the first step. You need to work with them very closely, build trust just as you would with your customers. While there’s definitely a scientific element to running successful campaigns and programs, it is far more than just a simple algorithm.

You have to trust the content creator and provide ample headspace to come up with something truly relevant and engaging for your audience. This is precisely what teams at Current stick to. Besides onboarding influential content creators, they curate their own material to add value to the creator and his/her followers (also potential current customers).

To sum it up, here are some learnings to maximize the impact of your influencer marketing:

- Collaborate with influencers instead of just onboarding and paying them. They might be the representatives but it is still your brand and as such you’re the prime stakeholder.

- Go beyond commonplace aesthetics and stock photos to create something unique, something that stands out among a crowd of similar posts.

- Focus on underserved communities and see how you can help. For example, despite the Hispanic community being recognized as a potential growth market for financial services, brands aren’t making a conscious effort to speak to them or their interests like family and home.

- Properly vet your product/service placement to ensure it adheres to the rules set up by the Federal Trade Commission. Also ensure there is a product-story fit before approving creator concepts. Be generic sometimes and focus on product placement on other occasions.

- Keep on creating and testing storylines. In this long game, learning never stops!

2

Honest and open communication of brand value and purpose

Millennials and Gen Z as a cohort are attracted towards purpose-driven brands. The MZ audience prefers its favorite brands to stand up for what’s right. On the face of it, this might not seem like something brands need to actively chase after but considering millennials and Gen Z is poised to become the largest consumer segment, it makes perfect sense.

While most brands these days portray a sense of purpose through their messaging, it often comes across as contrived rather than authentic. A brand’s purpose should be a verb instead of a noun, i.e., the purpose should be present across all brand actions and not just communication.

|

🎯 As Jeff Fromm, the author of several books deciphering the subject consumer behavior of the MZ audience like ‘Marketing to Millennials’, ‘Marketing to Gen Z’ and ‘The Purpose Advantage’, states in order to become purpose-driven genuinely it is crucial for brands to focus on societal, functional, and emotional benefits for the customer. |

- Societal Benefits: As the name suggests, a brand should be able to do something good for society and the community. This is what will differentiate the brand from its competitors and make it enticing for the millennials and Gen Z.

- Functional Benefits: Pretty straightforward, basically any advantage that makes it easier, faster, and more convenient for the customer to use your services. These can range from speed and bandwidth of service to the performance of company stocks.

- Emotional Benefits: A brand’s ability to connect with its customers emotionally plays a key role in its usage or consumption. If you have a strong brand-customer connection, the user will purchase your product even if they need to pay a premium!

How did Current do it?

As a challenger bank, Current targets the section of Americans who are overlooked by the traditional banking system. This segment of users makes up almost half of the country viz. Hourly wage workers from service industries, gig economy workers, and young people, with a focus of course on the millennial and Gen Z.

The societal benefit is clearly communicated through the right blend of messaging and smart influencer marketing campaigns. The bank reiterates its stance of fixing and solving the systematic problems faced by underserved communities.

The bank wears its functional benefits like faster direct deposit, no hidden charges, free overdraft (of upto $100), instant gas hold refunds, and redeemable points on its sleeve.

The emotional connect that the brand creates with users via honest and open messaging, focused influencer marketing campaigns, and word-of-mouth referrals, can’t be overstated enough.

3

Leveraging word of mouth marketing and referrals

When it comes to matters of money and finance, voices closer to home, viz. Friends, family, and acquaintances carry more weight than any ad placement. Say, one fine day you’re browsing through your social media feed and suddenly notice all of your friends, colleagues, and mutual acquaintances talking about a particular product or service, what will be your first reaction? Checking out the said product or service, right? Or at the very least the brand name will be registered in your mind and the next time you see the brand name mentioned, it’ll trigger the thoughts conveyed through the tweets, Facebook, and Instagram posts.

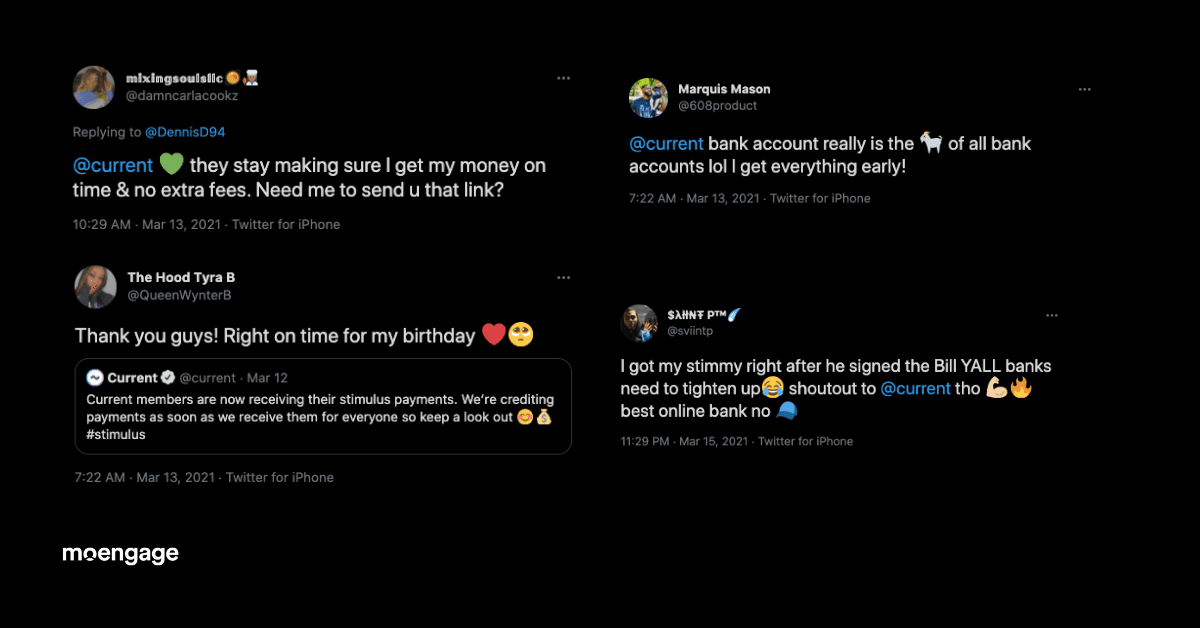

Word of mouth holds huge sway over how customers perceive a brand and its product portfolio. Through its fast, direct deposits among numerous other features, Current has created a collection of customers who vouch for the bank on social media and refer it to friends and family.

Here’s an instance, when the U.S. Government was rolling out stimulus checks, Current released payments faster than other banks and the users took note. The challenger bank was genuinely solving a problem, one that helped a significant majority of their audience base. What followed next was a barrage of tweets thanking the bank and recommending more people to use it.

One of the biggest learnings here is how Current engaged with those tweets showcasing the brand’s conscious effort in helping users and building an online community of satisfied customers.

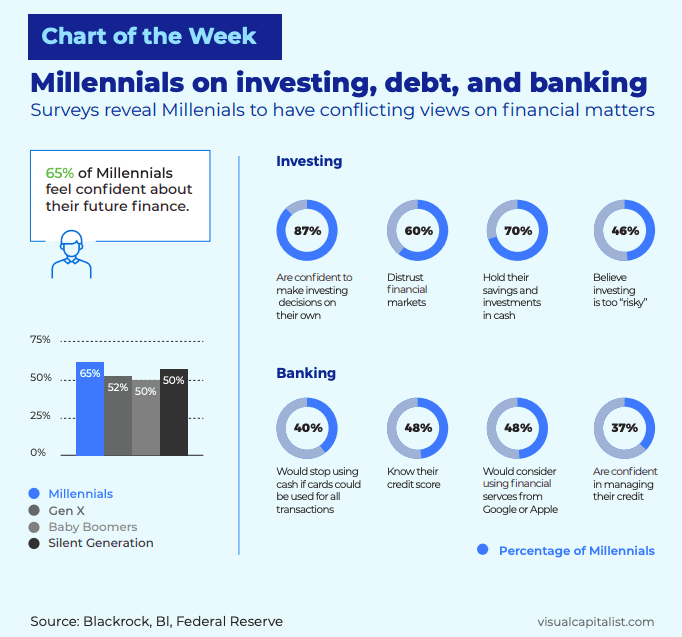

Decoding the millennial, Gen Z banking mindset

According to Business Insider and Morning Consult reports, millennials are delaying most major life events like buying a home, investing in medical insurance, getting married, and having children.

One of the stark contrasts between millennials/Gen Z and generations preceding them is how they approach to finance and wealth. Millennials and Gen Z are known to delay major financial decisions to make room for interests, hobbies, careers, and other lifestyle choices.

Banks and financial services need to ensure their communication is aligned to the appropriate life stage. Targeting the wrong personas is a wastage of marketing dollars as it will yield no return. With significantly changed life cycle goals, for millennials, banks need to account for that.

|

🎯 How exactly are millennials and Gen Z approaching personal finance?

|

How do banks gain the trust of millennials and Gen Z?

In a world of security breaches, trust is key to driving quality consumer engagement, irrespective of your bank’s omnichannel strategy. One of the easiest (also the toughest) ways to gain trust is through referral programs.

Enjoying one of the most successful credit card referral programs, American Express gets over 10% of new customers through referrals.

If you want to emulate that, you need to:

- avoid using financial jargons and technical terms in your consumer communication

- catch consumer attention while they browse through your website/app, encourage them to explore your portfolio

- be clear, concise, and consistent in your communication

- leverage customers’ social capital by encouraging them to talk about your services

- ensure that every communication (welcome message or a marketing email) is tagged to the life event the customer is planning for

- educate and empower customers with insights helping them make informed decisions

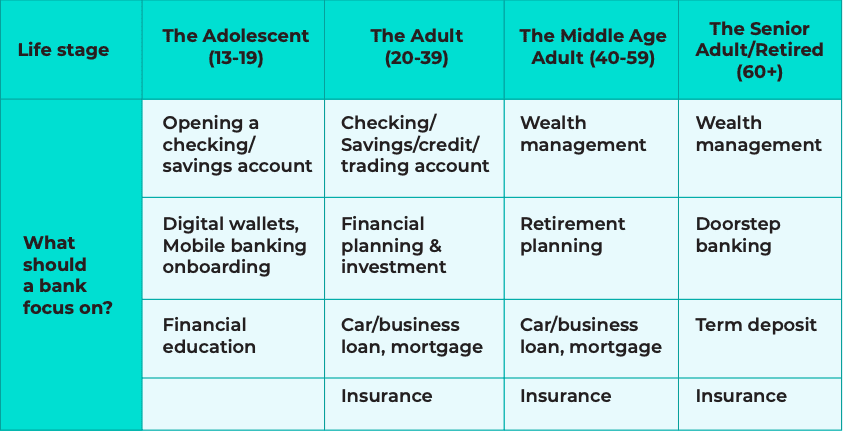

A bank should be familiar with the life stages depicted in the table below in order to suggest appropriate products for different kinds of customers. Since these life stages are segmented based on age, corresponding groups of customers have greatly differing needs.

How MoEngage helps banks and financial brands efficiently onboard, engage, and retain customers

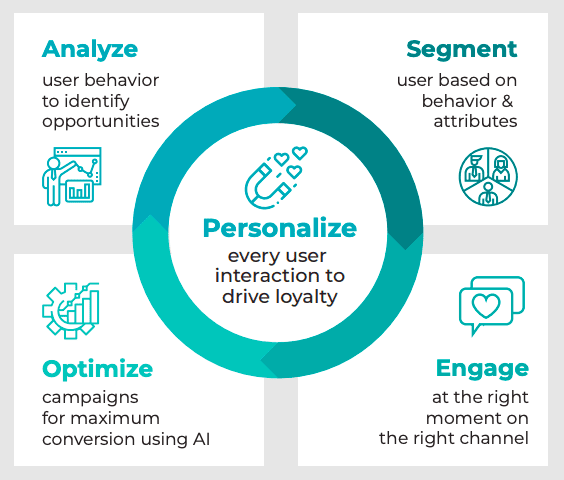

MoEngage’s intelligent Customer Engagement Platform is built for the mobile-first world which allows banks and financial institutions to connect with users across multiple channels seamlessly. The integrated platform has applications for both automation and analysis along with AI-enabled optimizations for every campaign.

Create a 360˚ customer view by integrating online & offline channels

MoEngage helps companies orchestrate campaigns through push notifications, emails, in-app messaging, web push, and SMS. The platform can be used to create, visualize and deploy omnichannel campaigns that reach users at the right time through the right channels, and with the right message.

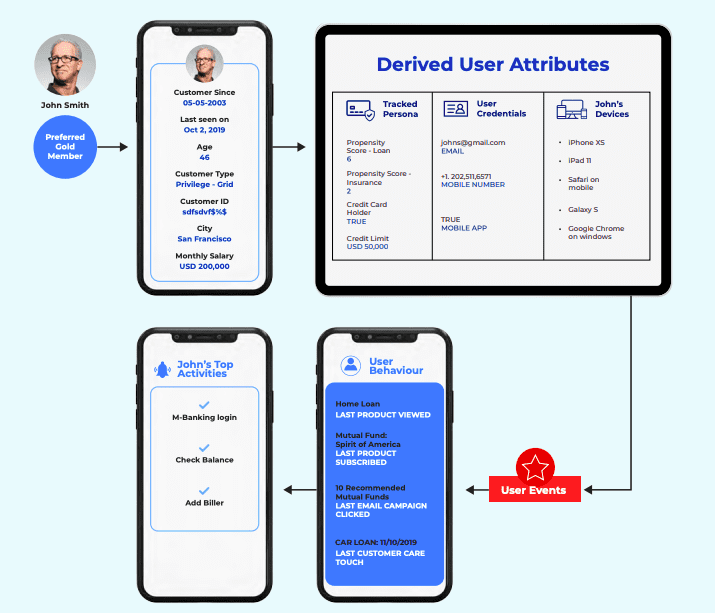

But even the best of campaigns are only as good as the underlying data. It is impossible to have an effective campaign without creating a holistic view of your customers. A 360˚ view of the customer involves two main categories of data:

- User Events: This primarily comprises a user’s online behavior and ways of interacting with the mobile app/website.

- Derived User Attributes: User details such as geographical location, device used, phone OS, etc. are clubbed together in this category.

Amplify your push notifications

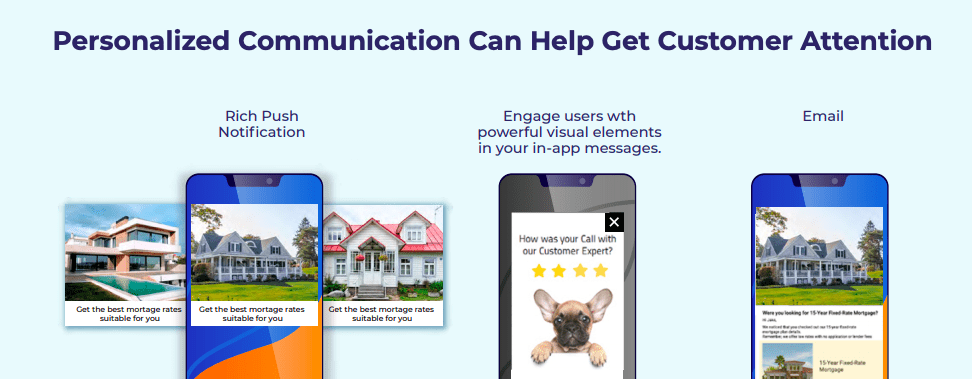

Push notifications are a good way to get your users’ attention. MoEngage leverages powerful visual elements that keep users engaged the moment they open your app and continue to engage them throughout the marketing automation flow.

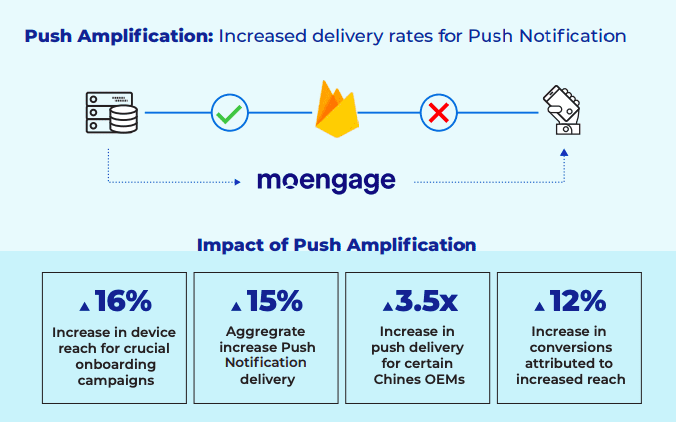

Between 40% – 70% of Android customers do not receive push notifications due to device and network restrictions. What’s worse is that most mobile marketing automation software does not measure the exact delivery rate of notifications to the customer’s mobile device. They measure the sent rate to Google’s FCM and Apple’s APNS servers, giving you a skewed representation.

With Push Amplification, you can reach customers who would otherwise be left out and see an immediate uplift in retention rates. The MoEngage SDK carries an ‘augmented notification delivery’ channel. When a notification delivery fails, the MoEngage Push Amplification acts as a fallback to FCM/APNS and delivers notifications directly to users’ devices, circumventing the challenges of typical push notification.

Segment and create personas to design high-performance campaigns

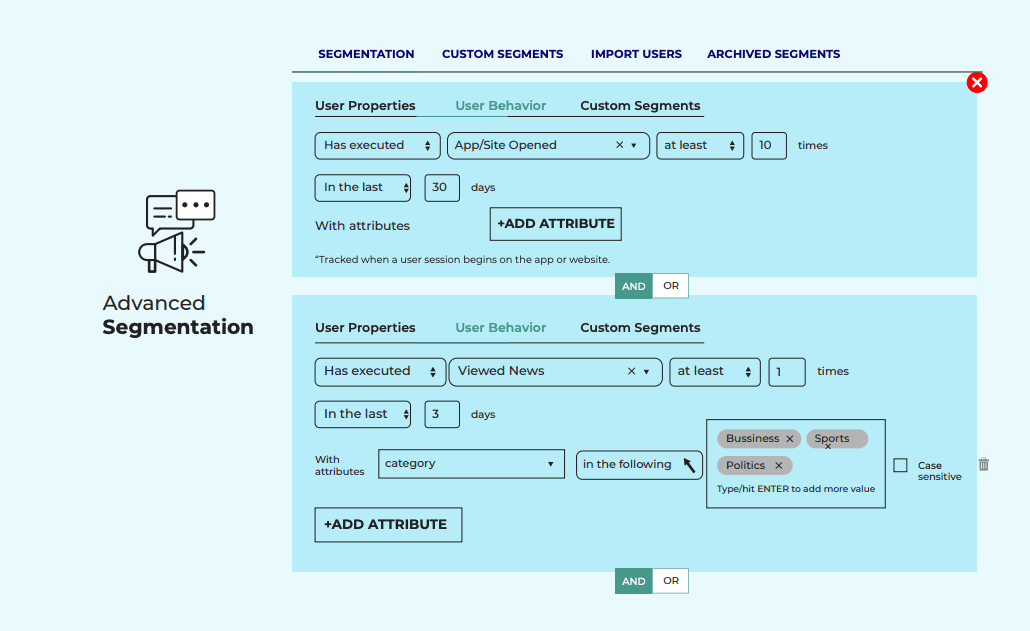

Segmentation is looking at your user data and grouping users who exhibit similar behavior or share similar attributes. Some examples of segmentation are ‘users who browsed for Mutual Fund Investments on the site/ app’, ‘users who completed more than five transactions in seven days’, ‘Users who browsed Mutual Funds and ended up investing in them’’. Segmentation could also include user attributes such as the model of cell phone used, place of residence, etc.

With MoEngage you can create easy segments of users in two main ways:

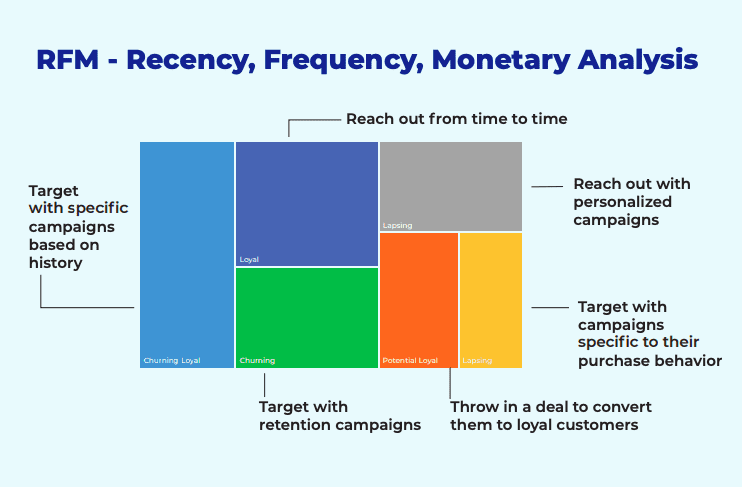

RFM Analysis (Recency, Frequency, Monetary): Create a chart of your users based on their likelihood to make a purchase, overall frequency, and the monetary value of purchases. The RFM chart gives you a quick overview of all users right from Dormant to Champion and helps you create appropriate marketing campaigns.

Advanced Customized Segmentation: Segment your users based on user events (for example, completed a fund transfer in the last 7 days) and derived user attributes (for example, located in Singapore). Such custom segments help you design high-performing marketing campaigns with ease.

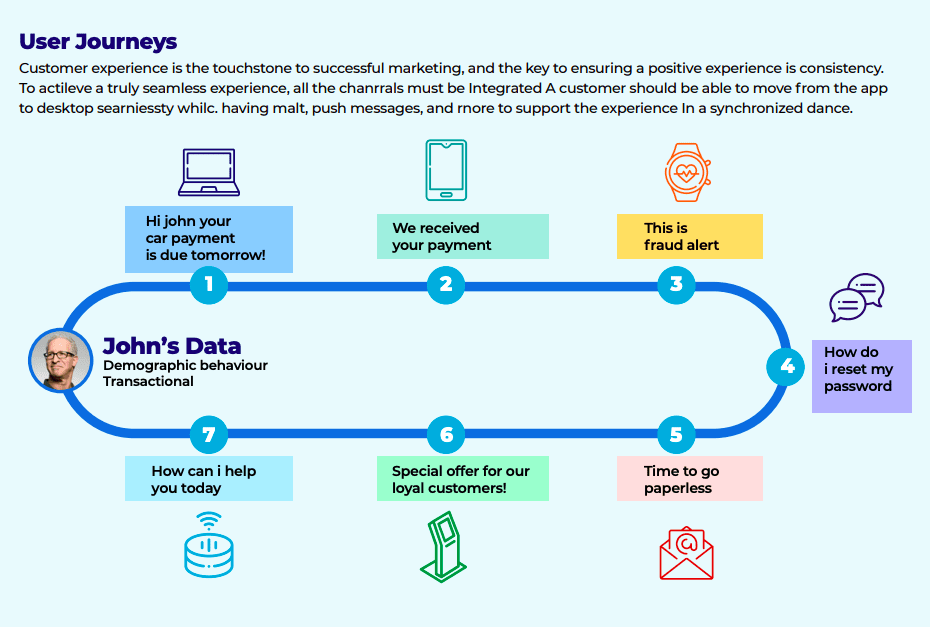

Orchestrate personalized omnichannel journeys across customer’s life cycle

With 77% of consumers wishing to receive personalized content online, financial institutions must learn to read and interpret each individual’s needs and provide a seamless experience across all user touchpoints. Banks and fintech brands acquire users through multiple channels and mediums. There is an obvious challenge to onboard these users and get them to explore different product offerings.

With MoEngage, it becomes easy to onboard new customers, engage, retain and also seek referrals from existing customers. With MoEngage Flows, banks and fintech brands are able to design marketing automation flows that are easy to create, visualize and deploy across channels. From onboarding new prospects to earning referrals from existing customers, Flows takes care of all customer touchpoints.

Send emails that land in ‘Primary’ inbox and not ‘Spam’

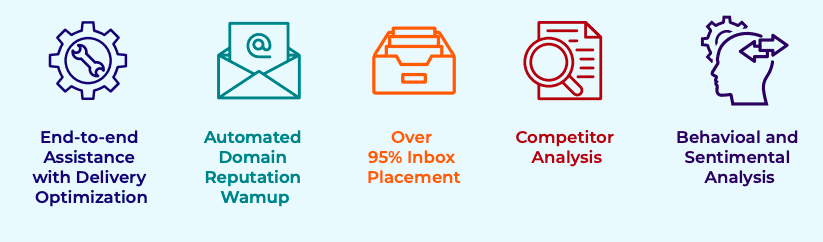

Sending emails to your banking customers doesn’t assure you of ready conversions or high-performing marketing campaigns. Here’s how email marketing can be revamped with an intelligent customer engagement tool:

- Personalized content: With MoEngage you can customize the placement of products/features in the email based on the customer’s likes and dislikes. Placing relevant content leads to higher conversion rates.

- Deliver right to the primary inbox: As marketers, we’ve all seen our well-crafted emails land up in spam, never to be viewed by customers. With MoEngage we assure you of over 95% inbox placement rates.

- End-to-end assistance with delivery optimization: Our special drag-and-drop Email Builder tool lets you insert gifs and other interactive elements. We don’t just help you with creating an email marketing campaign but also help you analyze it.

What’s Next?

- Discover how to create a perfect customer-centric banking experience and get a worksheet to design intelligent lifecycle campaigns.

- Want to implement smart and effective campaign orchestrations? Get in touch!

- Find out how MoEngage can help your bank or fintech brand here!

| Here’s what you can read next:

|