Succeed With Crypto Apps in the Philippines

Reading Time: 6 minutes

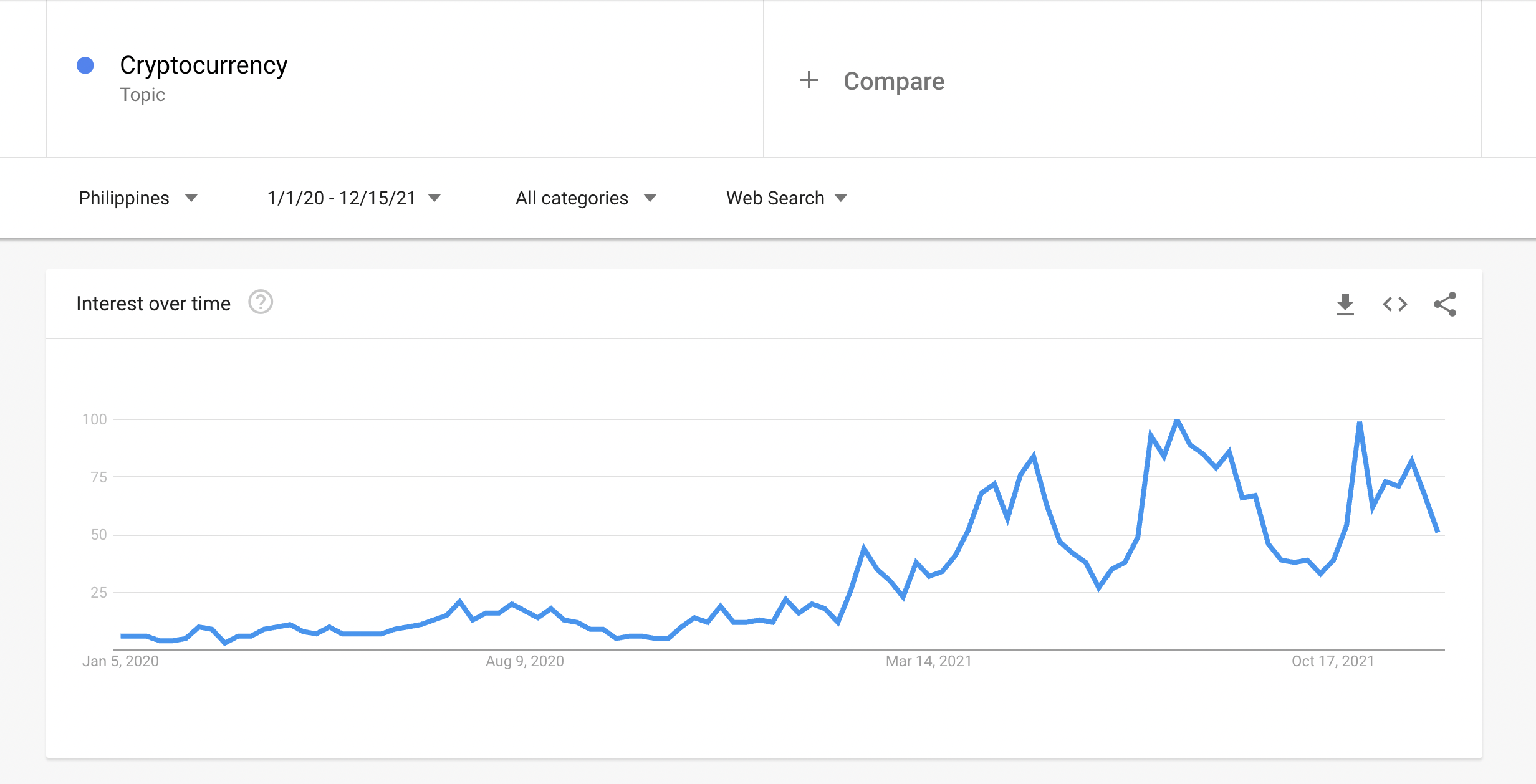

Ever since the Central Bank of the Philippines has legalized crypto currency, the interest has steadily soared in the Philippines, with the pandemic only accelerating the trend.

Since 70% of the Filipino population do not have a bank account yet, the central bank’s foresight of driving financial innovation and bring these people under the banking umbrella using crypto looks promising.

This is what makes the Philippines an interesting market for crypto app entrepreneurs wanting to be a part of this large-scale impending disruption that they plan to drive by offering utility services and convenience built within crypto apps.

As these services make lives easier for the common man and become integral to the customer’s lifestyle over time–making the app highly useful and scoring high retention rates for millions of app-based customers. However, it is easier said than done. The idea of serving millions of daily customers is surely exciting but driving adoption and retention in a nascent market is a bottleneck that these crypto apps can face and this is what we aim to address.

In this post, we take a look into major cryptocurrency app types prevalent in the Philippines. We will also learn why Filipinos prefer cryptocurrency and how crypto apps are looking to drive acquisition and app retention.

We finally conclude with three major challenges brands face in the crypto space and how to resolve them.

So without further ado, let’s begin.

What is Driving Crypto Growth in the Philippines?

There are three major drivers of Crypto growth in the Philippines:

Well Defined Regulations

The Philippines is not the biggest contributor to the global crypto trading volume but nonetheless, a set of clearly defined crypto regulations makes it favourable for many entreprenuers. In fact, the IMF says that the Philippines is one of the best nations to launch a blockchain company.

Socio-Economic Acceptance

Filipinos are a curious bunch and demonstrate a lot of excitement towards cryptocurrency apps that cuts a lot of hassle out of their lives.

A lot of these consumers deal with cash and are willing to exchange crypto for cash. Those with bank accounts dislike going for bank work as it consumes almost half of their day, which they can easily save if they transact with crypto bot instead.

Mobile Internet Penetration

The last growth driver happens to be mobile internet penetration in the Philippines, which is more than 74% coupled with a 72% penetration rate for smartphones to go with it. These are potentially millions of excited customers who are not afraid to try something new.

Types of Crypto Apps

Similar to other countries, four types of crypto apps prevalent in the Philippines:

| Wallet Apps

Allows customers to save crypto earnings, stores Passwords and sign transactions. Example – Coins.ph, Coinbase |

Crypto Trading Apps (Exchanges/Brokers)

Allows buying and selling cryptocurrency and trade cryptocurrency. Example – Binance, Coins.ph,Coinbase, eToro |

| Insight Aggregator

Aggregates data points for multiple currencies and UI centric. Example – Coinmarketcap.com |

E-commerce Apps

Helps customers buy goods using cryptocurrency within the app. Not many apps at this moment. |

The majority of crypto apps in the Philippines market are trading apps. However, some offer wallet and basic insight aggregator features as well. For example, Coinbase offers insight-based features, allowing customers to monitor crypto insights and stay ahead of the trends.

If you think this is exciting, local players such as coins.ph have made crypto far more interesting by breaking free from this conventional mold of four app-types. They allow customers to pay utility bills, buy mobile load, buy game credits, and much more.

With the ability to convert crypto to PHP and back, the value proposition is unmatched which is in fact one of the key strategies to drive acquisition.

How Crypto Apps Leverage Value to Acquire Customers?

Being able to trade cryptocurrency is great but that alone falls in the domain of crypto enthusiasts. As mentioned above, many crypto apps in the Philippines are bundling essential services with crypto trading and wallet features.

That way, the companies aim to make crypto integral to the lifestyle of a majority of Filipinos. Some of the major offerings from these apps include:

- Currency Conversion from crypto to PHP

- Store Crypto

- Apply for Crypto Loans

- Buy and Sell Cryptocurrency/Trading

- Monitor Crypto Insights

- Pay Utility Bills

- Buy Load for mobile (prepaid mobile recharge)

- Remit Money

- Buy Game Credits

- Scan and Pay in stores

- Payment Request and much more.

These value offerings have been successful in driving customer acquisition for these apps. Word of mouth follows often follows once a significant number of customers are acquired that triggers mass adoption.

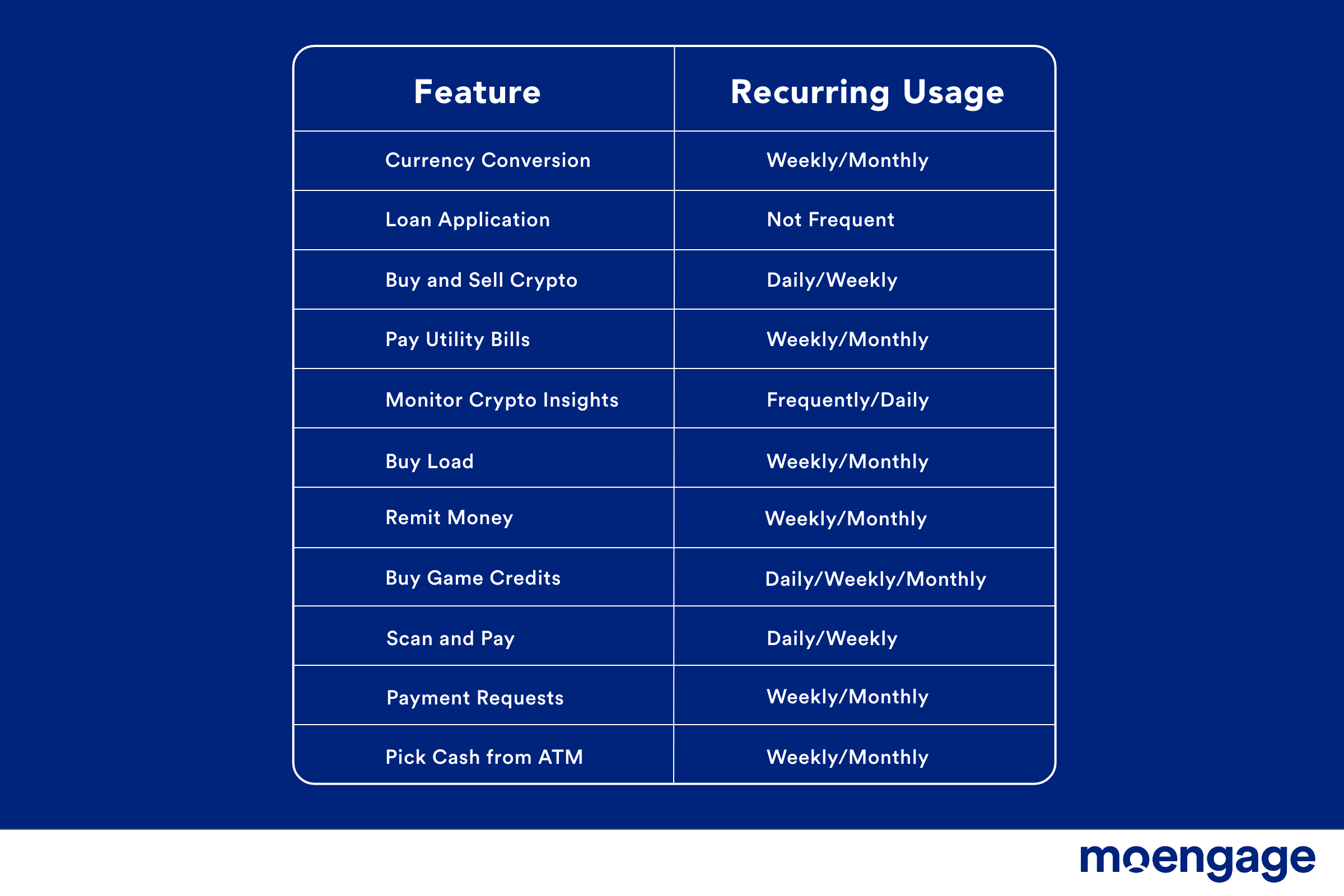

Retaining Crypto App Customers

The ability of the crypto app to drive frequent usage determines the retention rate for these apps. Features such as buying mobile load(prepaid balance), paying bills, and others encourage repeat usage. This is likely to drive a similar type of usage statistics witnessed in countries where payment and crypto apps are now mainstream unlike the Philippines

More than 40% Gen Z and Millennials are daily customers of payments apps with 50% of the sample using the apps for convenience that are similar to the ones offered by crypto apps in the Philippines.

Combined with our first hand experience using these apps, we can build a sense of usage frequency, that should look like the following:

If your app is glitch-free with a meticulously crafted onboarding and offers value, acquiring and retaining customers is usually easy. However, that is not always the case.

If your app is glitch-free with a meticulously crafted onboarding and offers value, acquiring and retaining customers is usually easy. However, that is not always the case.

Crypto app entrepreneurs frequently face challenges in driving adoption, building habit loops, and driving a high LTV for customers, which brings us to the major challenges for crypto in the Southeast Asia region and the Philippines in particular.

Challenges Faced by Cryptocurrency Businesses and Solutions

Business leaders from the South East Asia region are coming up with creative ways to drive adoption for cryptocurrency and hence crypto apps as well. However, Cryptocurrency businesses in the Philippines face multiple challenges, most of which stems from the nascency of the market right now.

To Provide Thorough Onboarding

In a nascent market like the Philippines, a great onboarding experience is a prerequisite to getting the customer enthused about your crypto app and its possibilities. A majority of crypto businesses in the Philippines and Southeast Asia such as Tokocrypto are taking onboarding seriously and relying on engagement metrics to do it right.

Solution. A great onboarding experience is all about showcasing and nudging the crypto app customers towards the features that comprise your value spectrum. It is important to ascertain and analyze meaningful onboarding pathways to learn about feature adoption and detect customer inactivity as soon as possible. Crypto apps must get this right if they want to play a long game in the Philippines or anywhere in the world.

Churn

Dormant customers are not good, but uninstalls are far worse. It is much cheaper to reactivate a dormant customer than to reacquire them.

Solution. Offering incentives within the app is also a popular way to lure customers into transacting and developing a habit loop. Customers can be nudged to transact, stack up loyalty points and and perform other behaviors. Since cryptocurrency apps in the Philippines and SEA offer opportunities to create multiple loops, rewards to establish these behaviors can be accomplished by Push Amplification.

Low App Stickiness

It is well-established that apps that make customers stick are preferred over apps that drive high acquisition but fail to generate stickiness and retention. Like any app-based business, crypto apps also face an upward challenge retaining customers.

It is for this reason that a lot of crypto startups from South East Asia are solving long-standing systemic challenges through crypto apps similar to Tokocrypto or Coins.ph. Not only are they driving acquisition by this strategy but also making sure that the app has enough stickiness.

Solution. Experts believe that stickiness for cryptocurrency apps can be achieved with the right set of strategies and insights that help you go deep into the drop-off moments, moment of dormancy and churn. Since a majority of crypto apps in the Philippines and the South East Asia region are offering multiple value-based features, it becomes important to monitor customer behavior over a period of time. And what better than cohort charts to unearth these insights.

Cohort chart allows you to analyze customers with respect to multiple shared characteristics such as acquisition date, channel, marketing campaigns and others. Cohort charts show the stickiness of customers for these characteristics over days and weeks.

A sharp decline in the number of customers is then correlated to these characteristics which is then followed by improvements in the campaign or app features.

Conclusion

The Philippines has successfully kick-started the cryptocurrency movement in the country. With clear guidelines and directives laid out, crypto app entrepreneurs can be sure to go forward with their vision to build their app and make it a success by tapping into the right insights to engage and retain customers.

Further Reading

- Discover the trends for mobile finance apps as well as predictions for the future along with actionable strategies

- Learn how Banks and Fintech can send personalized financial recommendations to each user

- Discover how Banks and Fintech can effectively approach omnichannel customer engagement