🔥 The Customer Engagement Book: Adapt or Die is live!

Download Now

MOENGAGE FOR FINANCIAL SERVICES

MoEngage is purpose-built to enable finance brands to rapidly adapt to evolving customer expectations. Say goodbye to dependencies and overheads associated with redundant legacy technology platforms. Revolutionize your brand’s presence in the digital-first world with our agile, security-first solution built for the Financial Service industry.

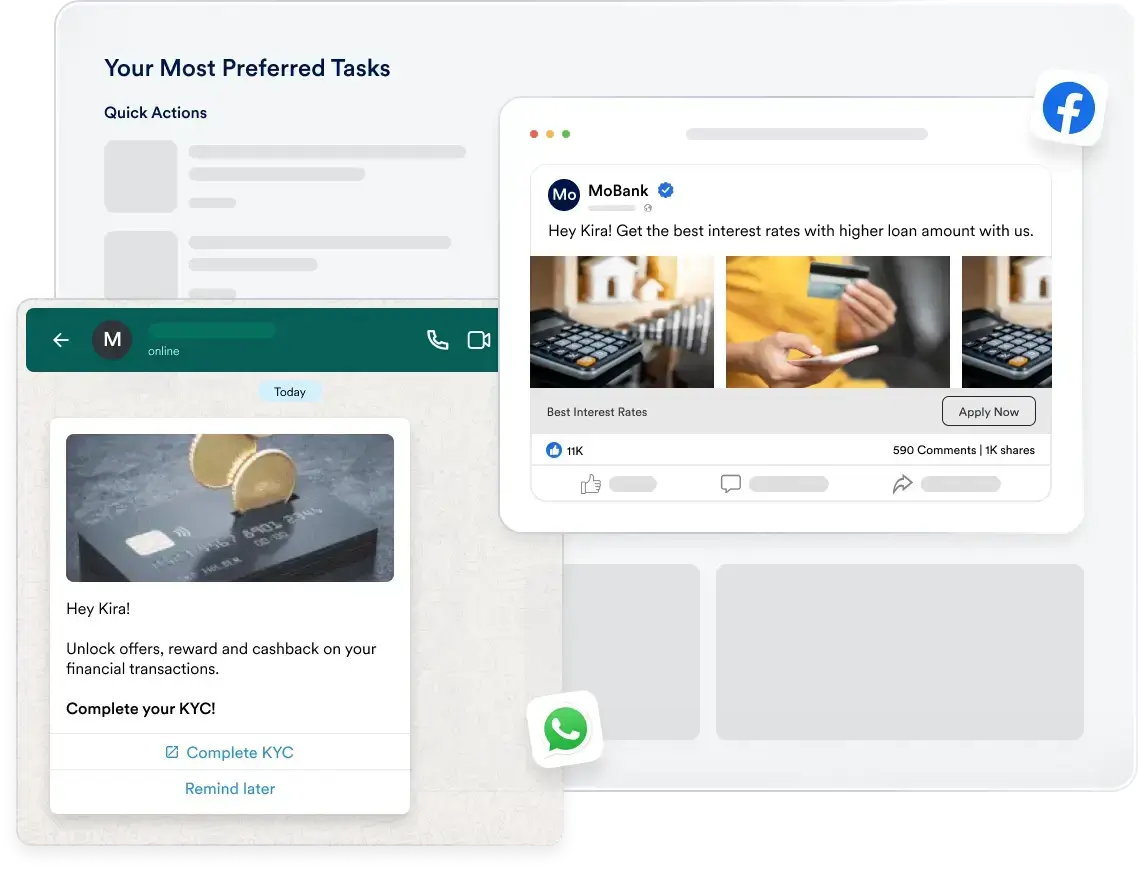

Meet your offline customers across digital touch points with curated digital experiences and drive digital adoption.

Increase your mobile app's active customer base. Simplify onboarding, reduce KYC drop-offs, and increase transaction frequency with contextual nudges, personalized offers, and reminders.

Send timely renewal alerts and new product recommendations – save agent/call center costs and boost upsells and cross-sells.

Improve the stickiness of your digital broking platforms through contextual communication, timely updates, and relevant financial education.

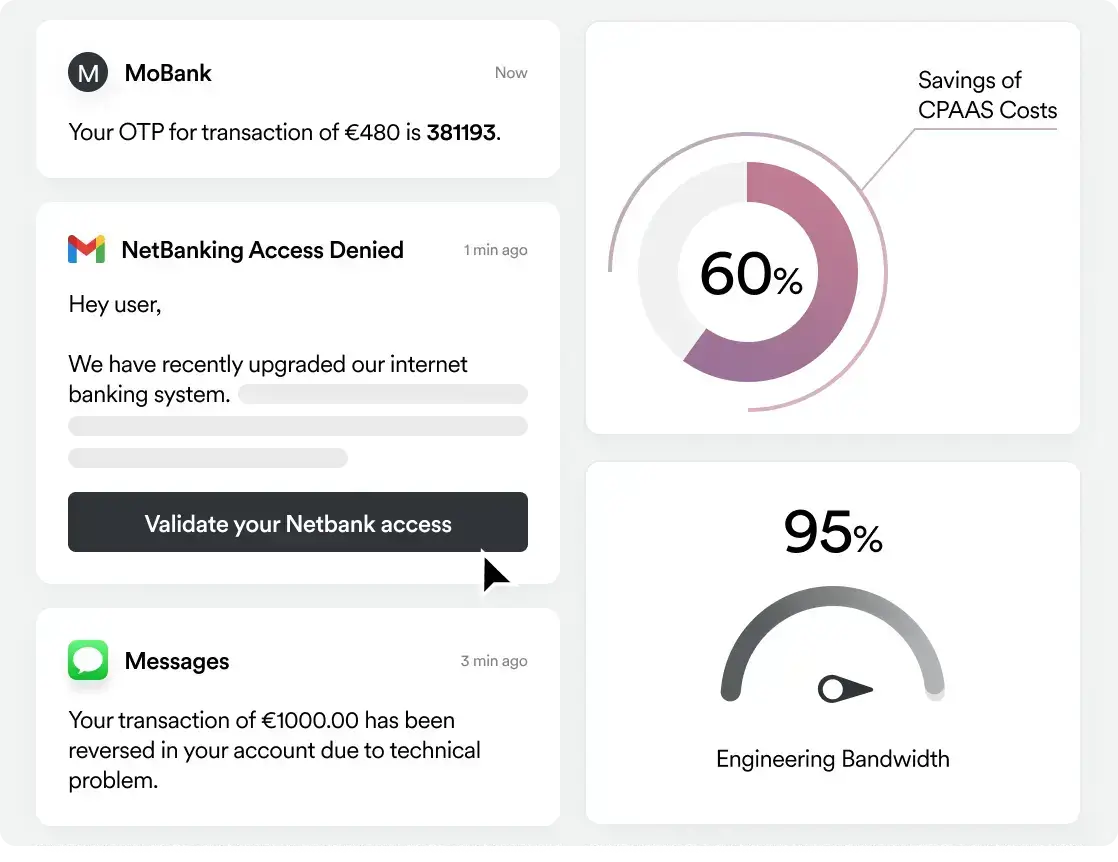

Make Service Messaging Reliable With MoEngage Inform

A Single, Unified Platform

Seamless, Secure Data Ingestion With Industry-first Features

Defend Your Data With Secure Data Storage and Access Management

Create In-the-moment Experiences, Easily

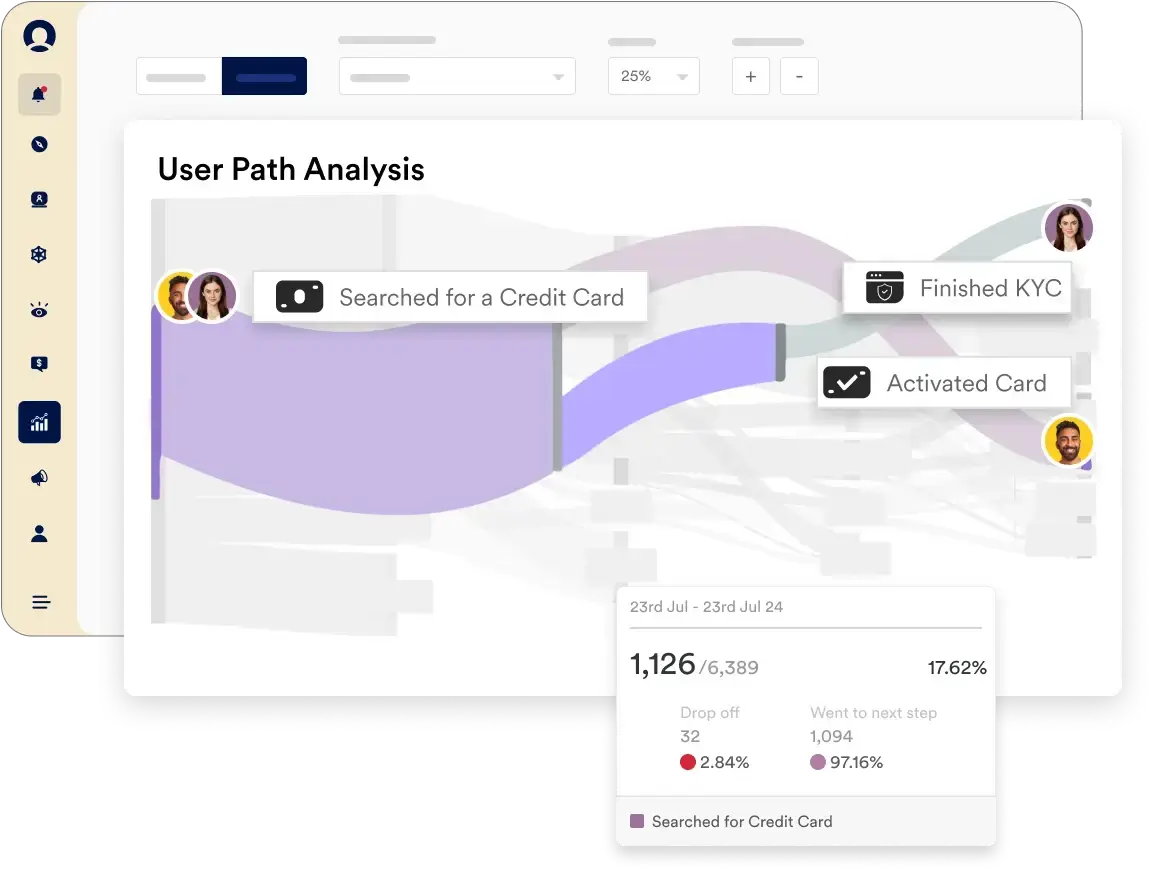

AI Powered Actionable Insights

Make Service Messaging Reliable With MoEngage Inform

Use one API to create and send your service messages across different channels. Ensure critical alerts are delivered without failure.

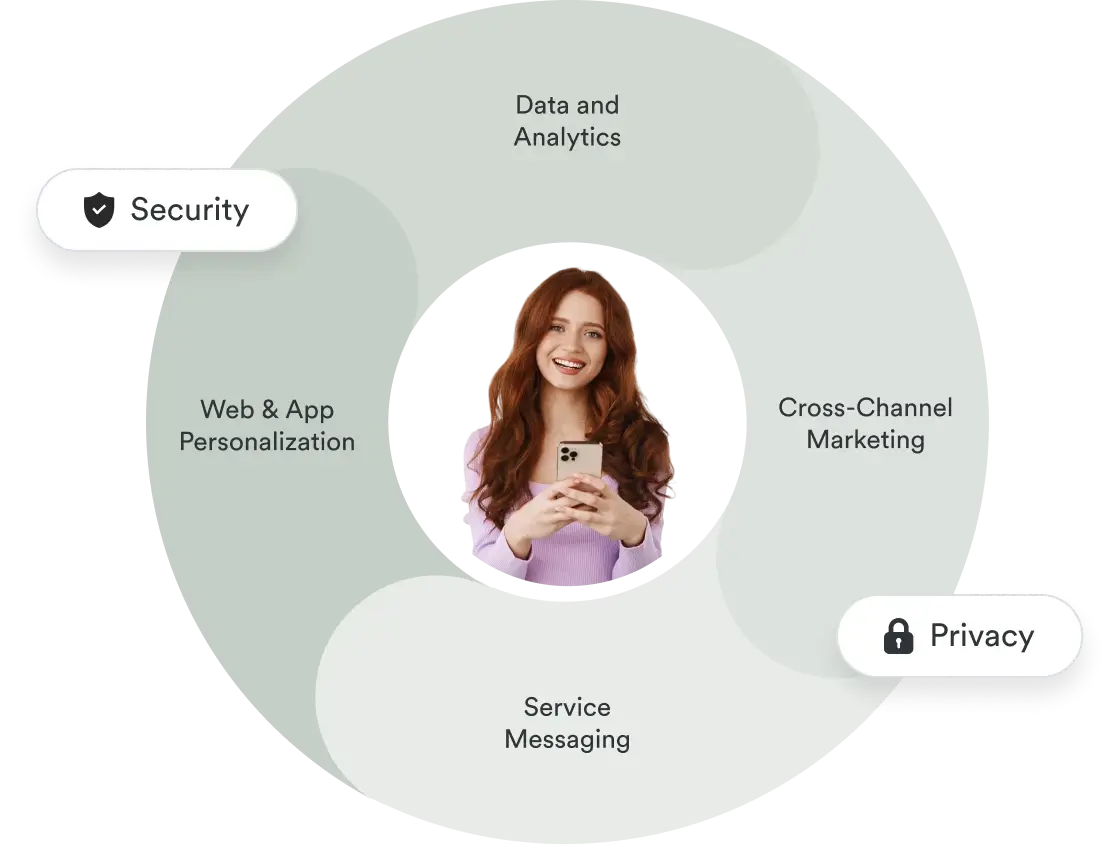

A Single, Unified Platform

Unify and analyze data, automate personalized campaigns on mobile apps and websites, and send service messages – all using a single platform.

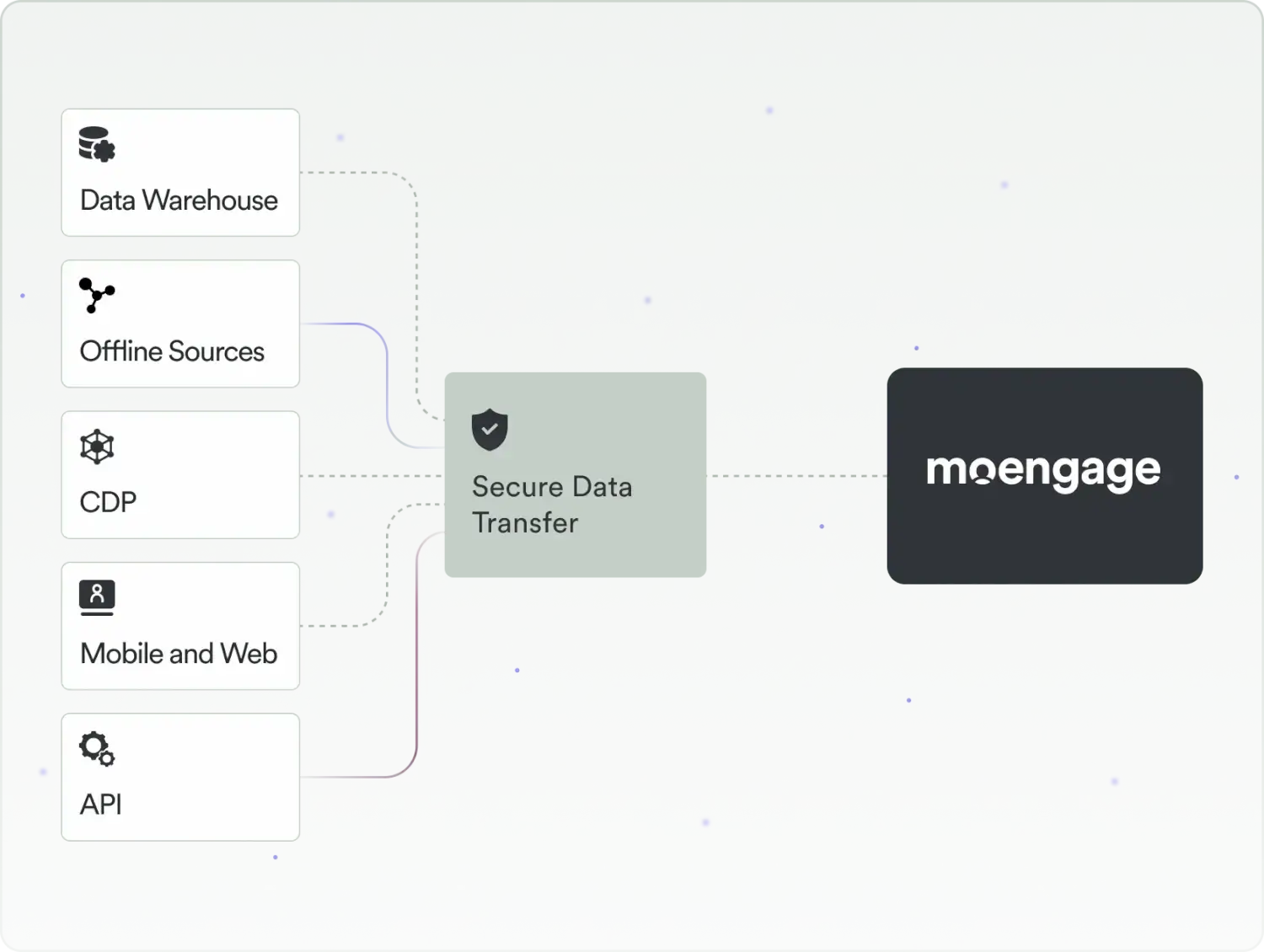

Seamless, Secure Data Ingestion With Industry-first Features

Seamlessly activate data from data warehouses & data lakes, with secure data ingestion through SDKs, APIs, and SFTP file encryption.

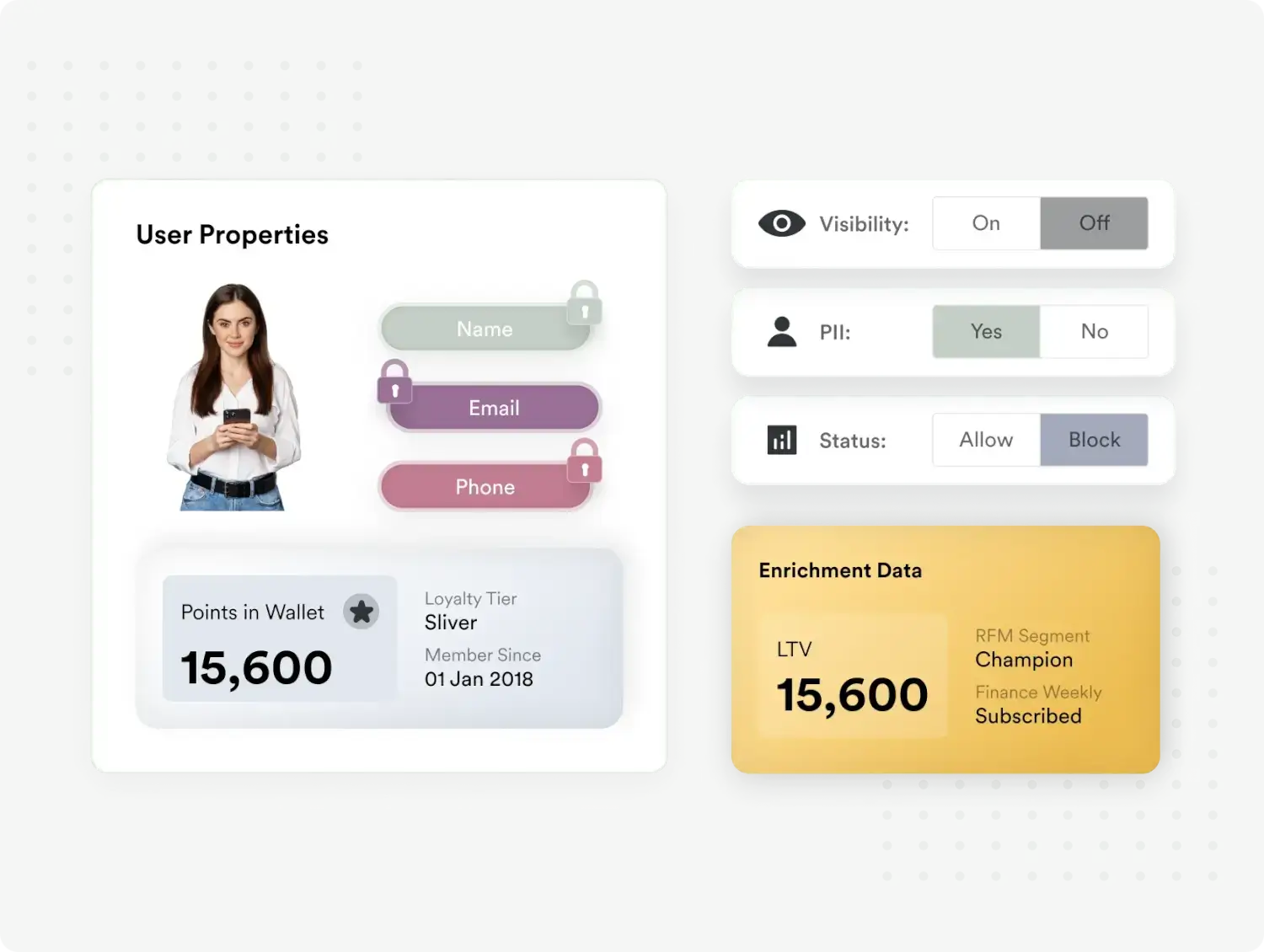

Defend Your Data With Secure Data Storage and Access Management

Secure customer PII with encryption and masking. Encrypt and secure SDKs on end-users’ devices. Control access with two-factor authentication, IP whitelisting, and identity management. And your data stays in local data centers!

Create In-the-moment Experiences, Easily

Sherpa, our Predictive AI, and Merlin, our Generative AI lets you optimize cross-channel marketing campaigns by identifying your customers’ preferred channel, best time to engage, and even the message that’s most likely to resonate with them.

AI Powered Actionable Insights

Get proactive insights about your customer’s behavior, preferences, journey, and friction points. And let AI dynamically group your customers based on real-time analysis of their behavior, history, likes, affinities, and other attributes.

MoEngage is an insights-led platform trusted by 1,350+ global brands like McAfee, Flipkart, Domino’s, Nestle, Deutsche Telekom, and more. MoEngage’s powerful analytics, personalization, and AI capabilities give a 360-degree view of your customers and help you create journeys across digital channels.

© Copyright 2025 MoEngage. All Rights Reserved.

Please wait while you are redirected to the right page...