Transactional Messaging 101: Deliver Clear, Concise, and Effective Communications

Reading Time: 7 minutes

Transactional messages are the most crucial channel of communication a brand has with its customers. These messages deliver valuable information customers look forward to. Just think of the number of times you come across transactional messages and notifications on a regular day.

In the morning, you might get a message from an E-commerce platform about the status of an order. Later in the day, if you step out for lunch and make a payment, you’d get a message from your bank. In the evening, if you place an order for tea, you’ll get notifications from the delivery platform. And at the end of the day, you might get a message from your service provider about your data consumption.

Transactional alerts are irreplaceable and evergreen. They give brands a great opportunity to build strong relationships with customers. In this article, we take a look at everything Transactional Messaging: what they are, why they’re important, and best practices for successful transactional communication.

What is Transactional Messaging?

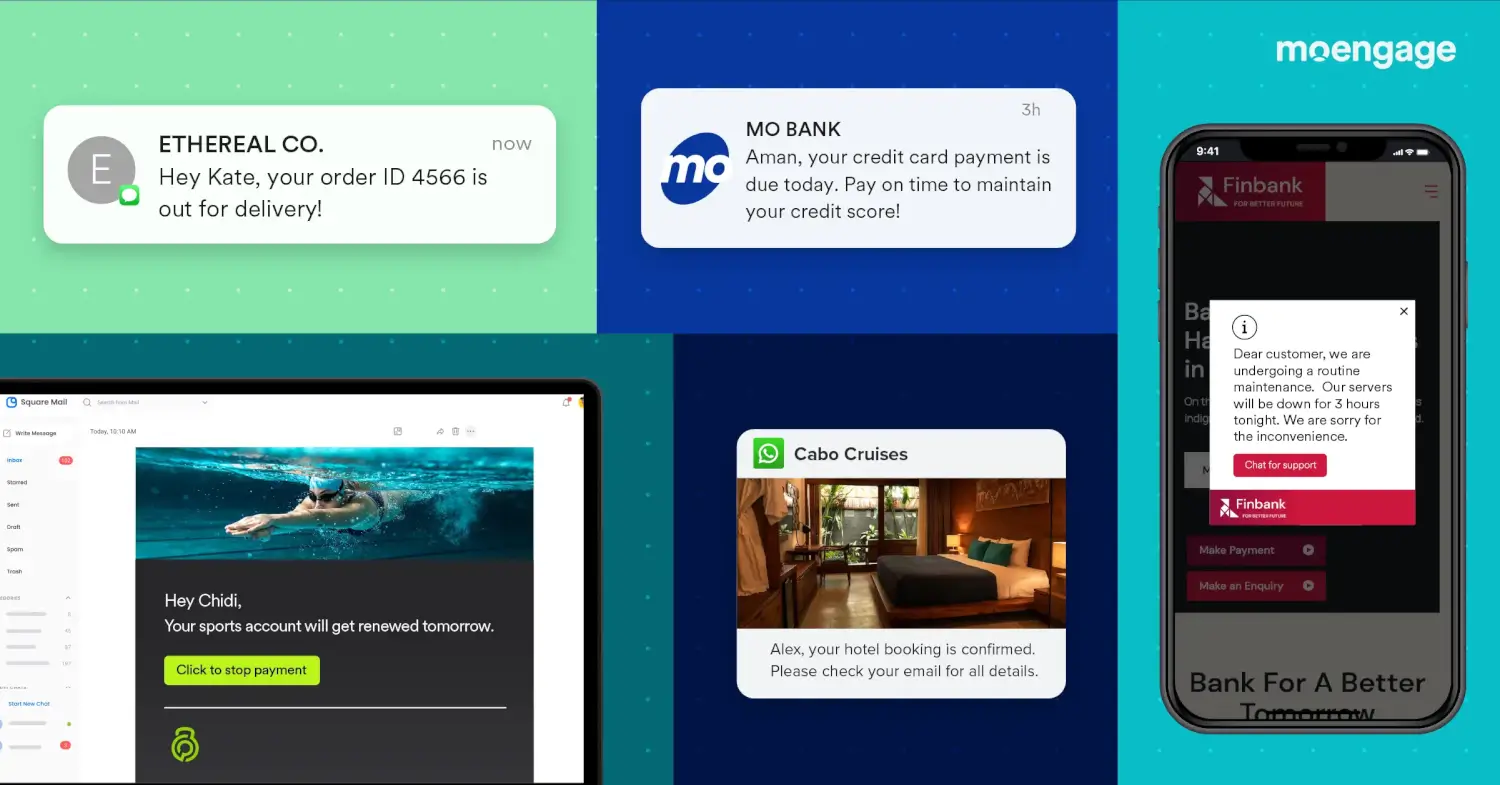

Transactional messages include emails, text messages, push notifications, in-app and on-site messages triggered in real-time when consumers perform specific transactional actions like purchases, password resets, or account changes. A great transactional messaging experience can go a long way toward improving customer satisfaction and increasing Net Promoter Score (NPS).

In this blog, we look at why transactional alerts are essential, seven strategies for sending killer transactional messages, and other best practices that can lead to better customer engagement.

Why Transactional Messaging is Important

Transactional messages are crucial because they provide a channel to convey important updates and alerts in real-time. They help the customer stay updated at every step of the journey, and this improves the overall experience. There are some other reasons why transactional messages are crucial, such as the ones listed below.

Send Critical Information

A transactional message often contains information that is critical and time-sensitive. For example, most online platforms today, especially in banking and finance, work on an OTP-based login. Sending these messages safely and on time affects customers’ perception of the brand’s security practices.

Other transactional messages, like those sent for password resets and order tracking, contain sensitive information. For these to be delivered safely, your IT infrastructure and security setup has to be top-notch.

Build Trust

Nobel Laureate and Economist Richard Thaler coined an interesting theory called the Endowment Effect. It is about a cognitive bias where humans place more value on items they own over those they do not.

The constant need to check the status of a purchase multiple times, from the moment it is confirmed to when it is delivered, can be explained by this theory. Providing customers with frequent updates about the status of their orders gives them the psychological satisfaction they seek. With every completed delivery, their trust is bound to increase.

The same goes true for banking brands as well. A daily update on the account balance or a timely transaction alert helps customers stay in touch with their financial security and increases trust in your brand.

Improve Engagement

A comprehensive omnichannel transactional messaging strategy helps increase customer engagement. We can attribute this to two reasons. First, customers look forward to receiving transactional messages. Second, transactional messages contain critical information.

That said, it doesn’t mean that transactional messages automatically guarantee high engagement. You must send contextually relevant messages at the right time to incentivize customers to engage with you.

Gather Insights

Some transactional messages provide a link for customers to leave their feedback. The link can be in any form, such as feedback about the delivery, comments about the transaction, support resolution, or the subscription renewal process.

Marketers can use these transactional messages to understand a customer’s perception of their brand. Such feedback helps marketers understand what’s working and what isn’t, how customers navigate the customer journey, and what needs improvements.

7 Powerful Tips for Transactional Messaging

Let’s look at some tips and best practices to help marketers develop a transactional message strategy to help increase engagement and retention.

1. Keep it Clear and Concise

Transactional messages are usually sent on a ‘need to know’ basis. Brands should keep it this way to ensure customers don’t get spammed. Open rates for these messages are high because they carry essential information, and consumers would not like irrelevant details sent along with these messages.

Every brand has a different view on what they consider ‘transactional.’ As a marketer, making this distinction early is the key to a good strategy. Study the lifecycle of the average customer and define points along the journey where they would expect a transactional alert. You can also enable an option for customers to unsubscribe from updates they do not require.

2. Speed is Key

In today’s market, customers are used to receiving transactional messages within seconds, and a delay of even a few seconds can impact the overall customer experience. Especially with OTPs, order confirmations, and password reset messages, speed is essential.

Consequently, the choice of a robust transactional messaging platform is crucial. Apart from sending messages, such messaging platforms give real-time delivery reports and metrics about their performance. This helps marketers study the effectiveness of the campaigns and make changes if needed.

3. Focus on The Customer

Transactional messages aim to give customers the information they require and deliver a positive experience. It is not much of an avenue to promote your brand. That is just an added advantage. So, while forming a strategy for transactional communications, the average consumer’s expectation has to be kept in mind.

Personalized transactional messages are an excellent way to capture the customers’ attention. For example, send them a well-drafted welcome message with personalized recommendations as a show of effort from your brand’s side. This also tells them you care about their needs and are willing to create better, more customized experiences.

4. Add an NPS Survey

The biggest challenge brands face while calculating their NPS score is the inability to collect customer data. NPS surveys sent with promotional messages see low response or engagement rates.

Transactional SMS alerts solve this problem. Once you’ve sent transactional messages about banking, travel booking, or shipping updates, you can close the conversation with a quick message asking for their feedback. You get an opportunity to understand how customers felt about each step of the process, the likelihood of them referring other customers, and any feedback they might have.

NPS surveys sent along with transactional alerts see a high response rate. These surveys help brands accurately calculate their NPS score. But choosing the right messages to send the NPS survey is vital.

Your brand must not come across as opportunistic or insensitive to customer needs. It could be counterproductive to send NPS surveys with time-sensitive messages like OTPs and password resets.

5. Go Beyond Open Rates

Transactional messages have higher open rates than promotional ones, but this shouldn’t be your North Star Metric. It’s more important to keep your customers informed so they can focus on continuing their customer journey.

Sometimes, customers see transactional alerts on the home screen and swipe them away. Not all of them open every single message, especially if the software can read and type out OTPs without them having to do so.

Some customers also open transactional messages hours or days after the time you send them. For instance, a bank might send an email every time a consumer makes a transaction, but it’s unlikely that customers will check these messages immediately. They’d probably go through these messages only while keeping accounts of their expenses or needing payment confirmation.

This means that open rates might be low for certain types of transactional messages. Don’t let this discourage you.

Focus instead on how many customers move on to the next step after OTP confirmation. Look at the overall customer journey to understand how valuable these transactional alerts are.

6. Cover The WWWWH

Figure out the who, what, when, where, and how of every transactional messaging campaign. Who is the audience? Why do they need this message? What information should this message contain? Are they more likely to check it over their phone, in which case you can explore SMS, push notifications, or laptop, for which emails might be better?

Understand your audience and their requirements before you outline your transactional messaging strategy. Once you’ve taken care of these aspects, the chances of keeping customers engaged shoot up.

Customers might only pay a few seconds of attention (or even lesser) to your transactional messages. In these few microseconds, they don’t want to see irrelevant messages sent over the wrong time or medium.

7. Don’t Forget The Basics: Mobile Optimization

A survey found that over 70% of consumers prefer being sent transactional alerts on their mobile phones. This is why it’s crucial to optimize every transactional alert for mobile. You need to ensure that the form of your message, the content, strategy, and design, are all presented well over a mobile device.

A suitable transactional messaging platform can work wonders here. The platform should allow you to view how each message appears over mobile devices and provide different templates that work well over mobile.

Wrapping Up

Transactional messages are crucial aspects of a brand’s communication strategy. In this blog, we’ve covered seven ways to improve your transactional messaging setup, which are:

- Keep it clear and concise

- Speedy delivery is crucial

- Focus on the customer

- Gather feedback via timely surveys

- Focus on the customer journey, not just open rates

- Understand your customer

- Always optimize for mobile

The best practices we’ve listed will help you create better transactional messaging experiences for every customer.

If you’re looking for a reliable transactional messaging platform, check out MoEngage Inform! Inform is a no-code, single-API transactional messaging solution which enables all teams to create, edit, and publish transactional messages easily. Product and marketing teams don’t have to rely on tech teams every time they need to edit a transactional message or add a new channel. At the same time, tech teams can see their engineering bandwidth freed up significantly as all teams are empowered to take control of transactional messaging. It’s a simple plug-and-play solution.