Marketing in a Recession: How Can Online Ecommerce and Shopping Brands Navigate During Crisis

Reading Time: 9 minutes

Bonus Content

|

The COVID-19 pandemic has caused the next big economic recession since the Great Recession in 2009. For most online shopping brands, this is the first-ever recession they’re facing. Estimates suggest that ad spend will likely reduce by 30-60% throughout 2020 and possibly beyond. HBR, in a study, found that companies that cut marketing costs faster and deeper than their rivals have the lowest probability (21%) of pulling ahead of the competition once times improve!

During these times, it is important to know how consumer behavior has shifted, what impact it has had on metrics – particularly new users and user activity, how online shopping brands and marketers are responding to this change, and what channels can businesses leverage during these times. To help Online Shopping brands with this, Ravi, the CEO and founder of MoEngage, recently spoke to Ronen, the President and Managing Director of APAC at Appsflyer on a webinar. You can check it out below:

Lessons from past recessions

A major difference between the Coronavirus Recession and the Great Recession is, that, unlike last time, the impact of this recession is going to be more or less evenly distributed across geographies. Instead, the degree of impact will vary more by industry.

A recession, however, is no reason to halt your marketing and advertising efforts. In fact, if you look at historic recessions, the brands that came out stronger, were those that saw a long period of success after:

- During the 2000 recession, Target reduced its operating costs and narrowed its distribution margins, all while increasing its marketing and sales budget by 20%. Not only did Target bounce back from the recession practically unscathed, but the brand also went on to experience a stellar decade after (Source).

- Amazon sales grew by 28% during the Great Recession. The tech company continued to innovate with new products during the slumping economy– most notably with new Kindle products which helped to grow market share. In fact, on Christmas Day 2009, Amazon customers bought more e-books than printed books. As a result, Amazon established itself as an innovative company by introducing a lower-cost alternative to cash-strapped consumers (Source).

- In the 1990-91 recession, McDonald’s dropped its advertising and promotion budget. Pizza Hut and Taco Bell capitalized on this opportunity. By not deciding to slash their marketing budgets, Pizza Hut increased sales by 61% and Taco Bell sales grew by 40%, while McDonald’s sales declined by 28% (Source).

- During 2009, when most companies were holding tight to ride out the recession storm, Lego’s profits soared. After an interview where British soccer star David Beckham mentioned that he was building a Lego Taj Mahal during his downtime, sales soared by 663% – proof that sometimes celebrity endorsement is the best profit boost of all (Source).

- In the 1920s, Post was leading the breakfast cereal market. They significantly cut ad spend during the Great Depression while Kellogg’s doubled their advertising budget, and introduced a new product – Rice Krispies. This led to increased profits by 30%! Kellogg’s went on to own the breakfast cereal category for the coming decades (Source).

What is the impact of the Coronavirus Recession on online shopping, and how has consumer behavior changed?

Undeniably, the biggest shift in direct-to-consumer e-commerce has been witnessed in Southeast Asia. Consumers have moved away from an ‘on-the-go lifestyle’ to more ‘safe in-home consumption’. While brands might see a slight dip in online shoppers, this shift from offline to online is predicted to continue for the coming months, with downloads and DAU numbers to average well above the pre-COVID times.

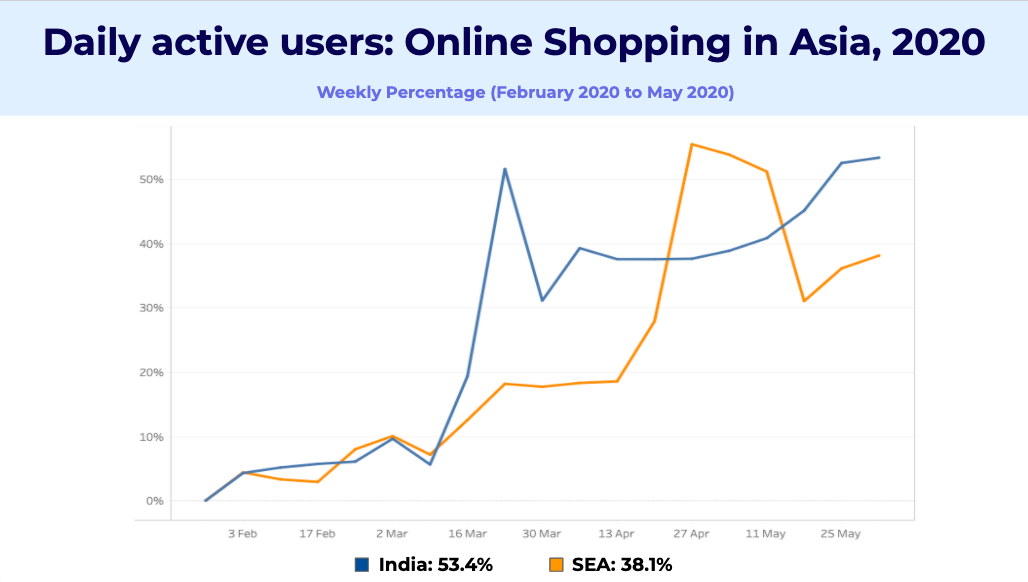

Daily Active Users (DAU) for Online Shopping apps in Asia

There is a mass migration from offline shopping to online, especially to mobile apps, where the download numbers increased by about 122% in April. Customers who are already accustomed to purchasing online will increase their online spending even further while those who have traditionally spent little to nothing online, will be forced to increase or start.

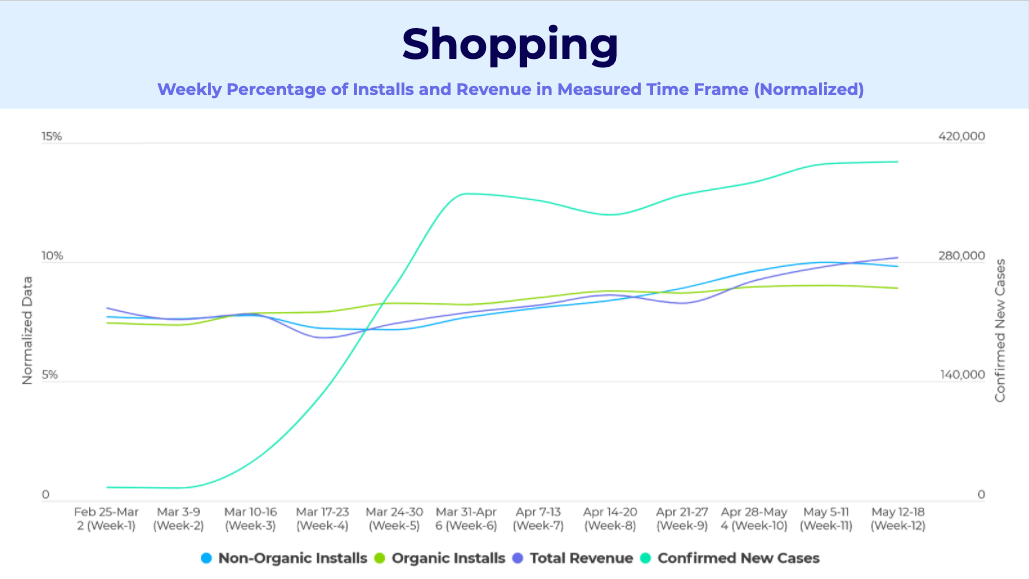

App install channels and trends for Online Shopping apps in Asia

Verticals within online shopping that have seen an increase in demand are gloves, medicines, food supplements, grains, and rice, packaged foods, milk and fresh produce, dishwashing supplies. Here is an infographic of verticals within online shopping that have seen an increase in demand. Grocery has seen the biggest growth. Since the beginning of March, the daily activity for grocery shopping has risen by about 54%. This is followed by essential services like medicines and sanitization products. Social distancing has converted all of us into better cooks and since ordering food has taken the backseat, home cooking supplements and prepared meals/kits have increased in demand. In fact, according to a recent survey by Neilsen, 89% of consumers in Mainland China said that they will be more willing to buy daily necessities and fresh products online once the pandemic is over.

Governments have clearly differentiated essential services like vitamins, personal care, and fresh meat and vegetables from non-essential services like clothes, luxury items, and beauty products. But even as restrictions ease, people are going to be hesitant to shop physically, and are going to continue shopping for non-essentials online.

New buying patterns and shopping behavior

The COVID-19 pandemic has led to an increase in new customer buying patterns. Shopping brands are now upgrading their marketing strategies in order to support retail, e-commerce, buy online pickup in-store (BOPIS), and home delivery. Long term goals for retail brands should be:

- Continue fulfilling normal store replenishment for in-store purchases and BOPIS

- Support a significant increase in e-commerce orders as buying behavior further adapts

- Allow customers free and easy return options

How are brands coping with these changes?

As businesses focus on navigating this crisis, technology will continue to play a critical role in these changing consumer dynamics. Accelerating technology adoption will be a powerful catalyst for brands that want to survive.

E-commerce in Southeast Asia is projected to grow explosively and exceed US$100B by 2025 – and a significant role in this will be played by merchants who will spend efforts building online direct-to-consumer businesses. It is paramount for retailers to understand the unique consumer needs and priorities of different groups – what segment of users are regularly shopping and their frequency, which product category is in high demand and what isn’t, what combinations of products are shoppers purchasing the most, and so on. The dependence on machine learning will not only increase but we will see a lot more brands invest in platforms that provide intelligence and insights like these. Understanding what products are most important to consumers across different categories will not only drive loyalty but allow brands to identify the attributes that consumers are willing to pay a premium for.

MoEngage’s intelligent cloud platform allows online shopping brands to identify and understand user behavior through a simple integration.

You can request a demo of MoEngage here.

A) Frictionless commerce led by technology

Every step between a customer and purchase is “friction,” and product marketers are constantly working on reducing this friction to increase more purchases. This is being done by eliminating as many redundant steps as possible. E-commerce has a natural advantage on price and selection over traditional stores, but due to COVID-19, the convenience factor for e-commerce seems to be on the rise. In North America, Best Buy generated 81% of last year’s sales without a single customer entering their stores (source)! They’ve been able to weather this pandemic well precisely because of their recent investments in frictionless commerce—which enabled their quick pivot to curbside pickup, which then enabled them to continue selling all of the different kinds of consumer electronics people need right now.

Examples of frictionless shopping experiences

- Streamlined digital transactions. In other words, honing and slimming down the online shopping processes you know already, especially the ones closest to checkout. Eliminate those redundant steps!

- Click-and-collect pickup. Your customers drive to the store, but only to collect their purchases, not to browse and pick from the in-store collection.

- Cashierless checkout. Also known as the U-Scan self-checkout machine, here you don’t have to stand face-to-face with a cashier who’s stood face-to-face with other people.

Brands have also started diversifying to other essential segments, either through partnerships or on their own, to engage and delight their users. A few retail brands have already procured material and have started producing PPE, handwashes, and sanitizers. In March alone, there were a whopping 152 new sanitizer producers that entered the market, contributing to 46% of category sales in that month!

B) Traditional retail brands are increasing their digital presence

Consumers appreciate businesses with their own e-commerce platforms. Proprietary e-commerce platforms with strong, stable supply chains have a clear advantage over dealer merchant platforms that rely on external logistics. This has inspired businesses to pivot to online services (mobile apps) and platform partnerships:

- Future Group, which serviced online orders for groceries only from its Easy Day stores in Delhi NCR, has extended that capability to include 250 Big Bazaar stores across India. While Future Group has its own delivery fleet, the retailer is also working with hyperlocal delivery app Dunzo and logistics player Shadowfax to pick up and deliver orders to homes.

- Spencer’s Retail, another player in India, has partnered with food delivery platform Swiggy, cab-hailing app Uber, and bike taxi startup Rapido to deliver orders placed by customers on its website. The brand, in fact, partnered with Walmart-owned Flipkart, making its inventory visible to shoppers on Flipkart in order to service a larger number of out-of-store orders.

- German wholesaler Metro Cash and Carry India also launched its mobile shopping app early April. Initially, it had planned to pilot the app in one city only, but the Covid-19 pandemic prompted it to roll out the facility nationwide.

- Walmart’s Best Price wholesale store chain revamped its app last month and has also enhanced delivery services to cater to the big jump in delivery orders during the lockdown period.

What messaging and narrative are brands using to drive engagement?

A survey of more than 35,000 consumers globally by Kantar found that only 8% of customers thought brands should stop advertising during the coronavirus outbreak. However, 78% of consumers believe brands should help them in their daily lives, while 75% stated that brands should inform people of what they’re doing and 74% preferred companies to not exploit the situation.

Early 2020 campaigns were quickly outdated and became irrelevant to the situation, leading to brands struggling with communication. The longer brands remain dark, the more users they lost to those who actively communicated. For many consumers, a lack of communication translated to a lack of care for what they have faced. Here is a campaign run by Blibli, an e-commerce unicorn in Indonesia, which has been very vocal during this time.

Blibli ran an awareness campaign during the Coronavirus recession

Empathy, trust, authenticity

These are the common winning traits we’ve seen in those retail brands that have remained functioning during these times.

1. Empathy: It is vital to remain relevant to consumers’ emerging needs. You don’t have to remind your users that they’re in a pandemic – everyone knows that – instead focus on their needs. A good way to start is by observing what product categories your users are interacting with the most – essentials, fresh produce, home cooking supplements, personal hygiene, etc. Then centralize your communication around these categories – for example, you could start sending push notifications about the ready-to-cook meals and two-minute products (popcorn, noodles, soup, etc) on your store. Another example would be showing an advertisement on social media about ingredients for healthy food and fresh produce.

2. Trust: Consumer trust is more valuable than ever in these times and brands can leverage content here to win back user confidence.

- By showing photographs and videos of the packaging processes and warehouses, brands can reassure consumers that they’re taking the right steps to maintain hygiene and safety.

- Highlighting what brands are doing for their employees will play a big role in winning back faith from consumers – showcase the videos and photographs of PPE provided to employees, the training sessions conducted for them, etc

- Interactive infographics can be used to highlight what sanitization steps brands are at every step of the supply chain – from storage to transportation.

3. Authenticity: The last thing consumers want right now is a brand making false promises. If there are changes to your policies – for example, a guaranteed 24-hour delivery, make sure your users are made aware of it and it is communicated clearly. Similarly, if there are certain products that are out of stock (OOS) – which is the biggest challenge faced by most brands in this recession – make sure those products are marked accurately. This is the best way to repair broken relationships while strengthening new ones.

Conclusion and key takeaways

- Consumers have moved away from an ‘on-the-go lifestyle’ to more safe in-home consumption. This is reflected by an increase in both new users and daily active users, and this trend is predicted to continue.

- The COVID-19 pandemic has led to an increase in new customer buying patterns, especially an increase in the buy-online-pickup-in-store (BOPIS) option

- Traditional retail brands are increasing their digital presence and brand affinity by launching websites and mobile apps, or through partnerships

- Empathy, trust, and authenticity in communication are the common winning traits in the retail brands that have remained functioning during these times

Next steps

This is a three-part series of how brands can continue marketing during a recession. Check out the other two parts about finance and banking, and OTT media below to know more.

- How Fintech and Online Banking Brands Can Survive During a Crisis

- OTT Platform Marketing in a Pandemic: How Can These Brands Keep Winning?

MoEngage’s intelligent cloud platform allows online shopping brands to identify and understand user behavior through a quick and simple integration. You can request a demo of MoEngage here

| Here’s What You Can Read Next |