Marketing in a Recession: How Fintech and Online Banking Brands Can Survive During a Crisis

Reading Time: 7 minutes

Bonus Content

|

The Coronavirus Recession could be the next big challenge to financial institutions since the late 2000s. For most fintech brands, this is the first-ever recession they’re facing.

Although traditional banks have been in a similar situation before, the Coronavirus Recession is quite different from the Great Recession. This time the economic impact is felt across multiple business verticals. Estimates suggest that advertising spend will likely reduce by 30-60% throughout 2020 and possibly beyond.

During these times, it is important to know how consumer behavior has shifted, what impact it has had on metrics – particularly new users and user activity, how fintech apps and marketers are responding to this change, and what channels can businesses leverage during these times. To help online banks and digital finance brands with this, Ravi, the CEO and founder of MoEngage, recently spoke to Ronen, the President and Managing Director of APAC at Appsflyer on a webinar. You can check it out below:

In this discussion, Ravi and Ronen answer the following questions:

- What is the impact of the Coronavirus Recession on fintech apps, and how has consumer behavior changed?

- How are brands coping with these changes?

- What messaging and narrative are brands using to drive engagement?

What is the impact of the Coronavirus Recession on fintech apps, and how has consumer behavior changed?

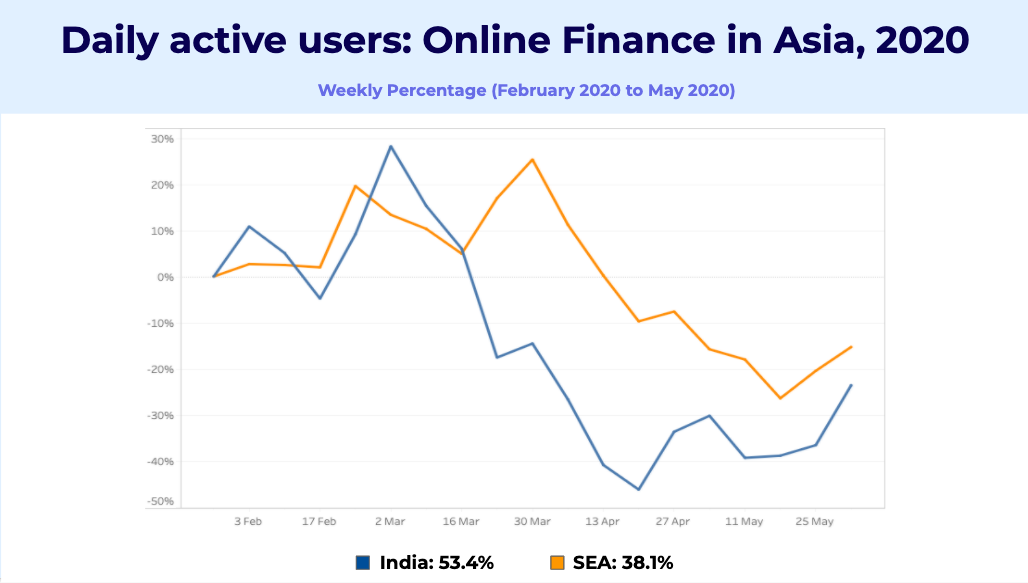

Daily Active Users (DAU) for Online Finance apps in Asia

Overall, the downloads and active users for BFSI apps seem to be decreasing in Asia from February 2020 till April 2020. However, online banking apps have started bouncing back since May 2020, and it seems the trend in increased users and activity is here to stay for long. Here are some quick learnings:

- Approximately one-third of retail banking customers plan to increase their use of online and mobile banking services post COVID-19, which is expected to increase as the duration of the crisis extends longer

- Younger consumers will be more likely to increase their digital banking use, mostly through mobile apps and websites

- Online banking consumers who have not used mobile banking are more likely to start using mobile services

- 35% of consumers stated that they had increased the use of online banking (laptop or PC) since the COVID-19 crisis, and 30% of consumers have increased their use of mobile banking

A shift from traditional banking to digital banking

This recession has reshaped consumers’ channel preferences, products, offerings, and bank choices for their individual financial needs. These behavioral changes have accelerated the shift from transaction-based needs toward more high-value operations like checking account status, managing payees, customer support, and seeking safety practices for online banking. On top of it all, customers are now expecting much more personalized offerings that cater to their individual needs.

During this time, users want banking to be about ease and convenience – enabling customers to remotely open new accounts, access existing accounts from any location, and perform transactions across multiple digital channels and devices.

During the early days of the spread, the World Health Organization (WHO) advised people to use contactless payment and avoid handling banknotes as much as possible. Following this, The Bank of Korea started quarantining bills originating from local banks, keeping them isolated for up to two weeks. Likewise, the Chinese government requested lenders to disinfect physical notes and place them in quarantine.

Some financial services and banks have closed their physical retail branches and now depend on contactless experiences, like online channels and ATMs, to serve their customers.

Banks and credit unions with a robust omnichannel strategy can now differentiate themselves as a partner of choice to merchants looking to set up business relationships virtually.

Neobanks will accelerate digital adoption

Even after the pandemic passes, digital banks will have long-term relevance. The growing popularity of neobanks and fintech apps (like peer-to-peer lending and broker apps) will play a key role in accelerating the digital adoption of banking.

Did you know that neobanks offer 42% more features in their mobile apps than traditional banks, and boast two times the login speed? Traditional banks that quickly learn from the lessons from digital financial institutions are more prepared to compete with both during the coronavirus pandemic and after it is over.

How are fintech brands coping with these changes?

People are increasingly expecting personalized offerings that cater to their individual needs, and fintech brands need to leverage data to fine-tune their communication to deliver on those expectations.

Leveraging customer segmentation data is necessary to predict and meet individual customer needs. For example, to identify which customers are better positioned to ride out the crisis and those who will need more active management and outreach. From here, brands may need to develop specific, well-defined solutions for the latter customer segment. While some brands with an online presence already have access to this data, those that do not need to step up and quickly adopt the right tools needed that can provide them this information. A good starting point is MoEngage’s intelligent cloud platform that can seamlessly integrate with your existing toolkit. If you’re interested, you can request a demo here.

Singapore’s DBS has taken the following measures to provide its business clients contact-free digital banking:

- The brand has moved 11 financing processes online to reduce the need for manual intervention

- The bank is also running webinars to train its staff on how to use digital tools

- They’ve built the option for SMEs to apply online for short-term loans to soften the blow of reduced sales and cash flow

Fixing broken digital experiences

The rise of digital leaders such as Amazon and Netflix has primed consumers to expect premium online interactions in all areas of their life – banking being a core part. According to McKinsey, customers who are highly satisfied with their digital experience are 2.5X more likely to open new accounts with their existing bank than those who are merely satisfied; they are also less sensitive to price and generate more positive word of mouth.

Unfortunately, there is an increase in consumer frustration on finance apps due to broken digital journeys. According to a recent Lightico survey, 56% of banking consumers report that they have been redirected from online banking interactions to physical locations – and 48% say they’ve been asked to print, sign, and email papers while banking online! These numbers are alarming because a broken experience adds up to the negative influence your brand is having on your consumers – and can be the key factor that drives them to switch brands.

Adopting technology

Finance brands need to ascertain what systems and technology will sync and fit well with their legacy systems – what they currently use or have the ability to upgrade. While developing such systems in-house is an option, banks will need a dedicated innovations-focused R&D team, which is not readily available. To add to this, building a solution in-house takes longer than integrating with an existing solution, and with the increasing number of brands embracing a digital presence, time is a luxury.

What messaging and narrative are brands using to drive engagement?

Brands are going to be judged in the future based on their response to the crisis today. The primary focus for online banks and fintech apps here should be to maintain brand loyalty.

PassTo, a fintech product by Blabla Connect, has won customer empathy by waiving off all transaction fees during the coronavirus outbreak for its users. Here is a screenshot of PassTo’s in-app message that conveys the same to its users:

PassTo’s notification about waiving off extra charges

How traditional banks respond to their customers is pivotal to how their brand is perceived for years to come, and as with other industries, content plays a key role here.

- Highlighting your offerings is one way to win consumer trust. Through communication on owned media (such as mobile app notifications, SMS, and emails) you need to educate consumers about features that resonate with their current situation. While a group of people would find tremendous value in a live chat option, they might not be impressed by the option to change their ATM pin online.

- Increase awareness about fraudulent signs and scamming attacks. In the first week of April, there were over 18 million monitored attempts of phishing and malware attacks using COVID-19 lures and since the end of February 2020, there has been a 667% increase in COVID-related phishing attacks. By talking about precautions and measures your customers should take, you’re winning their trust and increasing your brand value.

- Talk about your self-service options. Highly engaged digital consumers prefer to solve problems independently using the online platforms provided by their banks. They’d prefer not to use other channels to fix issues they can solve by themselves.

Email should be the go-to online touchpoint for fintech brands

The average open rate during COVID for financial institutes is 25.8%. Digital consumers today are receptive to a greater frequency of communication from their financial institution when it is delivered via email. Apart from transactional communication, emails can include awareness content such as articles and videos. Links to online FAQs around currency exchange rates, service fees, and sending time frames can be included in these emails as well – anything that adds value to your customer during these times.

Conclusion and key takeaways

- Although the downloads and active users for fintech and online banking apps decreased in the first half of 2020, these apps have started bouncing back.

- Neobanks and fintech apps (like peer-to-peer lending and broker apps) will play a key role in accelerating the digital adoption of banking.

- It has become even more necessary to leverage customer segmentation data to predict and meet every individual customer’s needs. Learn how MoEngage helps digital finance apps like yours here.

- During a crisis like The Coronavirus Recession, BFSI brands need to highlight digital offerings, increase awareness about fraudulent signs and scams, and emphasis on self-serve functionalities.