Customer Engagement for Banking in India: Payment, Lending, and Trading Sub-segment Growth

Reading Time: 10 minutes

As per the FIS PACE (Performance Against Customer Expectations) Pulse Survey, 2020, 68% of Indians are using online and (or) mobile banking to conduct their financial transactions and 51% said they’ll continue this mode. Retail Banking and Financial Services were already going digital but the pandemic has accelerated the pace of digital transformation and forced the industry to relook customer engagement for banking in India.

Just to set some context, apps in the banking and finance industry have noticed close to 1.3 billion downloads in quarter 2 of 2020 alone with finance apps being used over 1 trillion times on Android devices throughout 2019. Research conducted by Google further indicates that a smartphone user on average has close to 3 personal finance apps installed on their mobile devices with 4 in 10 using their devices for managing finance, checking account history, tracking investments, paying bills among other financial activities.

As we observed in our State of Mobile Finance Report 2021, the personal finance industry is currently going through an upward growth trajectory, spurred on by the pandemic. With an increase in adoption observed across the board, sub-segments like payment, banking, lending, investment, and wealth management are further driving growth.

The pandemic-induced economic uncertainty is one of the contributing factors behind this fascinating growth observed by the banking and finance vertical. As more and more users hunker down on their personal finance, prioritizing wealth generation and management, there is a conscientious effort to improve financial outcomes during an economically turbulent time.

As more and more users migrate to online modes of payment and transactions, banking, investing and trading, and applying for loans, banks and fintechs need to relook at their customer engagement strategies. In this article, we will look at how the various subsegments of the finance and banking industry have performed in the past year and how customer engagement for banking in India has evolved. We’ll also look at how these banks and fintechs can continue growing their user base through meaningful, insights-led customer engagement along with examples and insights from top banks and fintech in India, the likes of Ujjivan Small Finance Bank, MoneyTap, ZestMoney, and CoinDCX.

Let’s begin by looking at the growth trends across the various subsegments within banking and finance and peel back the layers of customer engagement for banking in India:

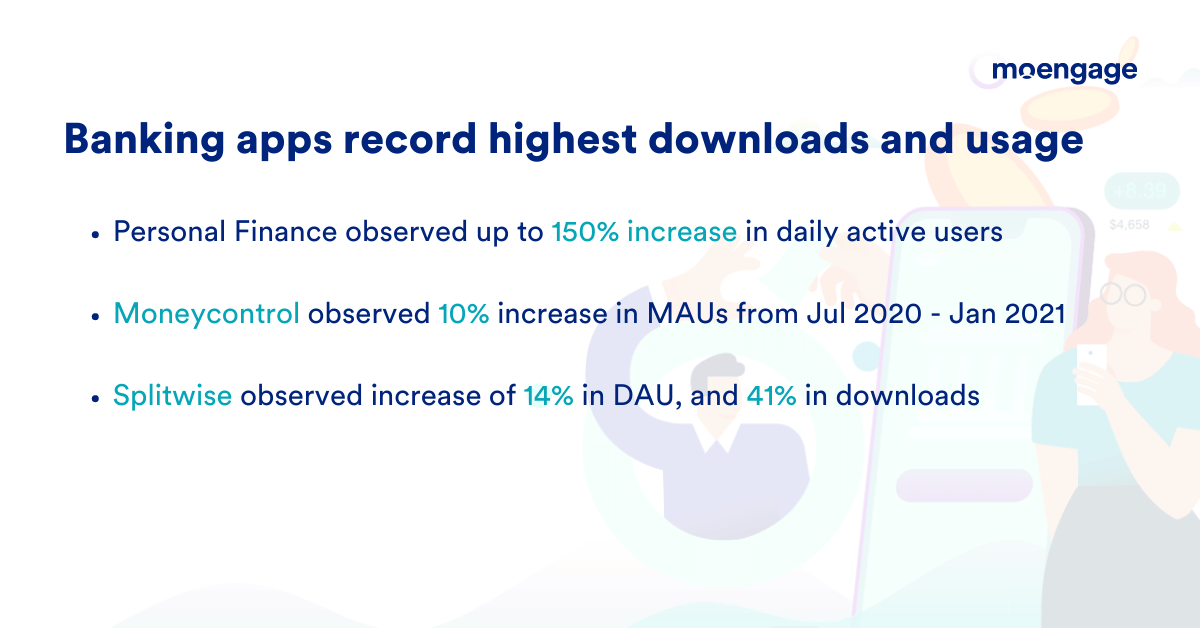

Personal finance and banking apps observe record-high download, usage, and time spent in-app

With lockdowns and state-mandated curfews (to curb the pandemic) keeping consumers at home, the captive audience had enough time on their hands to browse through offerings from several personal finance management apps. Unsurprisingly, banking and personal finance apps have observed up to a 150% increase in daily active users. The downloads for the said apps have skyrocketed through most of 2020 and continue to grow well into 2021.

|

🎯 The personal finance management arm of Moneycontrol has observed a 10% increase in monthly active users during the period of July 2020 to January 2021. 🎯 During the same time, the popular expense splitting app, Splitwise noticed a 14% increase in daily usage, 6% growth in monthly usage with a 41% increase in downloads. 🎯 Meanwhile, Moneyfy from Tata Capital, the platform providing mutual funds, insurances, and loans, among other portfolio offerings saw a 150% increase in daily active users, 290% increase in monthly active users, and a whopping 220% increase in downloads. |

It is expected that over 65 billion transactions worth $270.7 billion will move from cash to cards and digital payments by 2023, increasing to $856.6 billion by 2030. With digital payments recording a new high, UPI* transactions crossed the 200 crore mark in October 2020. It peaked at 221 crore transactions worth $53 billion in November 2020. India’s largest independent mobile POS merchant acquirer and network provider, Mswipe, observed contactless payments go up from 13% of total transactions in January 2020 to about 30% in December 2020.In India, the fintech sector has seen consistent and record growth in 2020. App-based payments reached close to 210 million transactions in September 2020 bringing in close to $10,000. Internet banking stood at 280 million transactions raking in $4.6 million.

While it was the 2016 demonetization that sparked the initial take-o of digital payments in India, the government’s efforts over a period of time have kept the momentum going. The Covid-19 pandemic has fuelled tremendous and large-scale adoption of digital payments and digital commerce in India, right from metros to even tier 4 and 5 cities – Manish Patel, Founder, and CEO, Mswipe

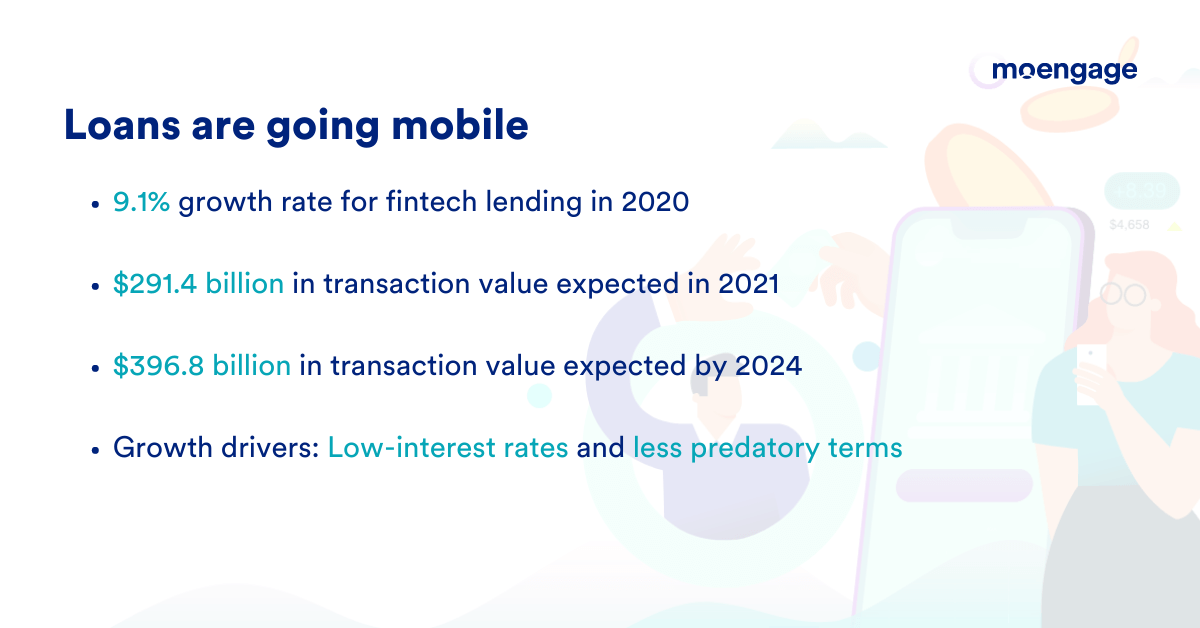

Loans are increasingly going mobile with consumer lending fintechs leading the way

The growth surge in the number of users opting for loans via fintech lending apps and neobanks shows that there is a convincing case in favor of loans going mobile. In fact, the estimated growth rate for fintech lending in 2020 was 9.1% and the market is poised to reach $291.4 billion in transaction value in 2021 and is expected to rise to $396.8 billion by 2024. Downloads of the top ‘buy now pay later’ apps have seen a year-on-year increase in Quarter 4, 2020 (the holiday quarter).

This growth is driven by low interest rates, less predatory terms compared to traditional credit card companies, and lending decisions independent of credit score leading to faster adoption of digital installment plan apps among younger consumers. The daily active users for alternative lending apps grew by 36.3% in January 2021. This is a further indication of growth in this vertical. The monthly active user trends reveal a similar story with 28.4% growth in January 2021 compared to the previous months in the last quarter of 2020. Despite the pandemic-induced economic uncertainty and lockdowns, the consumer lending space in India recovered phenomenally with demand ballooning up to 150% of pre-covid levels.

In May 2021, ZestMoney, one of the biggest consumer lending fintechs in India crossed 10 million signed-up customers. The Overall demand has been great with MAUs across the web and mobile apps increasing by 75% over the pre-covid numbers and conversion improving by 30%. Despite successive rounds of lockdowns the demand has sustained and hasn’t dipped. The rise of ‘buy now pay later’ as a legitimate payment option, along with convenience and affordability has further driven growth. While having access to formal credit isn’t very common in India, but that is changing with consumer lending fintechs providing access to the credit-starved unserved, and underserved segments. This coupled with the general comfort in transacting digitally is driving the surge in demand.

Discover how the consumer lending space in India is shaping up with expert insights from Nikhil Joy, VP, Product Management, at ZestMoney here in our detailed podcast!

The investment and trading sector observes a bull run

For the investment and trading segment, in addition to the growth in downloads, new users and global app sessions have also risen consistently over the spring and summer of 2020 leading up to the holiday period and well into 2021. Users across all generations increased the time spent on finance and trading apps, with Gen Z spending nearly 127% more time in-app to track investments. Time spent in-app on trading apps such as Robinhood, which have no commission fees, increased by 183% in the pandemic year.

|

🎯 With economic uncertainty looming large, one interesting trend across the investment landscape is the renewed interest in managing personal finances. Investment apps are observing increasing daily and monthly usage as consumers diligently pursue day trading and crypto trading. 🎯 This is further corroborated by the growth in daily active users for apps in the investment vertical. The metric grew by 78.8% compared to the previous months of Q4 2020 heading into 2021. The trend for monthly active users is similar with a growth rate of 47.3% in January 2021. |

One of the major growth drivers for the investment and trading vertical is crypto-trading. After the Supreme Court of India lifted the ban on Cryptocurrency exchanges in March 2020, the crypto-coin industry witnessed a bull run with several currencies witnessing up to 80% growth in value, with global giants like Tesla, PayPal, JP Morgan, and Visa giving credence to the industry.

Since the lockdown began last year, the estimated volume of crypto trading in India grew dramatically with an average of $60-65 million worth of Bitcoin trades per day happening by end of December 2020. Globally too, Bitcoin saw a whopping 159% rise in its value with Ethereum observing a 337% year-to-date rise in value, and XRP reporting a 221% gain.

CoinDCX, one of India’s biggest cryptocurrency exchanges, has seen a rising trend with more Indians actively trading in equities and crypto-assets through platforms and apps like CoinDCX Go, which has more than 600,000 users trading 15 million cryptocurrencies on daily basis. With a positive regulatory environment, the entire crypto ecosystem will get a further boost going ahead.

Discover how CoinDCX is driving engagement through user education and marketing efforts as we speak to Ramalingam Subramanian!

Role of the pandemic in accelerating pace of digital adoption and customer engagement for banking in India

The branch visits across banks have reduced drastically and so has the volume of calls to the call centers. In fact, branch visits are expected to dip from six times a year to two visits by 2022 among millennials aged 18 to 24 years. As a matter of fact, branch traffic isn’t the only metric expected to fall. With mobile devices becoming the primary mode of access, desktop banking is also reported to decrease by 63% in 2022.

The overall digital banking adoption has increased many folds. This behavior will act as a spur to bring in new customers to the digital fold, even those who aren’t that digitally savvy. There has been a significant amount of upswing in contactless payments viz. Apple Pay, Samsung Pay, Google Pay, etc. This change in customer behavior has affected banks and financial institutions who are gradually moving away from branch network expansion (to add customer access points) owing to increased operational costs and dwindling footfall (with increased adoption of digital banking channels). They’re now providing digital kiosks and digital channels (mobile) to provide the users the facility to transact or bank at their convenience, thus helping banks reduce costs (maintaining and operating physical channels) and customers (by providing 24×7 access).

There are three aspects to the changed behavior and how banks & financial institutions are meeting the changing demands:

- Sourcing customers (onboarding new customers)

- Engaging the onboarded customers

- Retaining customers.

The pandemic has turbocharged the first two. The third part i.e. retention was always powered by digital, to ensure optimal customer retention, increases stickiness, and improved loyalty. While banks used to source around 30-40% of their new customers via digital means previously, the number has increased to more than 90% post-pandemic. This is because digital provides the opportunity to create seamless customer experiences, provide transparent communication about services and offerings, and provide the option to select the offerings. Customer engagement has also been turbocharged. Earlier 40-50% of requests were coming in through mobile/internet banking, and the pandemic has shifted it to 70-75%.

How the mass-market, small finance banks are reshaping customer engagement for banking in India

Overhauling customer service

Small finance banks have a very high-touch model with customer relationship managers meeting the customers physically and the customers having the opportunity to reach the contact centers for information about loans, moratoriums, and more. Ujjivan Bank, one of the most popular small finance banks overhauled the process by decentralizing the contact centers and introducing cloud-based contact centers.

Rethinking overall collection process

For a small finance bank, digital collection from retail customers (who take out small-ticket loans) was virtually unheard of. Partnerships with payments banks and pan-India players. Ujjivan Small Finance Bank was able to ramp up the entire collection infrastructure to about 1.5 million touchpoints. Customers could walk up to the payment banks or BC outlets to make the payment and credit it to the bank account. Ujjivan Bank observed 40% digital collections at peak, which has since stabilized to 15-20%, which is a huge achievement resulting in further cost savings

Optimizing internal processes

The key was creating an RPA (Robotic Process Automation) roadmap, automating processes to reduce dependency on humans, and creating a system-driven process starting with operations and touching other bank functions as well.

In order to overcome the limitation of the traditional collection process and to engage customers in the digital ecosystem, Ujjivan Small Finance Bank integrated with BBPS aggregator SETU and enabling EMI repayments via digital wallets. The Small Finance Bank also built partnerships with leading Indian telecom operators to help the digital non-natives repay EMIs by simply walking to the stores and depositing the EMI amount.

Check out how Ujjivan Small Finance Bank fast-tracked digital adoption and engaged customers using an omnichannel approach:

Changed approach to customer engagement for banking in India: How top banks and financial services brands are adapting to the changed scenario

- MoneyTap realized that an insights-led engagement approach was essential to building a deeper understanding of the customer. Using advanced analytics, MoneyTap analyzed the customers onboarded, predicted their preferred communication channels, content preferences, and the likelihood to churn. Once the analysis was completed, MoneyTap created customer segments based on geographical location, content affinity, and preferred language and added layers of personalization on top of it. MoneyTap could then drive user engagement and increase active user count by orchestrating data-driven user journeys, increasing user reachability, and optimizing the performance of engagement campaigns using machine learning. MoneyTap could retain customers by informing them about incomplete applications and other similar abandonments, send personalized offers and deals, nudge to complete registration using reminders, and announce relevant offerings at the right moment.Check out the detailed story of how MoneyTap optimized customer engagement!

- Financial inclusion has been the mission of ZestMoney from day one, captured by the brand tagline of ‘EMI for all’, and till this day 35% of all customers served are completely new to credit i.e. don’t have a credit score, haven’t taken credit cards, etc. While the credit card holding population is anywhere between 50-60 million, about 200-250 million households are creditworthy but don’t have access to credit. In order to increase adoption and engage more customers, ZestMoney started providing more avenues to transact and made the distribution of places where a consumer can transact more universal. Through credit on UPI product from ZestMoney, customers can transact not just where ZestMoney is integrated but across any merchant that supports UPI mode. ZestMoney also invests in a strong merchant acquisition engine singing up merchants on a daily basis giving customers more avenues to use credit. The brand is currently investing in building a rich customer experience by doubling down on mobile app development, adding more features and capabilities that enrich the experience.

- CoinDCX enhanced the onboarding journey by connecting gaps and building an omnichannel engagement strategy which included analyzing and understanding customer behavior while engaging them on various channels. As the first step towards their revised strategy, the team’s plan was to analyze their whole onboarding process. Using advanced analytics, the brand learned the highest touchpoints at which the user either went inactive or dropped off. They then explored the user’s last active action which helped them identify the touchpoints they should focus on during a user’s onboarding process.After the first purchase, the CoinDCX users are usually active and continue to buy/sell their cryptocurrency based on market conditions or personal choice.

However, there were still a few users who were going inactive after a certain period of time. So the next step in the brand’s engagement strategy was to reactive these dormant users and nudge them to continue their activities.Apart from onboarding and reactivation campaigns, CoinDCX was also running push notifications and email campaigns for active users. The objective of these campaigns was to understand the user pulse regarding the experience and various product features. This strategy to understand users’ pulse helped them understand the gaps within the engagement and overall experience across the website and app. Using the feedback, they were able to make necessary changes in user experience and engagement messages. This directly impacted their weekly active users’ count which grew to 80% since January 2021.Go behind the scenes and discover how CoinDCX grew weekly active users to 80%!

Further Reading:

- Now, that you have understood how customer engagement for banking in India has evolved, check out how banking works in the era of connected customer.

- Check out how you can choose the right engagement platform for your bank or financial institution!

- Find out if you should go for a point or an integrated solution for your engagement woes.

- Here are six signs that your bank or financial institution needs an engagement platform urgently!

- Find out how the changing consumer needs reshaped the modern purchase funnel and how to engage users better.