2022 Trends in Banking: Decoding Mobile Consumer Experience for CXOs

Reading Time: 5 minutes

Today’s financial institutions have a lot riding on their mobile marketing programs and apps. Mobile has become a critical channel for banks to reach and engage customers, and it now has the attention of the highest levels of management. The latest consumer trends in banking reveal that mobile banking is one of the top three apps used by consumers in the U.S., making it top of mind for all levels of senior management.

Whether it’s the chief marketing officer (CMO) who builds the marketing engagement strategy; the chief financial officer (CFO) who pays the bills and makes sure programs have funding; the chief technology officer (CTO) whose team develops the core apps; or the chief exec (CEO) who is responsible for keeping the company in the black, there are a lot of critical senior stakeholders in the effort to create a mobile experience that consumers will remember.

| Bonus Content

👉 Your Guide to a Winning Customer Experience in Financial Services [Download Ebook] 👉 Banking in the Era of the Connected Customer [Download Ebook] 👉 Mashreq Neo Boosts Debit Card Activation by 16% [Download Case Study] 👉 How Symbo Insurance used MoEngage as an All-in-one Engagement Platform [Download Case Study] |

Here’s how to know what these executive decision-making personas will have on their mind and how you can position the importance of optimizing the mobile consumer experience for your bank.

Mobile UX Persona #1: The CMO Wants Better Engagement

No one is more concerned with engaging customers on mobile than the CMO. They are dedicated to ensuring that a steady beat of the right campaigns, offerings, and content is delivered to banking consumers on their mobile devices. But nowadays, it isn’t always easy to achieve excellence in mobile engagement. Consumers can no longer be bothered with “one-to-many” bulk marketing emails and messages. Just over half of all consumers now expect companies to anticipate their needs and make relevant suggestions before they make contact.

Watch Alyson Clarke of Forrester Research describe how personalization can help banks build long-lasting customer relationships:

Mobile marketers must employ the right engagement tactics to keep banking consumers happy in the mobile channel. Among the most important things you can focus on are the following:

- Building more hyper-targeted campaigns that understand the factors that influence action on mobile and analyze to see when customers have accomplished the desired action, like opening an investment advice article or logging into a new banking app feature.

- Engaging customers during their personal “micro-moments” with highly personalized messages they will respond favorably to.

- Use analytics to identify leaks in funnel marketing and improve conversion rates.

- Creating push notification campaigns that bypass OEM restrictions to reach up to 40 percent more customers (typically, 40-70 percent of push notifications never even reach the recipient!)

Mobile UX Persona #2: CEOs Think About Long-Term Customer Value

Chief executives have more on their plate than most, of course. They worry about sales, finance, operations, and brand, but at the heart of it is the desire to acquire customers and keep them happy. Financial institutions often dedicate resources to finding and closing new customers. Still, the real trick is retaining those customers and increasing the long-term value (LTV) of each one. The happier they are, and the more time they spend engaging with your company, the more they are apt to spend, and the faster your brand will grow.

It turns out that it’s much easier (and less costly) to retain an existing customer than to spend resources acquiring a new one. Studies show that it can cost five times more to attract a new customer than retain one, and increasing customer retention rates by just five percent can increase profits by as much as 25-95 percent, according to a Bain & Co. study.

So that means for the CEO, better engagement through a great mobile customer experience can go a long way to retaining customers to enhance LTV. The right mobile engagement solution gives CEOs (and marketing teams, of course) a birds-eye view of retention numbers for all acquisition channels to see which segments should be engaged optimally and what tactics should be used to create the best customer journey.

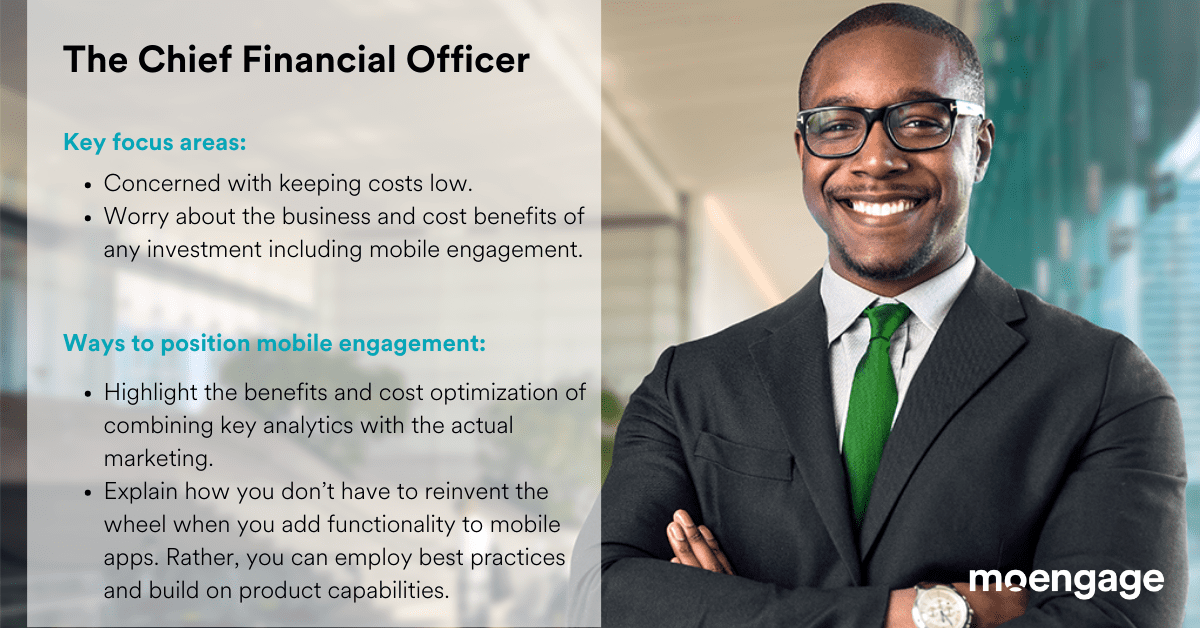

Mobile UX Persona #3: CFOs Want a Low Cost of Entry to Mobile Success

It is no surprise that chief financial officers are concerned with keeping costs low. Cost control is so crucial in today’s corporate environment that 71 percent of Deloitte Cost Management Survey respondents say they are planning to undertake cost-reduction initiatives over the next 24 months. The good news for rolling out highly engaging mobile apps is that you don’t have to reinvent the wheel when you add functionality. Instead, you can employ the most effective best practices and product capabilities and build on what you already have.

Even though it’s fundamentally a marketing discussion, the CFO will respond to the business and cost benefits of a system that combines vital analytics (to identify key customer groups’ most critical behavioral patterns) with the actual marketing engagement and automation platform. Rather than build two silos, you can rely on a comprehensive do-it-all solution that ensures you’re spending less and optimizing your marketing efforts. That’s a powerful value proposition to present to the CFO.

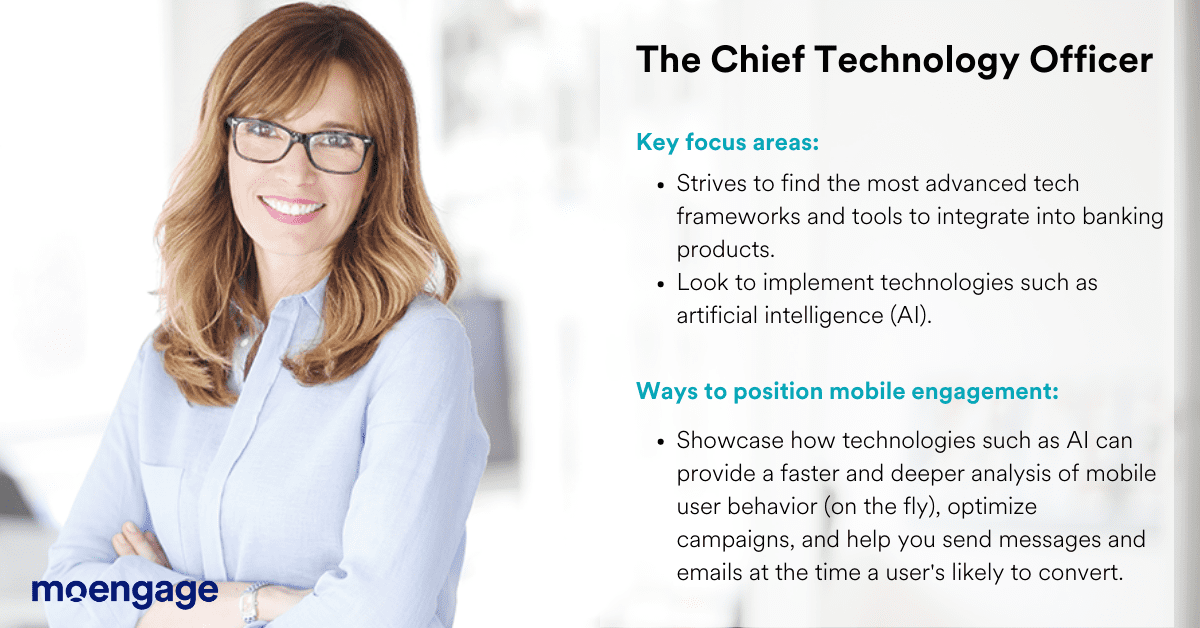

Mobile UX Persona #4: CTOs Look for the Most Advanced Tools Available

The CTO is a final constituent vital to deploying a successful mobile app and mobile programs. Technologists strive to find the most advanced tech frameworks and tools and integrate them into their products. And no technology trend gets a CTO’s attention more than implementing artificial intelligence (AI). A recent Gartner survey reported that 37 percent of organizations had implemented AI in some form, growing 270 percent in the last four years and 3x in the past year.

AI is the hottest technology in town and can be a big part of the mobile banking consumer experience. AI-powered optimization processes provide a faster and deeper analysis of mobile customer behavior (on the fly), optimize campaigns to enhance engagement in a more personalized way, and help you send push notifications at the specific moment when a customer is most likely to convert. It’s a vital part of the mobile engagement foundation and one that CTOs will find compelling.

Here are first-hand insights from an expert about the benefits of using technologies such as AI for banking and financial service brands:

Before a financial institution can roll out new capabilities in its mobile apps, several constituents will need to sign off. Fortunately, from the CMO to the CEO, CFO, and CTO, there is a value proposition that will convince them that building a great mobile consumer experience is a benefit machine. Tell the story the right way to each, and you’ll surely get winning support for your mobile banking efforts.