Omnichannel Banking Platform: Everything You Need to Know

Reading Time: 11 minutes

Over the past two decades, banks have completely changed how they interact with customers and deliver value-added services.

Today, customers can withdraw cash through ATMs, use online banking portals to view their account activity, manage transactions, and more. The entry of mobile banks has also made it much easier for customers to manage routine banking tasks. All of this enables customers to manage their finances anytime, from anywhere, when this was previously only possible at physical bank branches.

As banks continue to embrace this omnichannel approach, delivering a consistent and continuous experience across all channels is important. It is essential that every customer interaction is convenient, flexible, and cohesive.

This is where an omnichannel banking platform becomes important.

Here we will help you understand how an omnichannel banking platform is key to delivering a seamless banking experience.

Let’s dive in.

What is Omnichannel Banking?

When it comes to channels, today’s customers are spoilt for choice. They can visit physical banks, ATMs, or cash deposit machines. They can also use banking portals, websites, mobile applications or even SMS.

Omnichannel banking ensures that the communication on all these channels is stitched together so that every customer’s journey remains interconnected, consistent, and cohesive. This is because information and context are shared across channels, ensuring that customers do not have to repeat themselves or receive inconsistent updates. For instance, a customer may initiate a conversation on live chat and then later transition to a phone call without having to reiterate details of their query.

With omnichannel banking, banks can deliver personalized services and multi-device support around the clock. This also contributes to a holistic banking experience that keeps customer convenience at its core.

In fact, according to the World Retail Banking Report by Capgemini Research Institute, nearly 80% of customers prefer an omnichannel banking experience.

5 Benefits of Omnichannel Banking

Omnichannel banking is challenging to perfect, but when done right, it yields incredible results that are well worth the effort. Here are some of the key benefits of this approach:

1. Improved customer experience

Traditional banking requires customers to visit a bank’s physical branches to manage all account-related activities. The bank’s branches are the primary channel for customer interactions, and this poses plenty of limitations, such as long wait times and geographical constraints.

With omnichannel banking, customers can manage their transactions across any channel of their choice. Also, since channels are interconnected, data and context are shared uniformly so that the customer receives the same level of service and information. This ensures that irrespective of the touchpoint, the customer feels as though they are a part of an integrated marketing and customer experience program.

The omnichannel approach also allows customers to access banking services from anywhere, around the clock according to their convenience. This contributes to increased customer satisfaction scores.

2. Increased engagement

Omnichannel banking helps to improve customer engagement because it allows you to reach the customer across multiple touchpoints that are tied together with customer data.

Let’s assume a customer is searching for a bank to create their savings account in on Google and browses through a few options, including XYZ Bank. Then when they log into their Facebook account, an ad from XYZ Bank pops up, highlighting the benefits of creating a savings account with them, such as the interest rate offered and zero-fee banking. The customer recalls the brand name and clicks on the ad enabling them to download the app from a Play Store. After they open the app, an in-app message pops up that is personalized with the customer’s name and mentions exclusive savings account features offered by the bank. Once the customer clicks on the message, another in-app message pops up that guides the customer on how to set up their account online in a few simple steps.

Do you see how seamless the entire process was and how it engaged the customer at every step of the way?

3. Higher operational efficiency

Traditional banking operations and communications are siloed, as there are separate systems in place to deal with different channels and functions. Hence, pulling up relevant customer data can be quite difficult, and without this, it can become challenging to gain insights into how customers are interacting with your brand.

Omnichannel banking, on the other hand, leverages automation to intelligently segment customers on a granular level. For instance, you can segment customers based on their lifecycle stage, transaction behavior, engagement level, and their channel preferences. This allows you to smartly allocate resources, drive targeted marketing campaigns, manage churn risks, and optimize channels.

4. Better cross-selling opportunities

Omnichannel banking offers plenty of opportunities to cross-sell. Banks can leverage data from various channels to understand customer preferences and behavior. Analyzing a customer’s transaction history, online interactions, demographic information, etc. can help identify cross-selling opportunities. This data also allows you to set up personalized recommendations for individual customers.

This is impossible with traditional banking simply because most interactions occur either at the bank or through very few channels. This leaves less room to gather customer data which is critical to identify cross-selling opportunities.

5. Greater competitive advantage

An omnichannel presence offers a better competitive advantage to banks since it’s easier to attract and retain customers. Omnichannel banking also makes it easier for banks to adapt to changing customer expectations and be where their customers and prospects are. This is especially important in today’s world where consumers have become tech-savvy.

With traditional banking, on the other hand, customers struggle with limited accessibility and fragmented experiences. It makes it harder for banks with traditional strategies to stand out in the face of competition and ensure a high customer lifetime value.

Omnichannel Banking Platform Evaluation Criteria: How to Choose One

In order to successfully implement an omnichannel banking strategy, you need an omnichannel banking platform. However, choosing the right one requires you to carefully evaluate several aspects. It must align with your bank’s key objectives, budget, scalability, and other factors.

Here are some of the key features you need to consider:

1. Integration capabilities

The omnichannel banking platform you choose should be able to integrate with your bank’s existing tech ecosystem. This includes your website portals, mobile applications, customer data platforms, data warehouses, analytics tools, etc. Ensure you look for a platform with flexible omnichannel API and robust integration capabilities.

| Why this is a key criterion:

Integration capabilities are important because they enable critical data such as customer information, transaction details, and account details to be updated and accessible in real time across all channels. This improves operational efficiency and also ensures a smooth banking experience for your customers. |

2. Personalization features

Your omnichannel banking platform needs to be able to give you insights into how customers interact with different channels and messaging. These insights can help you deliver messages that are tailored to the type of channel(s), time slot, and use cases each customer is most likely to engage on.

Let’s say that the insights gathered from your omnichannel banking platform indicate that a ‘Price Sensitive’ customer consistently interacts with push notifications between 8-9 PM on the weekends. You can use this information to set up a promotional marketing campaign that involves sending offer-based push notifications at 8 PM twice a week. This will increase the likelihood of the customer interacting with your messaging, as it is catered to their preference.

When evaluating an omnichannel banking platform, look for features that can help you with hyper-personalization such as customer segmentation, dynamic content delivery, AI, device synchronization, and analytics dashboards that get updated in real-time.

| Why this is a key criterion:

Personalization is key to engaging customers and delivering financial products/services that actually resonate with them. It also fosters customer loyalty and improves customer retention. Aside from this, personalization can unlock upselling and cross-selling opportunities to drive revenue growth for your bank. |

3. Unified customer view

Another key feature your omnichannel banking platform should have is a centralized dashboard that gives you a unified view of your customers. This gives you a comprehensive insight into each of your customer’s interactions, channels used, transaction history, and more.

| Why this is a key criterion:

A unified customer view dashboard consolidates data from different sources, channels, and systems to better understand your customer’s journey. This is key to enabling proactive decision-making by identifying issues before they arise. Insights from such dashboards are also important to set up targeted marketing campaigns that can be optimized to better resonate with different customer segments. |

4. Robust analytics and reporting capabilities

Analytics plays an important role in helping you monitor the performance of your customer engagement strategies and campaigns in real-time. It also enables you to analyze customer behavior to understand usage patterns and preferences associated with certain financial products or services. For instance, you can analyze metrics like the number of customers using your product, the number of subscribers, or successful conversions, to improve service personalization and identify cross-selling opportunities.

You can also leverage analytics to understand how customers are using your mobile banking application or website. And if you spot that certain customers have a high risk of churn, then you can immediately think of how to re-engage.

| Why this is a key criterion:

An omnichannel banking platform helps you gather more data about the customer on things like demographic information, channel preferences, transaction history, product choices, engagement patterns, and more. All this data is consolidated so that you get a complete picture of your customers and their behavior. This allows you to make more informed decisions quickly. It also plays an important role in mitigating customer churn risks and achieving strategic banking objectives. |

5. Vendor support

While technically not a feature, vendor support is critical when evaluating omnichannel banking platforms. Any newly introduced platform to your tech stack can take some time to set up. It is also quite normal for these platforms to have some associated downtime every now and then, especially during scheduled maintenance activities. The important thing here is to have reliable vendor support at all times.

| Why this is a key criterion:

An omnichannel banking platform with good vendor support will provide 1:1 implementation assistance, training and onboarding services, and prompt technical support. Its proficient customer success team can help banks configure their communication systems properly to ensure a consistent and cohesive experience for all its customers. Timely vendor support also enables faster resolution of issues, minimizing downtime without impacting the customers’ banking experience. |

6. Security and compliance features

The omnichannel banking platform you choose will deal with a huge volume of highly sensitive customer data. This is precisely why choosing a platform that adheres to security and compliance protocols is crucial. When evaluating, check for features such as encryption, multi-factor authentication (MFA), identity verification, access controls, and audit trails, to name a few.

| Why this is a key criterion:

In omnichannel banking, customer data becomes more centralized and easy to access. While this is important for data analysis, it also means that from a security perspective, a single breach can have far greater ramifications. This is precisely why your omnichannel banking platform should offer robust security and compliance features. It protects customer data, maintains confidentiality by masking personally identifiable information, allows banks to send prompt alerts when detecting fraudulent transactions, and ensures customers can trust their banks to provide secure and reliable services. |

7. Flexibility and scalability

Banks grow and scale according to changing economic conditions, market landscape, and advancements in technology. Your omnichannel banking platform should be flexible enough to accommodate your bank’s communication and engagement needs as it grows. Features such as cloud infrastructure, modular components, and omnichannel API-driven integrations are important for ensuring that your banking platform can be scaled without causing a significant disruption.

| Why this is a key criterion:

Scalability is critical to ensure that your omnichannel banking platform can process a huge volume of messages across different channels (be it email, SMS, or dynamic in-app messaging) without compromising on the quality of customer experience. |

Best Omnichannel Banking Platform: Key Features

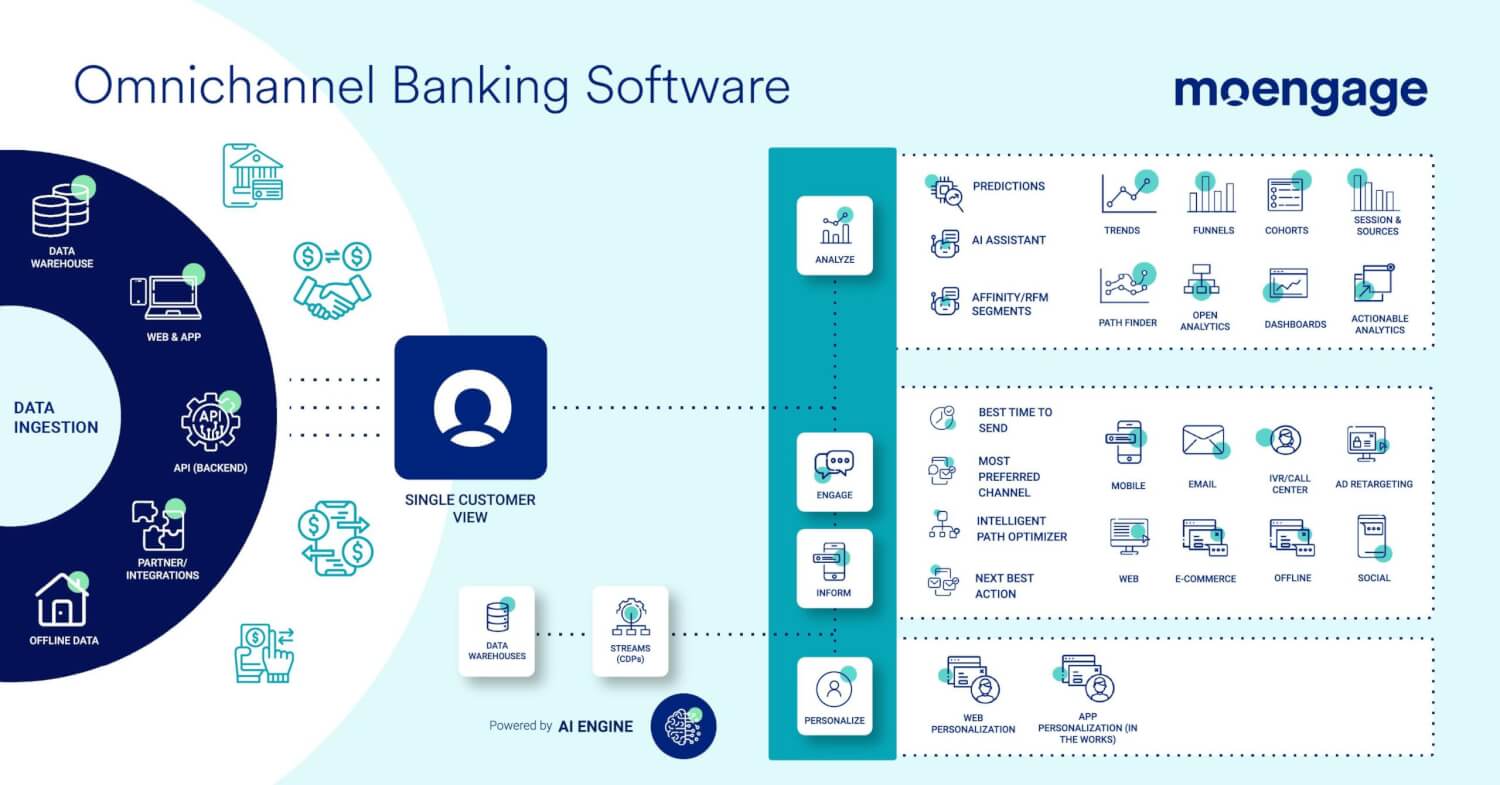

An omnichannel banking platform like MoEngage offers several robust features that can enable seamless banking experiences for your customers.

Here is a quick overview of MoEngage’s omnichannel features and how they can help you:

| Omnichannel Banking Platform Needs | MoEngage Feature | How This Helps |

| Integrated channels to establish as many customer touchpoints as possible for a continuous and connected banking experience | MoEngage’s omnichannel capabilities enable you to interact with customers across channels such as email, SMS, in-app messaging, push notifications, etc. |

|

| Customer journey mapping to optimize a customer’s interactions across the different touchpoints a bank may have | Customer journey orchestration leverages AI to build tailored experiences according to your customer’s behavior and preferences |

|

| Robust analytics and reporting to gain actionable customer insights, improve personalization, and optimize channel engagement | MoEngage’s powerful customer insights and analytics give you a detailed view of your customer’s behavior, conversion rates, churn rates, and more |

|

| Reliable and timely vendor support for training and onboarding assistance, and to minimize disruptions during downtime | MoEngage was the best-rated vendor and the Customers’ choice per Gartner’s Peer Insights in 2022. This is because the platform offers prompt technical support, comprehensive training, regular workshops, and solution consulting for customers |

|

How to Create An Omnichannel Banking Experience

Building an omnichannel banking experience involves integrating various channels through which customers can interact with your bank. The goal is to provide a cohesive experience across all the different touchpoints in a customer’s journey.

Here is a step-by-step guide to building an omnichannel banking experience:

1. Evaluate your current banking operations

Conduct a thorough evaluation of your current banking processes, systems, technological infrastructure, and customer experience. Identify what’s working and what processes are causing bottlenecks. This will help you understand the challenges in migrating to an omnichannel model.

For instance, you could start by evaluating the effectiveness of your ATM network, physical branches, and website portals. You can also send surveys to customers to get their feedback on banking habits and channel preferences. This assessment can help you identify opportunities to better your digital offerings and integrate more relevant channels into your banking ecosystem.

2. Set clear objectives

The next step is to clearly define the outcomes you’re looking for, from transitioning to an omnichannel banking strategy. Remember to keep these objectives achievable and measurable. Some examples include:

- Improving customer experience and CSAT scores

- Improving operational efficiency and reducing time taken to launch campaigns

- Improving message delivery time

- Increasing conversions and revenue

- Lowering churn rates

Your omnichannel banking approach may change based on your objectives. For instance, if your objective is to improve customer experience, you’ll need to integrate more channels across various touchpoints. Similarly, if your objective is to improve operational efficiency, your approach must also focus on adding self-service options and knowledge bases to reduce your employees’ workload.

3. Invest in the right technology

Once you’ve identified your objectives, you’ll need to invest in the right technology infrastructure to support your omnichannel banking needs. You’ll need a platform that offers multiple communication channels, insightful analytics, customer view dashboards, and AI capabilities.

For instance, MoEngage’s Customer Engagement platform offers several robust features to help you deliver seamless and personalized banking experiences at scale. The best part is that you can deliver these experiences without worrying about the complexities of a legacy system.

4. Integrate your channels

The next most important part of building an omnichannel banking experience is integrating different channels to ensure continuity. What this means is that you need to implement systems that enable data synchronization and communication between channels to offer consistent banking experiences.

For instance, MoEngage allows you to build connected customer experiences across your most impactful channels. This is crucial in improving customer engagement for Fintech companies and banks.

It lets you neatly consolidate customer data from various systems and sources into a single dashboard. This gives you a detailed overview of your customer’s lifestyle, demographics, choices, and more. Also, you can use this data to build tailored banking experiences.

5. Encourage digital adoption

Once you’ve invested in technology, you need to ensure both customers and employees adopt these channels.

You can do this by providing comprehensive training, highlighting the benefits, and delivering ongoing support to employees.

With customers, you can offer incentives to adopt your newly introduced channels. For instance, if you have a newly launched mobile banking application, you can offer a 20% discount on the first bill payment made through the app.

It’s always a good idea to offer in-depth educational resources, guides, videos, and tutorials to help both customers and employees transition from traditional banking to omnichannel banking channels.

6. Measure and iterate

Measuring the ROI of any new strategy you’ve implemented is important. Ensure that you constantly track and measure key metrics such as channel engagement, customer satisfaction, and transaction volumes to get a picture of how your strategy is rolling out.

Constantly analyzing these metrics will also help you identify any challenges with your omnichannel approach and make room for improvement.

Provide the Best Omnichannel Banking Experience to Your Customers with MoEngage

MoEngage’s cutting-edge customer engagement platform helps financial services companies engage with customers, personalize interactions, and drive meaningful interactions with ease. The platform’s no-code capabilities, enriched with AI, enable banks to deliver effortless customer experiences with a few simple clicks.

If you’re curious to know how MoEngage can elevate your banking to new heights, simply sign up for a free demo, and our customer engagement experts will help you explore tailored solutions to tackle your pain points.